The New York Department of Financial Services has approved Ripple’s stablecoin RLUSD for trading. This was announced by the company’s CEO, Brad Garlinghouse.

According to Garlinghouse, RLUSD will soon be listed on partner platforms such as Uphold, Bitstamp, Bitso, MoonPay, Independent Reserve, CoinMENA, and Bullish. Liquidity will be provided by market makers B2C2 and Keyrock.

Ripple began testing RLUSD in April 2024. Garlinghouse stated that the new stablecoin will become a “gold standard for the corporate sector” and will be suitable for payments, real-world assets (RWA), and DeFi applications.

At the same time, Ripple will continue to use XRP. Both currencies will be applied for international payments, offering flexibility and extensive opportunities for users.

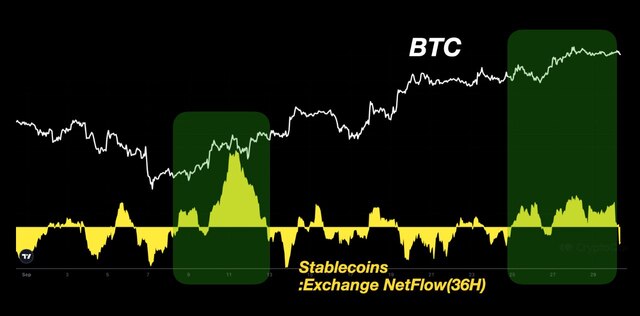

Following the announcement, the price of XRP surged by 10% within a few hours, breaking a two-day downward trend. At the time of writing, XRP is priced at $2.327, with a market capitalization of $133.12 billion.

Earlier, on December 3, XRP reached an all-time high of $2.909, driven by increased activity from major investors.