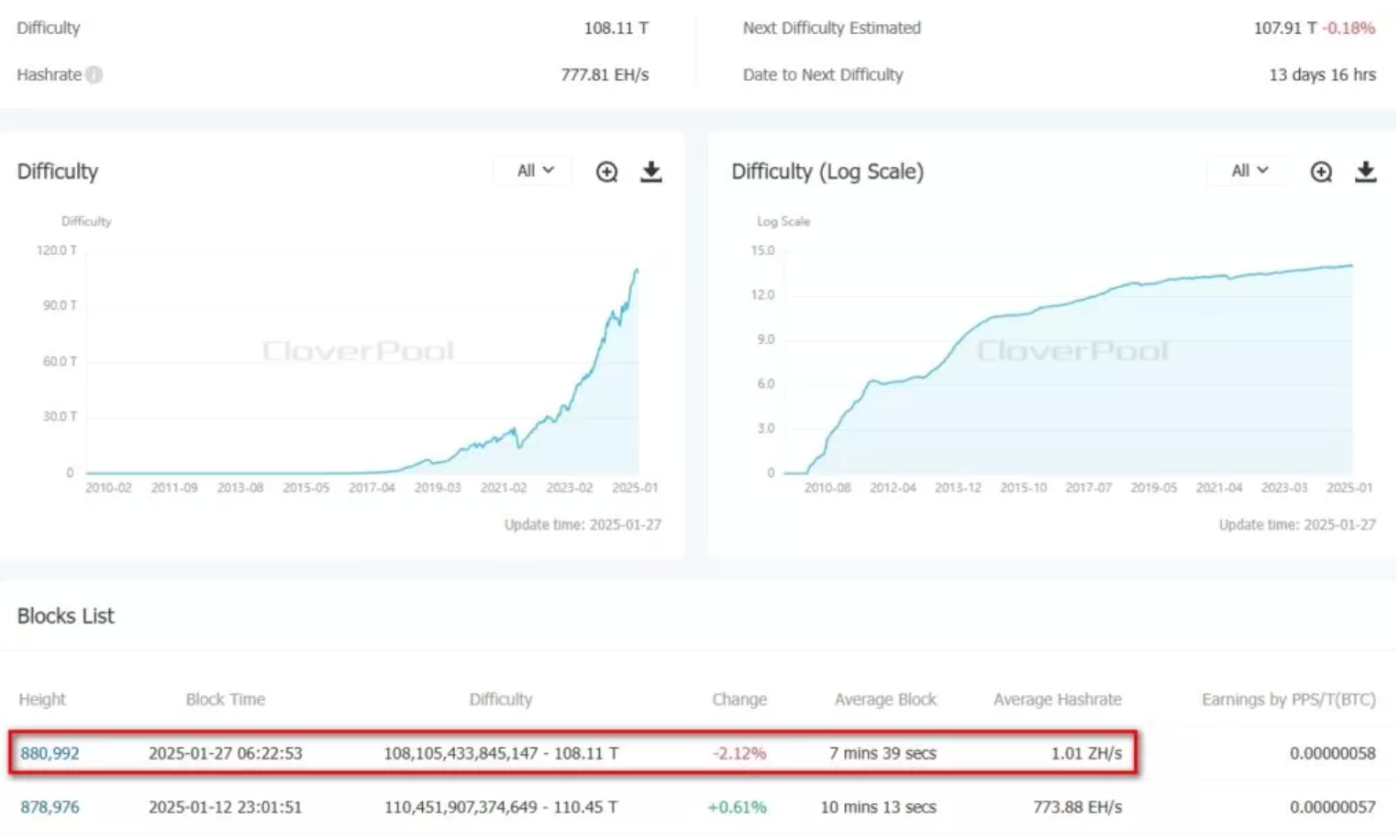

Following the latest adjustment, the difficulty of mining the first cryptocurrency decreased by 2.12%, reaching 108.11 T. This marks the first decline in the metric since September 2024, making it a significant event for the industry.

According to Glassnode, on January 2, the hashrate (7-day moving average) hit a record high of 818.7 EH/s before dropping to 766 EH/s. This indicates reduced activity among some miners, potentially due to changing market conditions. Data from Hashrate Index shows that over the past 24 hours, the hash price fell by 3.8%, from $60.3 per PH/s per day to $58. The primary driver behind the decline in mining profitability was Bitcoin’s price dropping below the key $100,000 level, increasing pressure on revenues.

Daily mining revenues in January ranged from $42 million to $49 million, approximately 1.5 times higher than the figures observed in fall 2024 but significantly lower than the levels reached before the April halving, according to The Block. At the same time, miners face growing competition and rising costs for equipment and electricity, presenting additional challenges to maintaining profitability.

Fidelity analysts suggest that the trend of decreasing transaction revenues for miners may continue in the long term, particularly under the increasing pressure on network fees. However, they believe this does not pose a threat to blockchain security, as the system remains robust due to its difficulty adjustment mechanism.

Experts also highlight the importance of the mining industry adapting to new realities, including the adoption of more energy-efficient solutions and diversification of revenue streams. In the future, this could lead to a redistribution of mining power between large players and smaller participants, ultimately impacting the overall structure of the Bitcoin ecosystem.