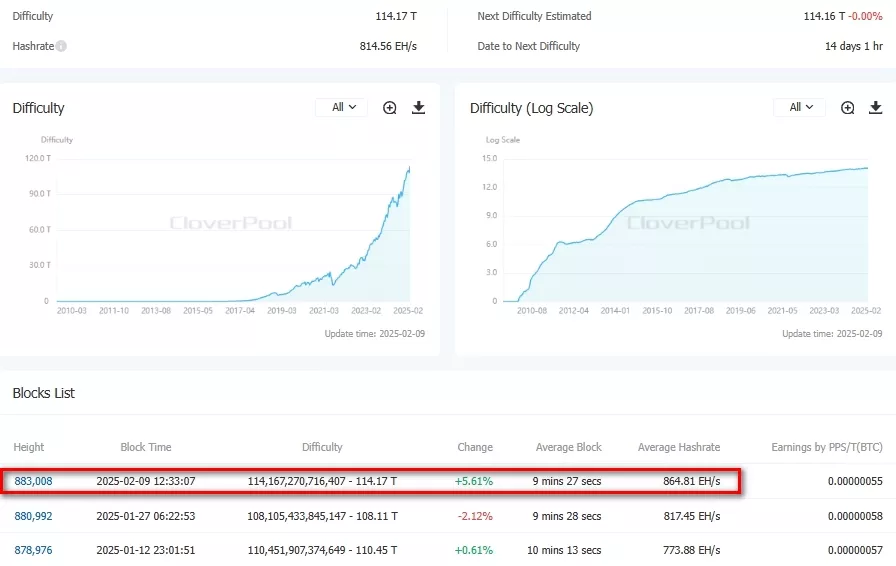

The latest recalculation of Bitcoin mining difficulty resulted in a 5.61% increase, setting a new all-time high at 114.17 T.

Two weeks ago, the metric declined for the first time since September 2024. Experts at Luxor attribute this correction largely to cold weather in the U.S., which led to higher electricity costs and reduced uptime for local miners.

According to Glassnode, on February 7, the hash rate (seven-day moving average) peaked at 844.95 EH/s before correcting to 827 EH/s.

Analysts at Hashrate Index report a drop in hashprice, which fell from around $62 per PH/s per day at the end of January to approximately $57.

Mining profitability is under pressure due to multiple factors, including Bitcoin’s 6% price decline over the past week and decreasing transaction revenue. According to CryptoQuant, on-chain activity in the Bitcoin network has reached a one-year low.

Previously, Fidelity analysts suggested that the share of transaction fees in miners’ revenue may continue to decline in the long run. However, they believe this does not pose a threat to blockchain security.