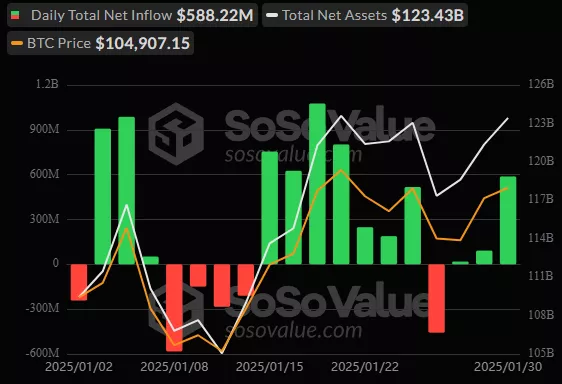

Which is certainly raising concerns among investors.

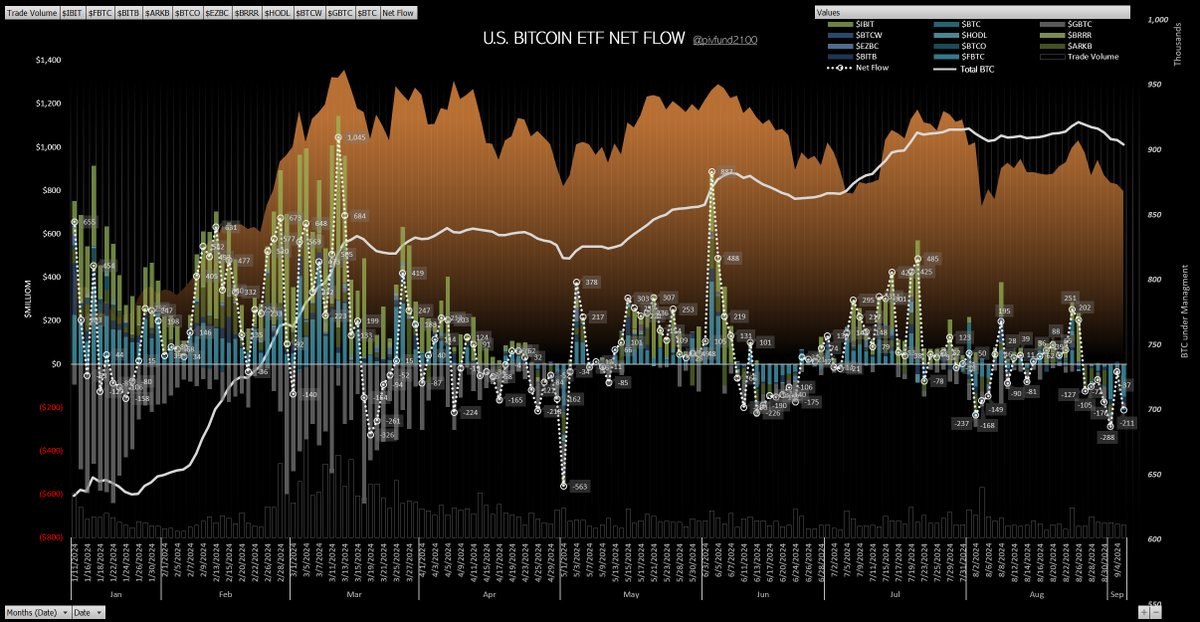

On Thursday, significant outflow of funds from these instruments was recorded. Bitcoin-based funds saw an outflow of $211.1 million, confirming the ongoing uncertainty in the cryptocurrency market.

Meanwhile, the outflow from Ethereum-based funds was minimal — only $0.15 million, which may indicate a more stable interest in this cryptocurrency despite the volatility of other assets.

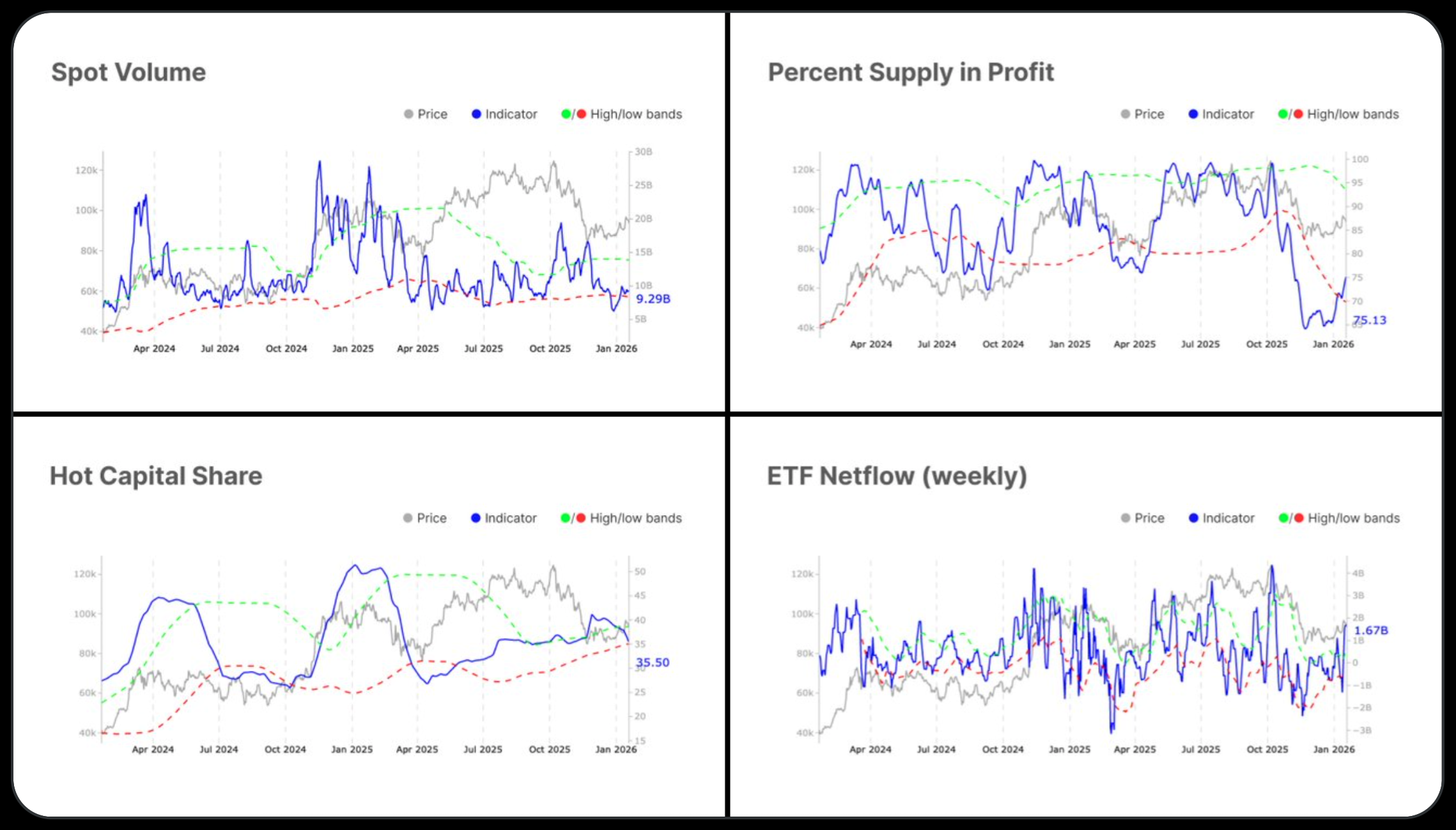

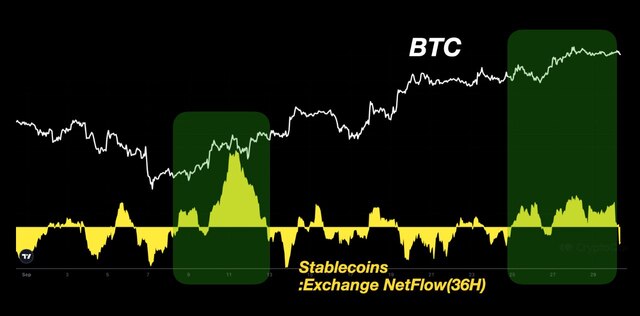

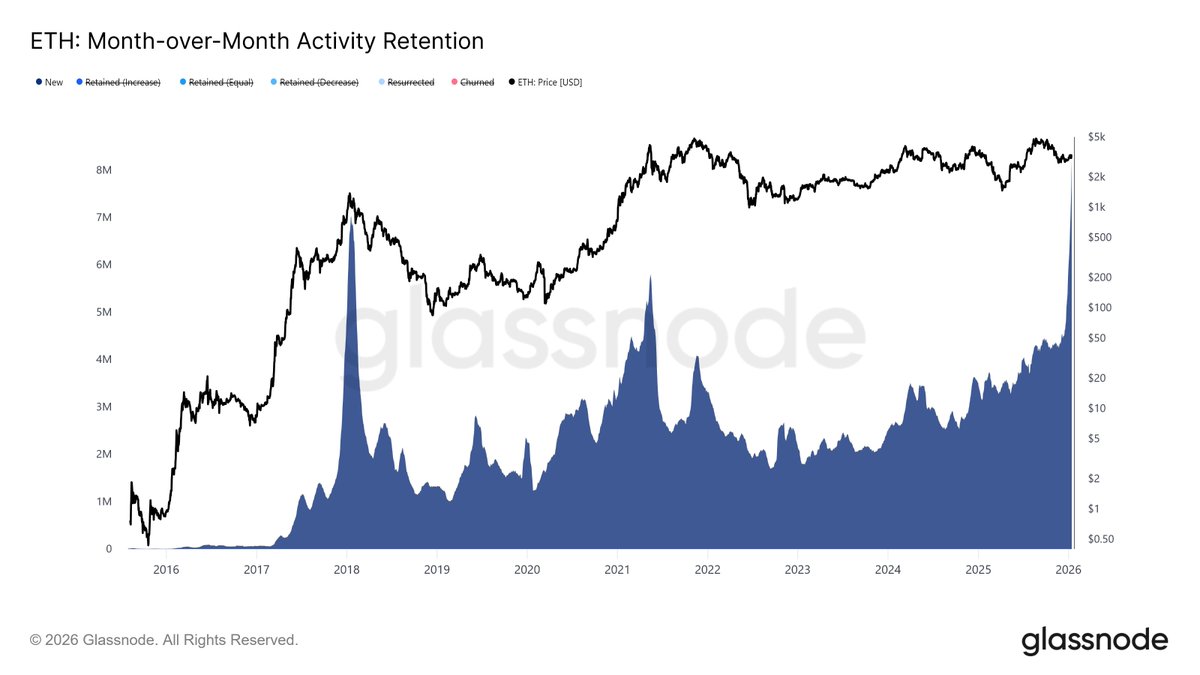

At the same time, there is a general increase in flows and trading volumes, suggesting that the market is gradually coming to life after the summer lull. Autumn has just begun, and many are expecting new movements in the market. Regulatory decisions and upcoming economic events may influence the dynamics of these assets, so we will be keeping a close watch on further developments.