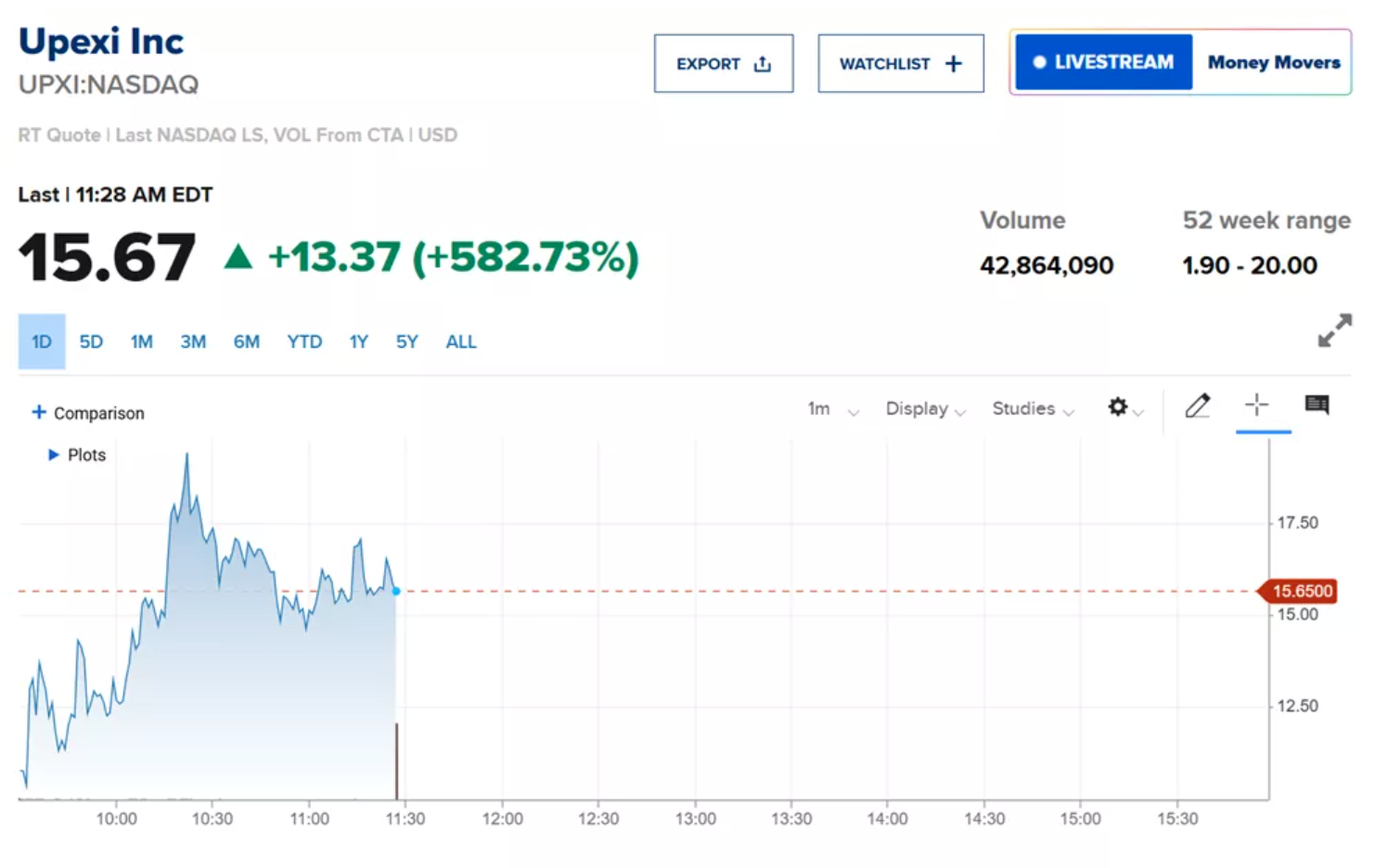

U.S.-based consumer goods company Upexi shocked the markets with its decision to adopt Solana (SOL) as a reserve asset, triggering a massive spike in its stock price. Shares surged 582.7%, peaking at an astonishing +746.5%, making Upexi one of the most talked-about stocks in April.

The company raised $100 million in a private funding round led by market maker GSR. Of that amount, $5.3 million will be allocated to reducing debt and boosting working capital, while the majority of the funds will be used to purchase SOL. Upexi also announced plans to stake its holdings, aiming to generate a steady stream of passive income.

“The speed, scalability, and vibrant developer ecosystem make Solana an ideal foundation for long-term growth,” said Brian Rudick, Head of Research at GSR.

Solana: The New Treasury Asset for Tech-Savvy Firms?

Upexi isn’t alone in this move. Janover, a company focused on commercial real estate lending, has also embraced Solana as a reserve asset, holding 83,000 SOL valued at $11.57 million. This reinforces the emerging trend among agile, growth-oriented companies using crypto assets to strengthen their balance sheets.

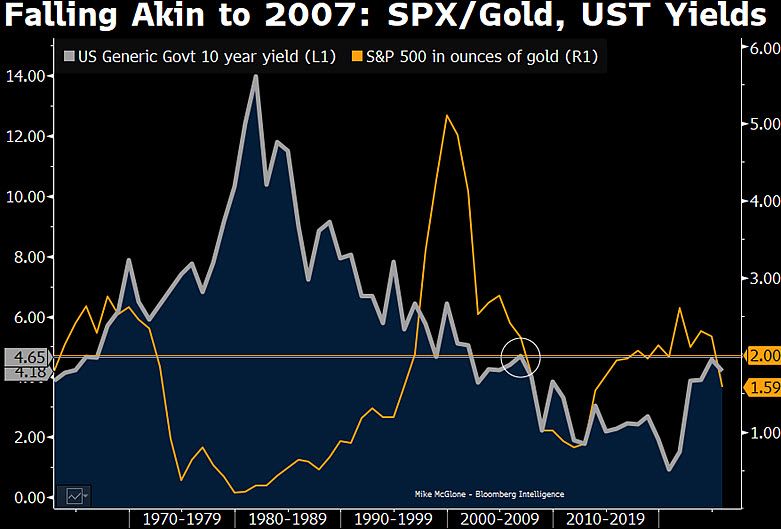

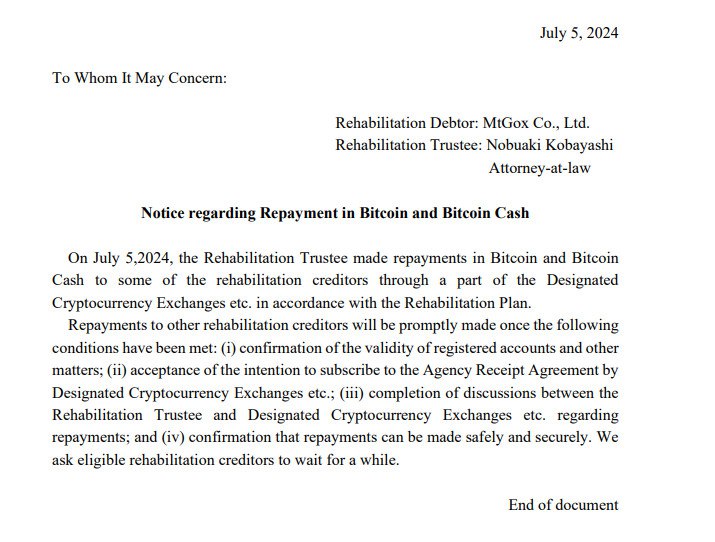

An increasing number of public companies are turning to crypto as a hedge against inflation and an alternative reserve strategy. According to Bitwise, as of early 2024, public companies held a combined 688,000 BTC (~$60.65 billion).

Elliot Chun, Partner at Architect Partners, predicted that by 2030, up to 25% of S&P 500 companies could hold crypto—primarily Bitcoin and Solana—as part of their long-term treasury strategy.

Institutional Interest in Solana on the Rise

The market has interpreted Upexi’s move as a potential catalyst for a new wave of institutional interest in Solana. Back in February, analysts at VanEck predicted that SOL could reach $520 by the end of 2025, driven by the expansion of DeFi protocols, NFT growth, and increasing developer activity within the Solana ecosystem.

Independent crypto analyst Alex Wong commented:

“If more public companies start adopting Solana as a treasury asset, we could see a rush similar to what happened with MicroStrategy and Bitcoin.”

Risks and Long-Term Outlook

Despite the excitement, analysts warn that Solana remains a high-volatility asset, and holding it as a reserve carries risks. Still, as shown by the experiences of MicroStrategy and Tesla with Bitcoin, strategic risk-taking can significantly boost market cap if executed wisely.

As the crypto and traditional finance sectors continue to merge, Upexi’s bold move may mark the beginning of a larger shift—one where decentralized digital assets become a standard component of corporate financial strategy.