According to Bitwise CIO Matt Hougan, capital inflows into spot Bitcoin exchange-traded funds (ETFs) are expected to reach $50 billion in 2025.

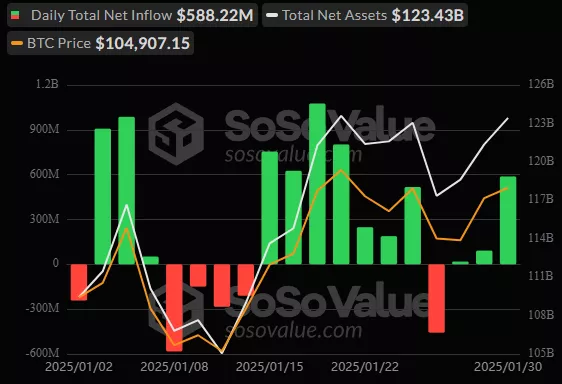

Hougan based his forecast on data from January 2025, when investors poured $4.94 billion into these products. Annualizing this figure results in approximately $59 billion. For comparison, total inflows into such funds in 2024 amounted to $35.2 billion.

The expert highlighted significant month-to-month volatility in these figures. In January, the leading funds in terms of inflows were BlackRock’s IBIT ($3.2 billion) and Fidelity’s FBTC ($1.3 billion). Bitwise’s BITB, with $125 million, ranked fifth, trailing Grayscale’s BTC ($398.5 million), according to Farside.

In its outlook for 2025, Bitwise analysts predict Bitcoin will surge to $200,000. Key factors driving this growth include:

- Record-breaking capital inflows into spot ETFs;

- Increased purchases of the asset by corporations and governments;

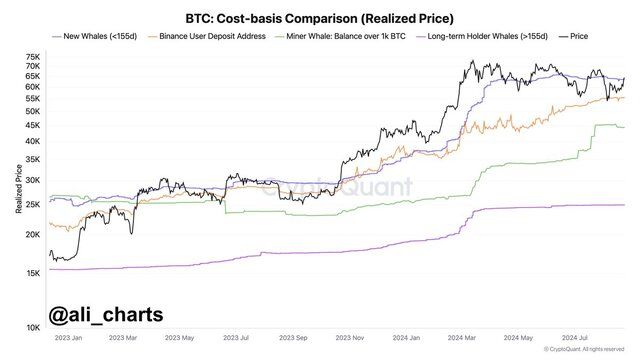

- A reduction in Bitcoin supply due to the halving that took place in April 2024.

Previously, Bitwise stated that Bitcoin corrections in 2025 are expected to be less severe, attributing this to policy initiatives by U.S. President Donald Trump.