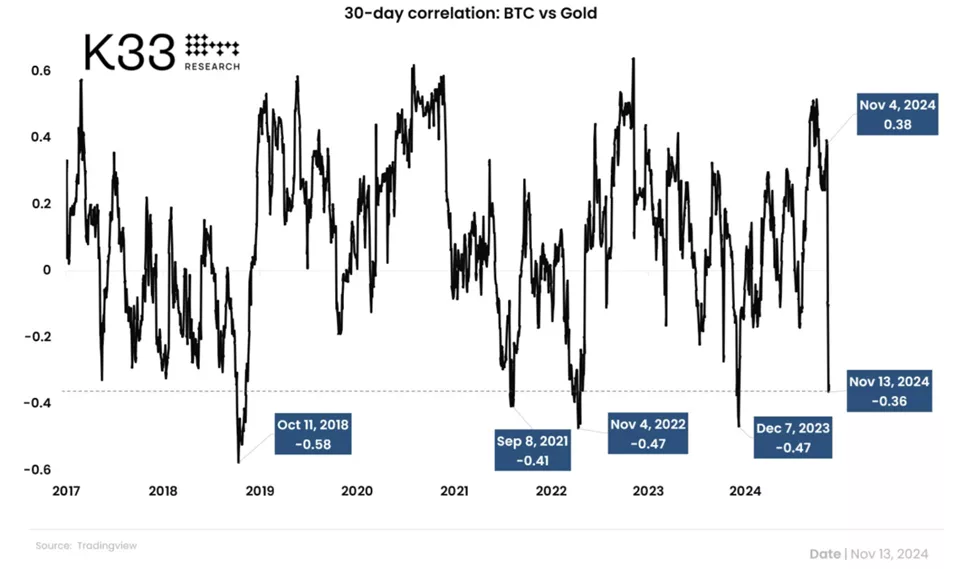

The correlation between Bitcoin and gold has dropped to an 11-month low (-0.36), according to analysts at K33 Research. This divergence emerged following Donald Trump’s victory in the presidential election: since then, Bitcoin has risen by 20% to new all-time highs, while gold has declined by 5% amid rising U.S. Treasury yields and a stronger dollar.

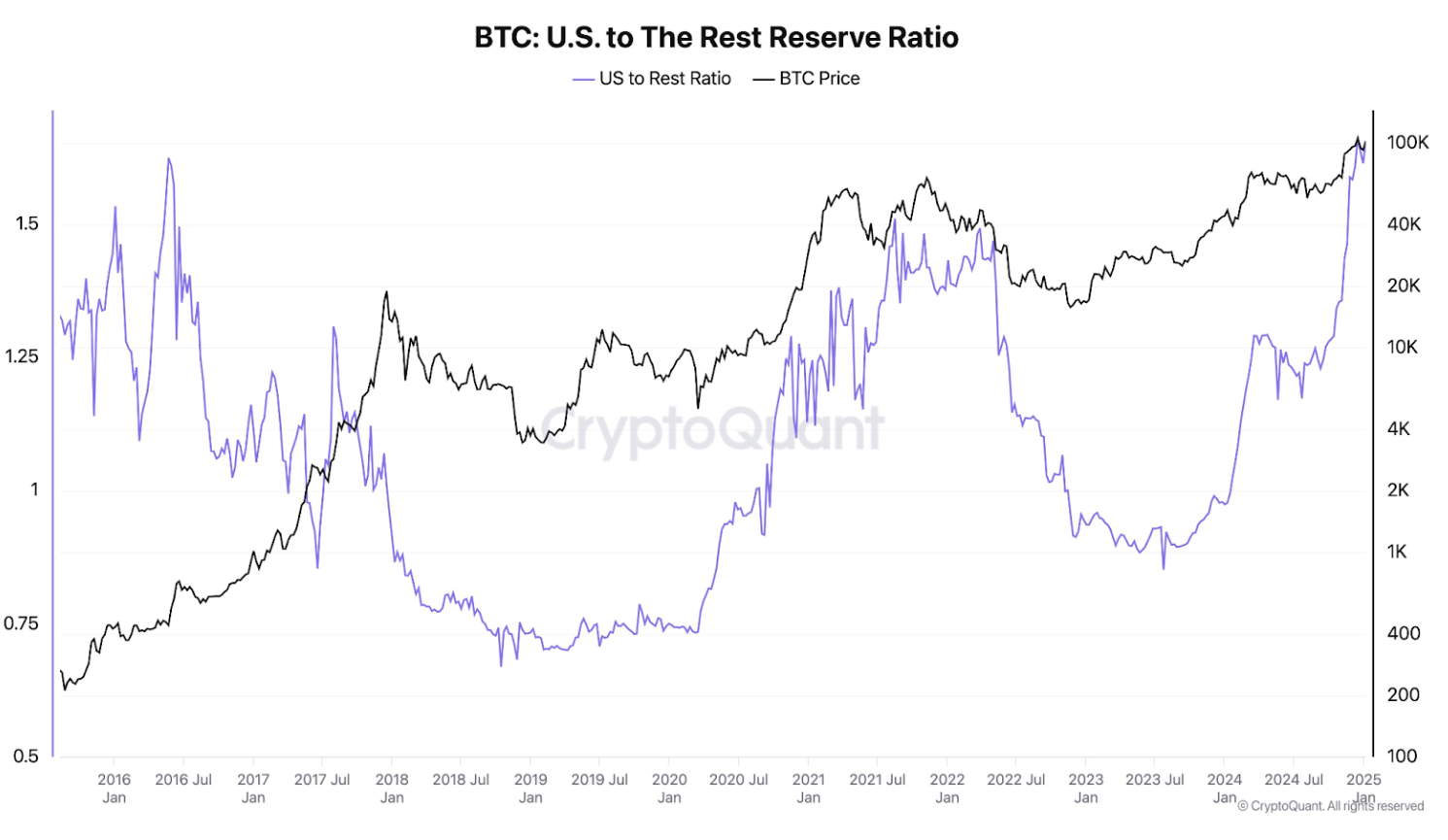

QCP Capital highlighted that Bitcoin is increasingly being seen as digital gold, driven by a shift of capital from traditional safe-haven assets to cryptocurrency. This trend appears to be gaining stability, with Bitcoin’s total market cap reaching $1.73 trillion, surpassing silver’s capitalization, though it still lags behind gold at $17.5 trillion.

Analysts point out that even a slight reallocation of capital — just 1% of the global gold reserves into Bitcoin — could push its price close to $97,000. Growing interest in call options with strike prices of $110,000 and $120,000 also suggests the market’s readiness for further upward movement of the asset.

In October, BlackRock CEO Larry Fink acknowledged that Bitcoin has already become a viable alternative to gold and is likely to continue solidifying its position in this role.