CryptoQuant analysts suggest that Ethereum could significantly increase in price if current trends in demand, supply, and on-chain activity persist. This was reported by The Block, citing the experts’ insights.

“Based on valuation metrics, Ethereum has the potential to surpass $5000 if the current dynamics continue,” the specialists noted. According to their observations, the upper limit of Ethereum’s realized value is around $5200, reflecting peak levels from the previous bull market.

Experts emphasize that new investors are buying Ethereum at higher prices, which may contribute to pushing this level even higher and enhancing the asset’s growth potential in the current market cycle.

Increase in On-Chain Activity

A positive trend in network activity is also being observed. The daily transaction volume now ranges between 6.5–7.5 million, compared to around 5 million in 2023.

“Additionally, the number of daily smart contract calls — an indicator of dApp usage — has grown to 6–7 million compared to 5 million in 2023,” the analysts added.

This surge in on-chain activity has led to an increase in transaction fees and a rise in the number of tokens burned under the EIP-1559 mechanism.

“Since September, the amount of Ethereum burned due to fees has increased, slowing down the supply growth rate and putting pressure on the digital asset,” explained CryptoQuant representatives.

Institutional Investor Interest

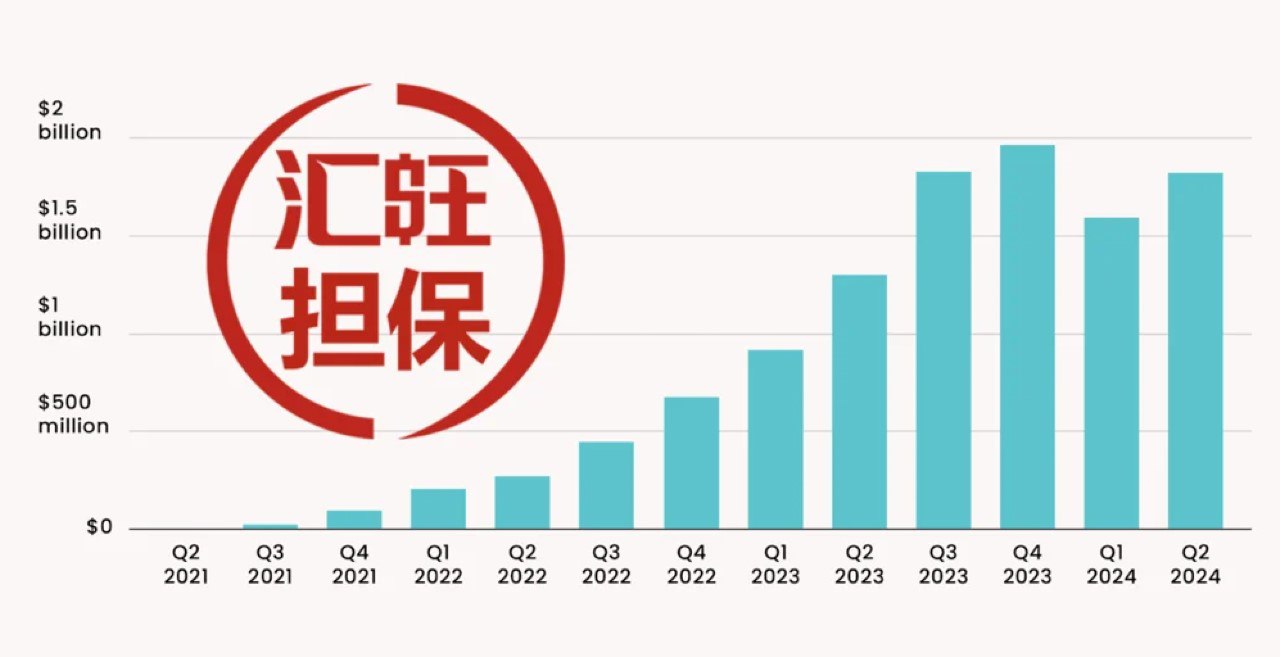

Since November 22, spot-based Ethereum ETFs have shown consistent net inflows. The total assets under management for Ethereum-based ETF providers have surpassed $13 billion, with cumulative net inflows nearing $2 billion, including $102 million in the last 24 hours.

According to experts, such demand from institutional investors indicates Ethereum’s potential to reach new price highs in the near future.

At the time of writing, Ethereum is trading around $3948, reflecting a 21.7% increase over the past 30 days. For comparison, Bitcoin has risen by 16.2% during the same period.

Notably, on December 10 and 11, BlackRock and Fidelity acquired $500 million worth of Ethereum for their ETFs.