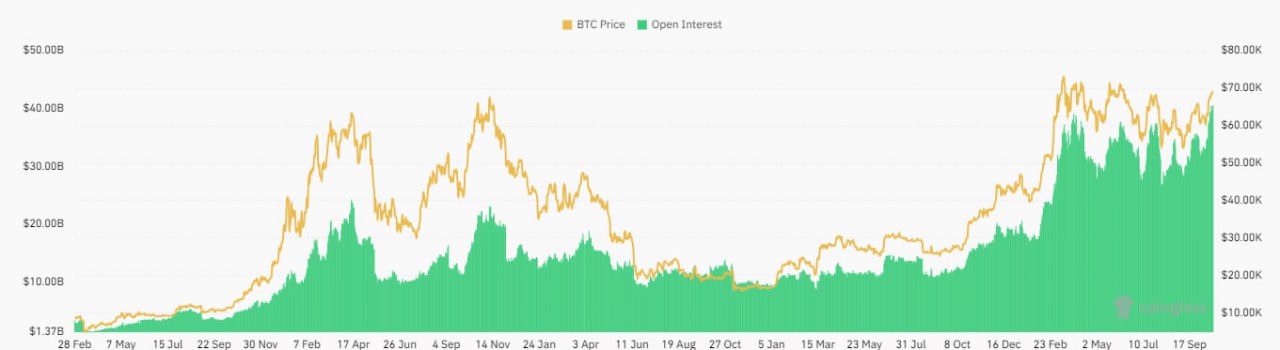

Open interest (OI) on Bitcoin futures has reached $40.5 billion as the price nears $70,000. The Chicago Mercantile Exchange (CME) leads with 30.7% of the OI, followed by Binance and Bybit.

The rise in OI indicates an increase in leveraged positions in the market, which could lead to significant volatility. In August, BTC saw a sharp 20% drop in just two days due to high liquidation of positions. Analysts warn that similar price swings could happen again, especially if traders’ interest starts to decline.