Dutch fintech company Quantoz has announced the release of EURQ and USDQ stablecoins, compliant with MiCA regulations, following investments from Fabric Ventures, Kraken, and Tether.

The tokens, pegged to the euro and US dollar, are built on the Ethereum blockchain. They aim to simplify international transfers, settlements in secondary markets, and transactions between cryptocurrency exchanges.

The issuance of these stablecoins is handled by Quantoz Payments, a subsidiary licensed by the Dutch Central Bank as an electronic money institution. Under EU regulations, the tokens are fully backed by reserves in fiat currencies and highly liquid assets, such as government bonds. These reserves are managed by an independent fund and stored in segregated accounts at top-tier banks.

Additionally, Quantoz complies with MiCA’s requirement to maintain 2% of the reserve value on its own balance sheet to ensure additional token stability.

Starting November 21, EURQ and USDQ will be available for trading on Kraken and Bitfinex, the latter being affiliated with Tether.

Quantoz Payments CEO Star Busmann commented on the launch:

“Investments from leading digital asset companies enable us to provide a timely solution for the crypto market and unlock new use cases for blockchain-based money in traditional financial scenarios.”

The MiCA regulation has sparked debate in the market. Earlier, Tether’s CTO, Paolo Ardoino, expressed concerns, stating that the new rules could pose a threat to stablecoins and the banking system.

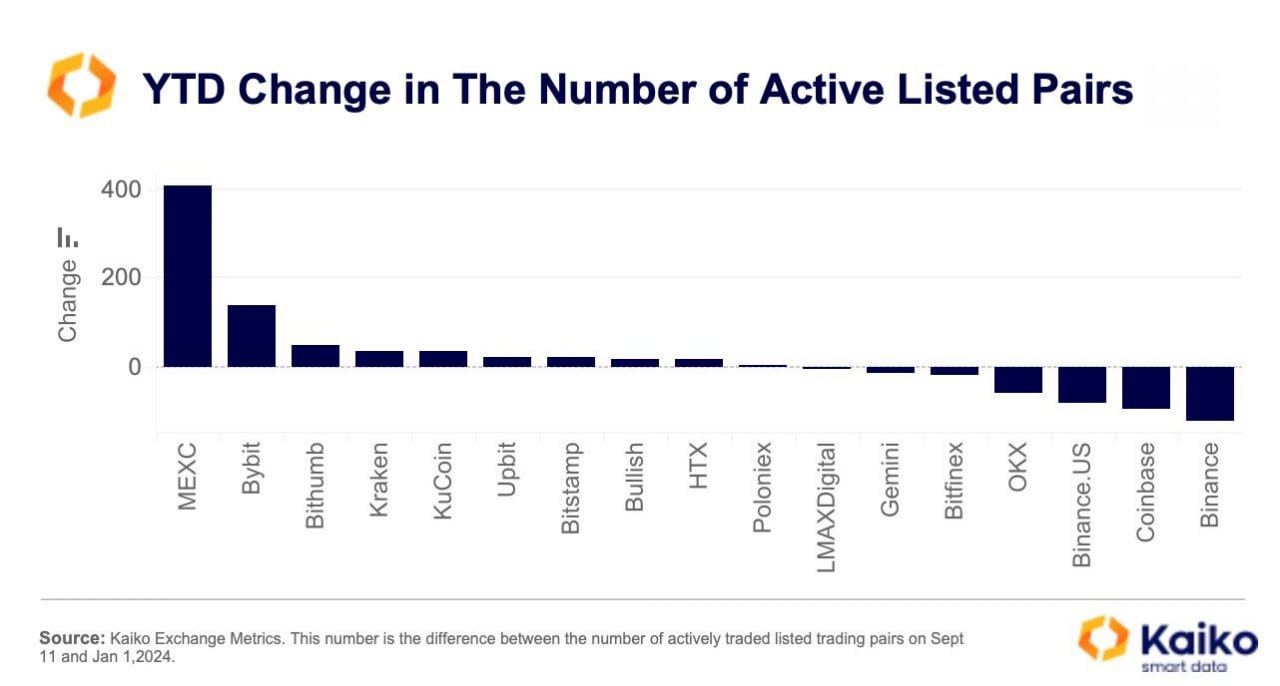

Furthermore, several crypto exchanges, including Coinbase, Uphold, Binance, and OKX, have begun restricting access for EU customers to unregulated stablecoins.