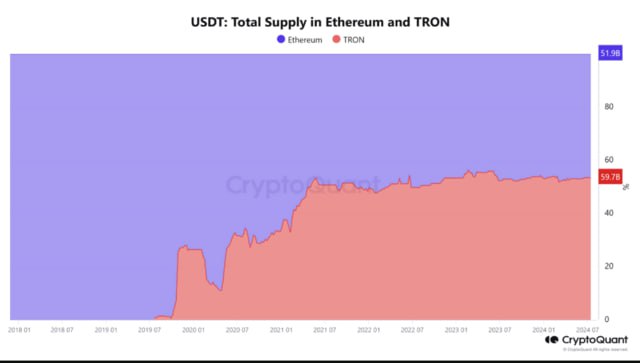

In East Asian countries, stablecoins are being actively adopted, gradually starting to replace fiat currencies. Experts at Deenar predict that in the future, stablecoins may completely replace fiat in economic circulation, especially in financial transactions and international trade.

The popularity of stablecoins is growing due to their ability to instantly transfer funds anywhere in the world with minimal fees. Unlike traditional bank transfers, the process takes just seconds and doesn’t require intermediaries. This makes stablecoins a convenient means of payment for both businesses and individuals.

If their adoption continues to gain momentum, interest in traditional banking services could significantly decrease, leading to the displacement of fiat. Banks may struggle to retain customers if they don’t offer more favorable conditions compared to fast and inexpensive blockchain transfers.

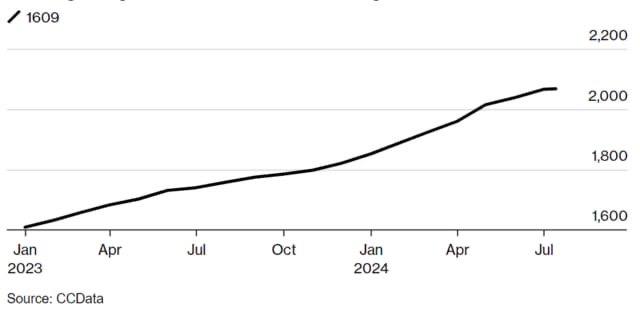

In 2023-2024, the volume of blockchain transfers in the Asian region exceeded $400 billion, and crypto companies are increasingly using stablecoins for everyday transactions. This not only attracts retail users but also large corporations that are starting to see stablecoins as a viable tool for payments.

Megacities like Hong Kong and Singapore are becoming key hubs for companies providing blockchain-based transfer services. These cities offer favorable conditions for blockchain startups, and the government actively supports the development of financial technologies. These megacities are becoming magnets for international crypto companies, accelerating the adoption of stablecoins in the region’s daily economy.

Experts also note that the successful integration of stablecoins into the economy could encourage other regions to follow suit, stimulating a global shift toward digital currencies.