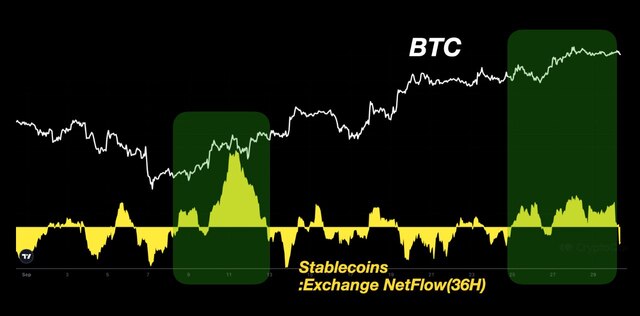

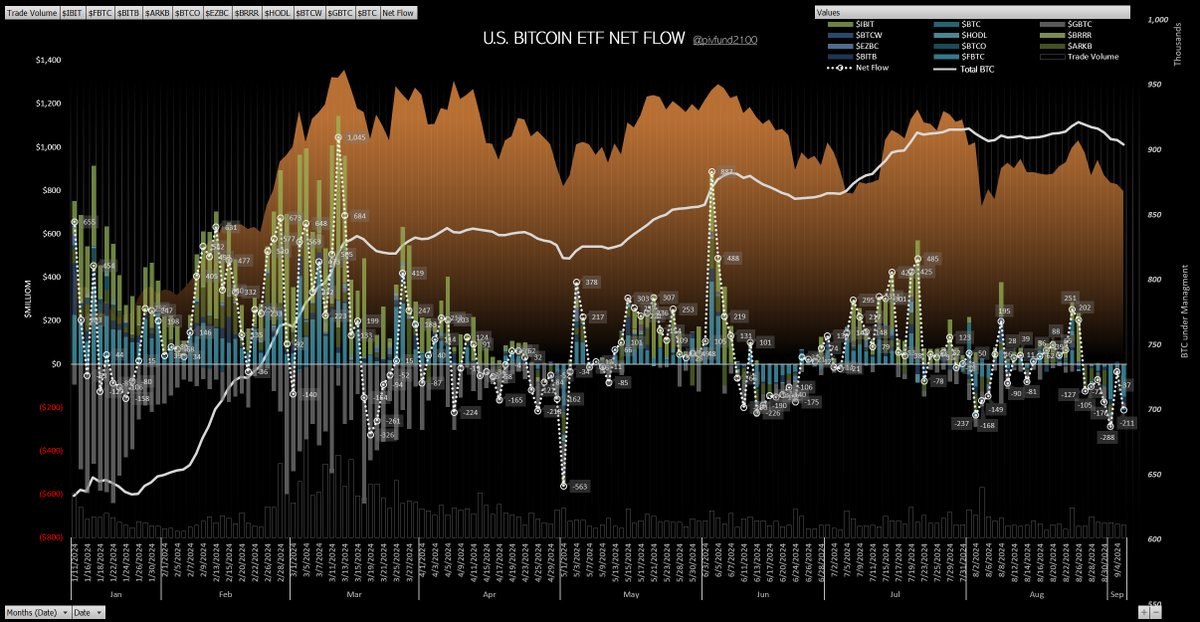

Indicating active interaction between these assets. According to CryptoQuant, since September 10 a significant amount of stablecoins has been entering exchanges, which was accompanied by an increase in Bitcoin’s value. This could signal that market participants were preparing to buy the leading cryptocurrency, using stablecoins as a means of entering the market.

However, in recent days, the situation has begun to change. Stablecoins are being withdrawn from exchanges, leading to a correction in Bitcoin’s price. Analysts emphasize that such changes in stablecoin flows could be a sign of capital exiting the market, potentially easing the upward pressure on the cryptocurrency’s price.

Additionally, they noted that over 80% of Bitcoin’s supply remains in profit, which traditionally signals bullish market sentiment when the majority of investors see their positions in the green. However, a drop in this indicator below 80% may suggest profit-taking, leading to an increase in loss-making positions and a potential price correction.

Despite the current changes, CryptoQuant analysts do not see clear signs of market pressure. On the contrary, they observe a decrease in Bitcoin balances on exchanges, which could indicate long-term strategies by investors who prefer to hold cryptocurrency off trading platforms, thereby reducing market supply and supporting the price.