The capitalization ratio of Ethereum compared to Bitcoin dropped to 24.52%, the lowest level since April 2021. At the beginning of 2024, this metric was 32.7%, according to The Block.

This indicator reflects investor sentiment and capital flows between the two largest crypto assets.

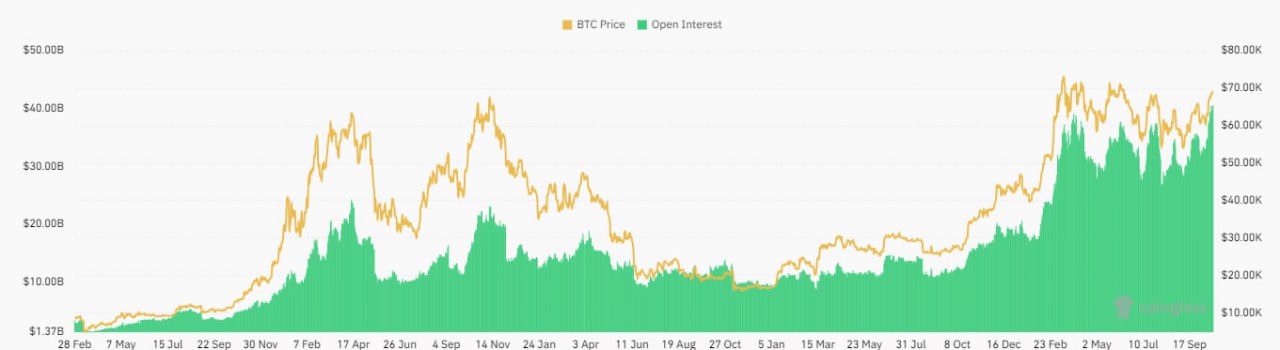

The growing popularity of Bitcoin as “digital gold” is supported by the demand for ETFs linked to it.

According to SoSoValue, cumulative investments in Bitcoin-based products reached $23.5 billion, while investments in similar Ethereum-based products remained negative (-$554.7 million).

The Block suggests that positioning Bitcoin as “digital gold” makes it more understandable for traditional financial institutions, possibly explaining the heightened interest in this asset compared to Ethereum, which is widely used in decentralized finance (DeFi).

“While Ethereum’s technological capabilities and ecosystem are more diverse, this complexity may make it harder for traditional finance players, who prefer clear and structured strategies, to understand,” noted the journalists.

The authors also suggest that Bitcoin’s successful integration into traditional finance may increase interest in Ethereum.

It’s worth noting that Michigan’s state pension fund recently disclosed a purchase of 460,000 shares in the Grayscale Ethereum Trust (ETHE) worth over $10 million and 460,000 shares in the Grayscale Ethereum Mini Trust ETF (ETH) valued at approximately $1.1 million.