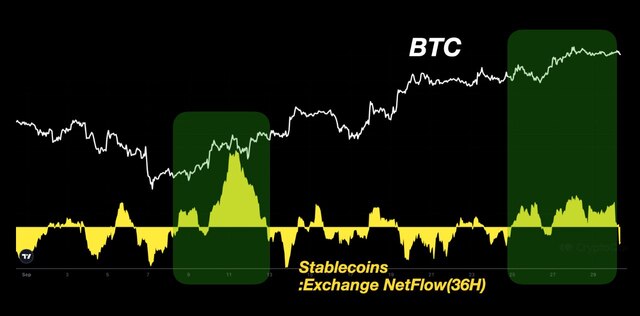

In which he analyzes the impact of global crises and financial stimuli on the growth of BTC amid the weakening of fiat currencies.

1.) Hayes criticizes capitalism and the corporate system in the U.S., arguing that private companies profit at the expense of society by using government support.

2.) He notes that the Chinese real estate market has become the largest bubble in history, and Beijing, recognizing the associated risks, introduced the “Three Red Lines” policy to control developers’ debt levels.

3.) Economic crises in Japan, the U.S., and the EU share common traits: the collapse of the real estate market and subsequent economic stimulus through quantitative easing.

4.) Hayes predicts that China will also resort to quantitative easing (QE), which will lead to BTC growth amid the weakening yuan and an increase in the money supply.