On March 6, the bankrupt cryptocurrency exchange Mt.Gox transferred 11,834 BTC (approximately $1.1 billion) to an unknown address “1Mo1…9gR9”, according to Arkham Intelligence.

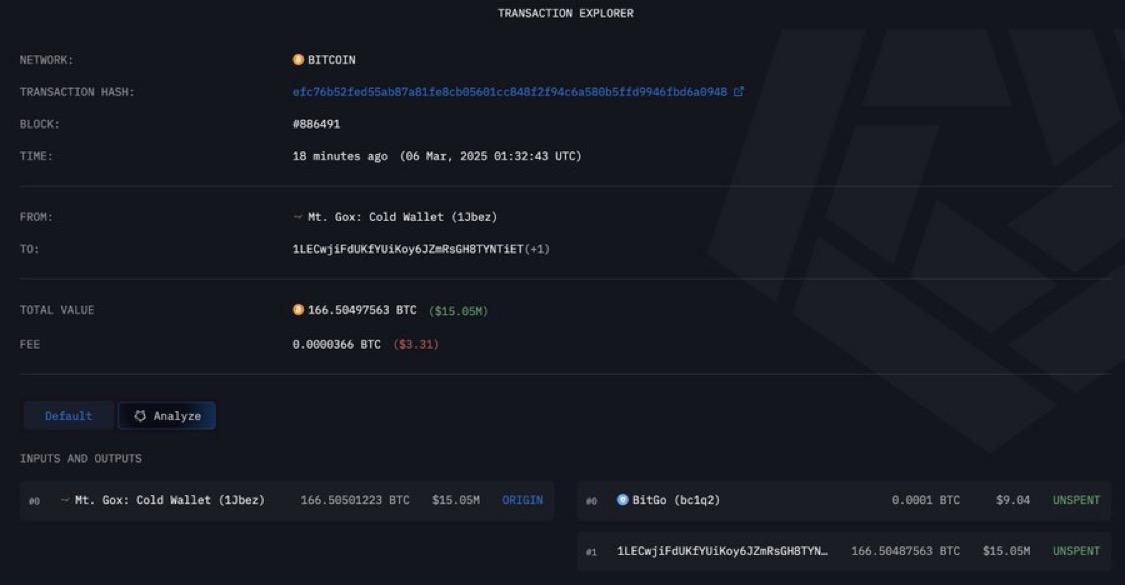

This marks the platform’s first major transaction since late January. Around the same time, the exchange also moved 166.5 BTC (worth $15.05 million) to its cold wallet “1Jbez”.

Mt.Gox’s wallets tracked by Arkham still hold 36,008 BTC, valued at approximately $3.33 billion.

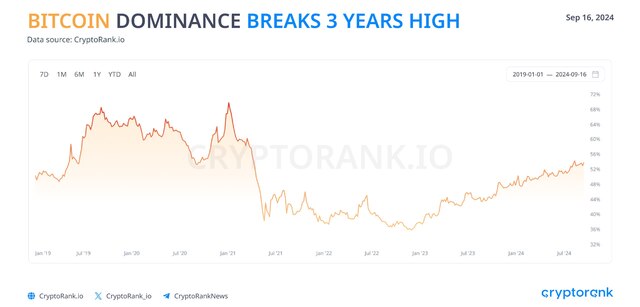

Despite the movement of such a large amount of digital gold, Bitcoin’s price has not declined. Instead, it rose by 4.8% over the past 24 hours, reaching $91,683. This upward momentum has also influenced the broader crypto market, according to CoinGecko.

Context: Creditor Payouts and Previous Transactions

Mt.Gox’s transfers continue to draw attention, particularly amid the long-awaited creditor repayments. In May 2024, the company moved its Bitcoin reserves for the first time in five years, with total transactions exceeding $9 billion at that time.

However, the timeline for repayments has been repeatedly pushed back. Previously, Mt.Gox’s management postponed the distribution date from October 31, 2024, to October 31, 2025, causing further concerns among creditors.

It remains unclear whether the latest transfers are related to the upcoming repayments or if they serve other internal purposes.