CryptoQuant CEO Ki Young Ju has publicly apologized for an incorrect prediction made two months ago regarding the end of Bitcoin’s bull cycle. He acknowledged that current market conditions are far more complex than previously anticipated.

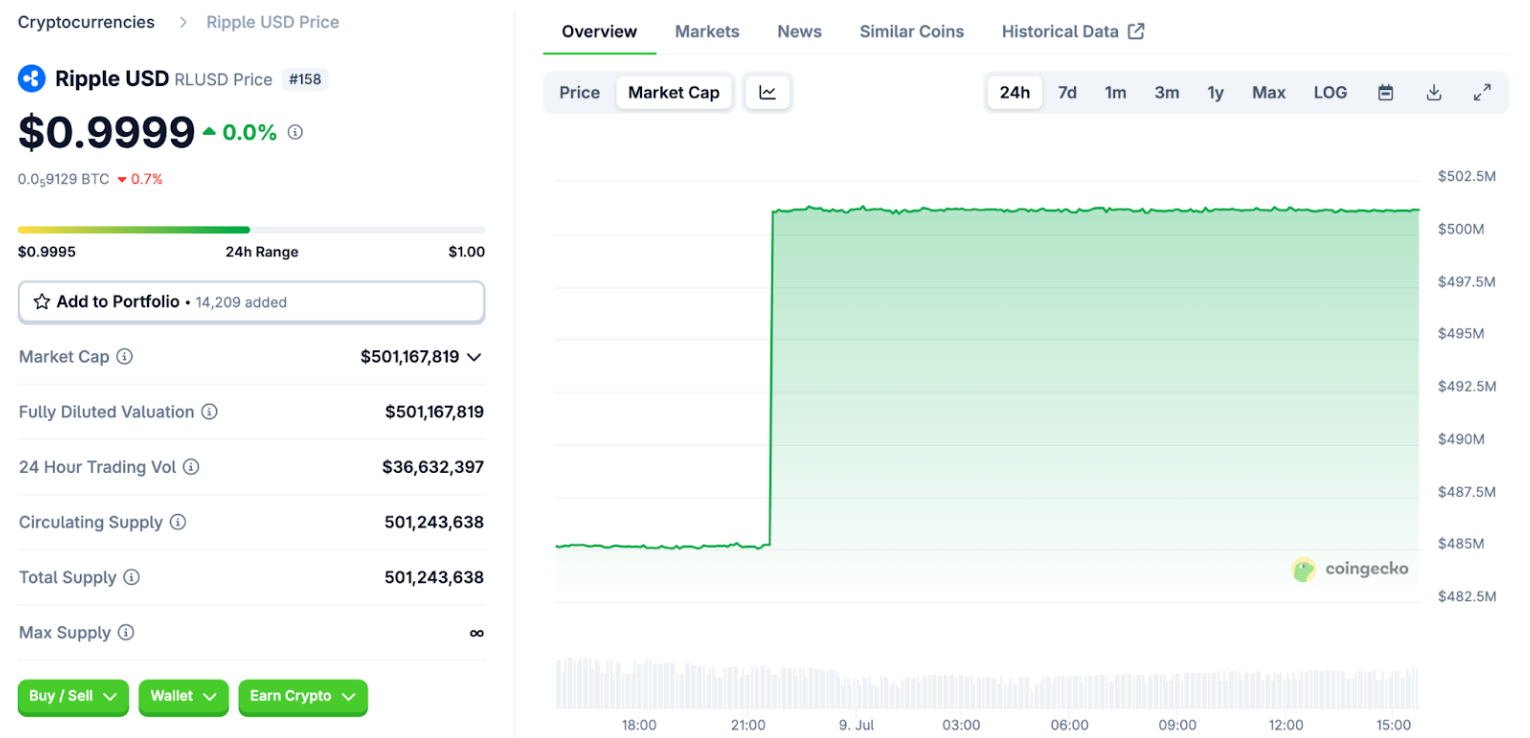

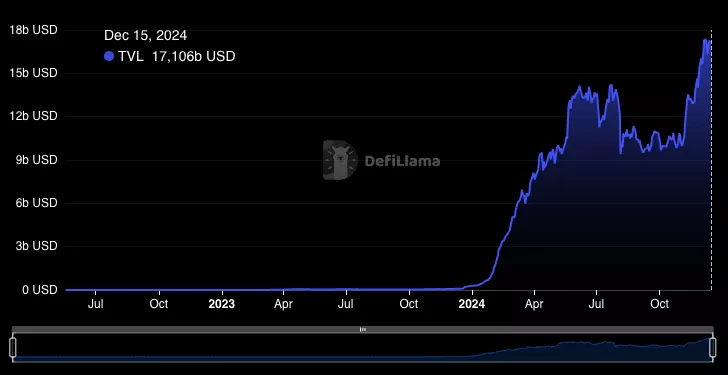

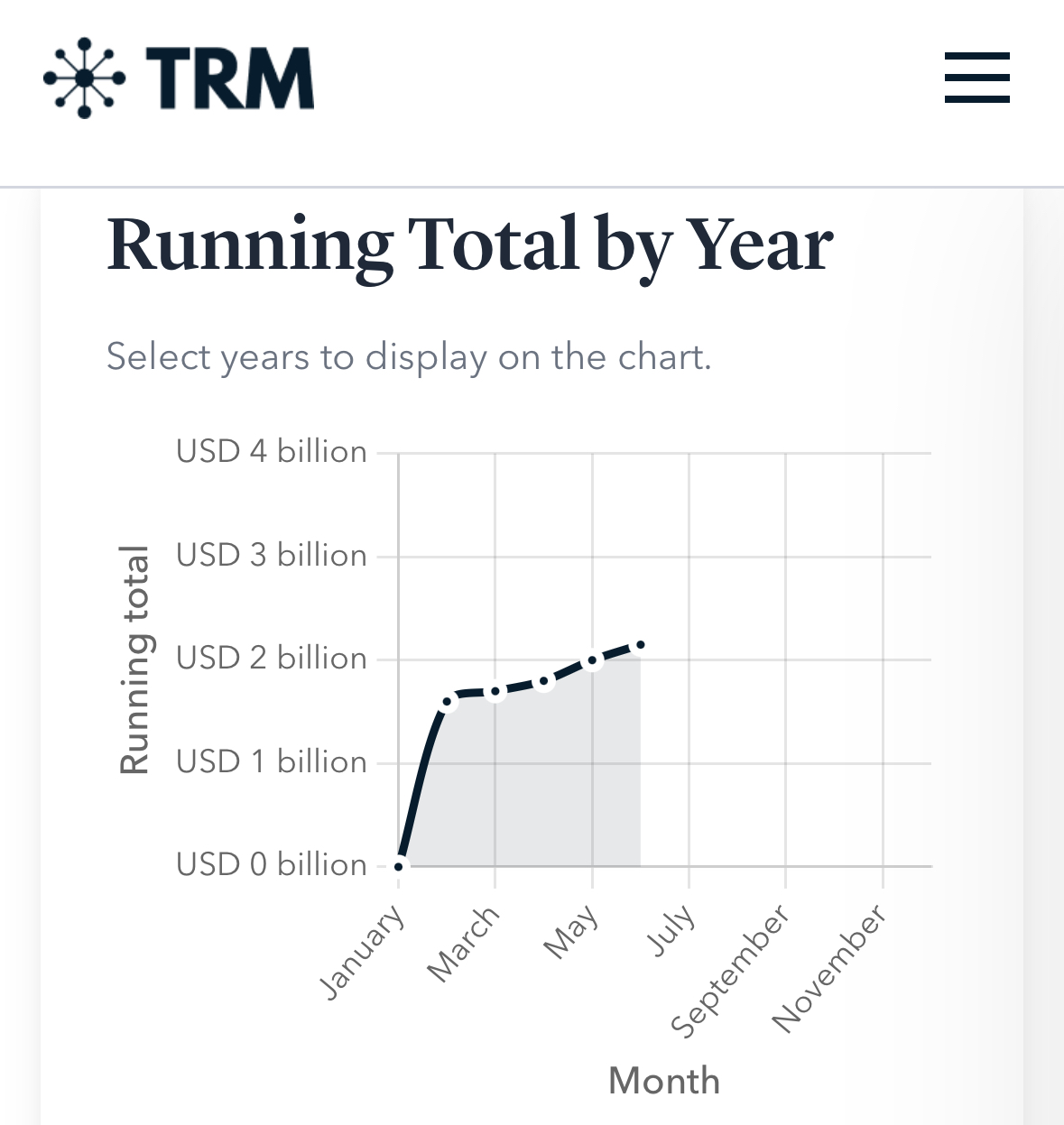

According to Ju, selling pressure on Bitcoin is easing, while significant capital continues to flow into the ecosystem through exchange-traded funds (ETFs). This trend signals growing institutional confidence and is reshaping previously reliable market patterns.

Historically, Bitcoin’s market dynamics were primarily driven by three groups: miners, whales, and retail investors. When inflows from new participants dried up and large holders began to take profits, this would trigger cascading sell-offs and sharp price declines. However, Ju now believes that this model is outdated.

“Today’s market is far more layered. In addition to traditional players, we’re seeing active involvement from ETFs, investment firms, publicly traded companies, and even government institutions. This creates a fundamentally new demand and supply structure,” he explained.

He emphasized that in this new environment, it’s no longer sufficient to track whale sell-offs alone. The scale of institutional and ETF inflows must also be considered. “These capital inflows can not only dampen volatility but also offset large-scale sell-offs by major holders,” Ju added.

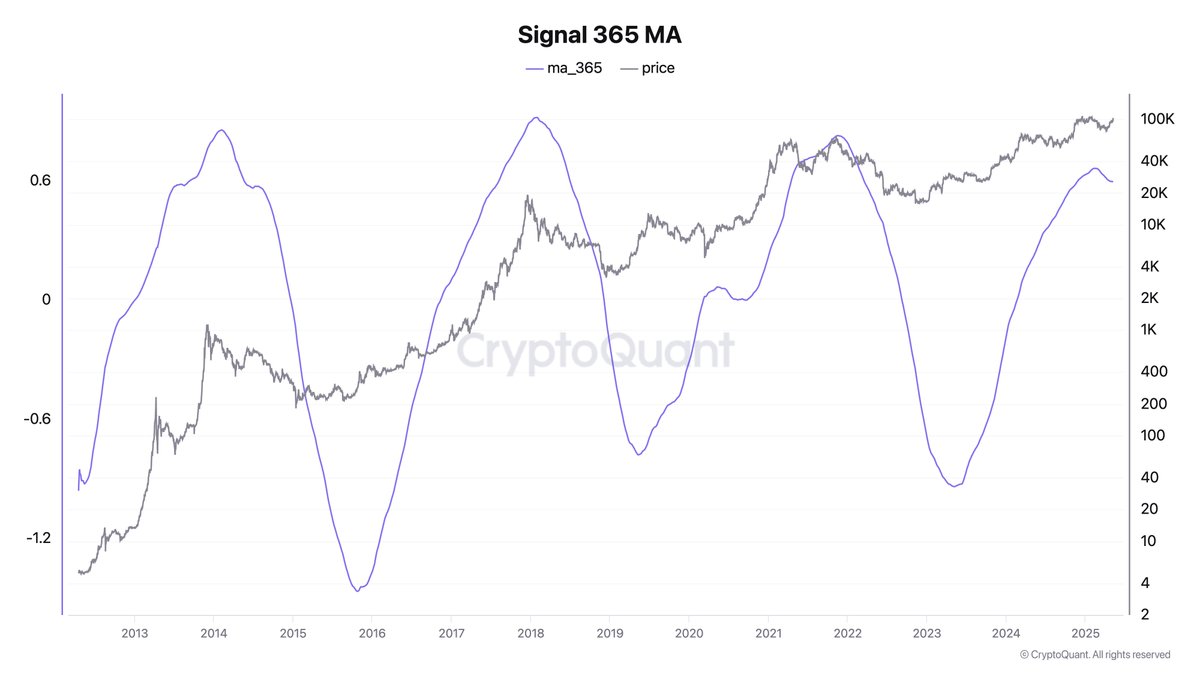

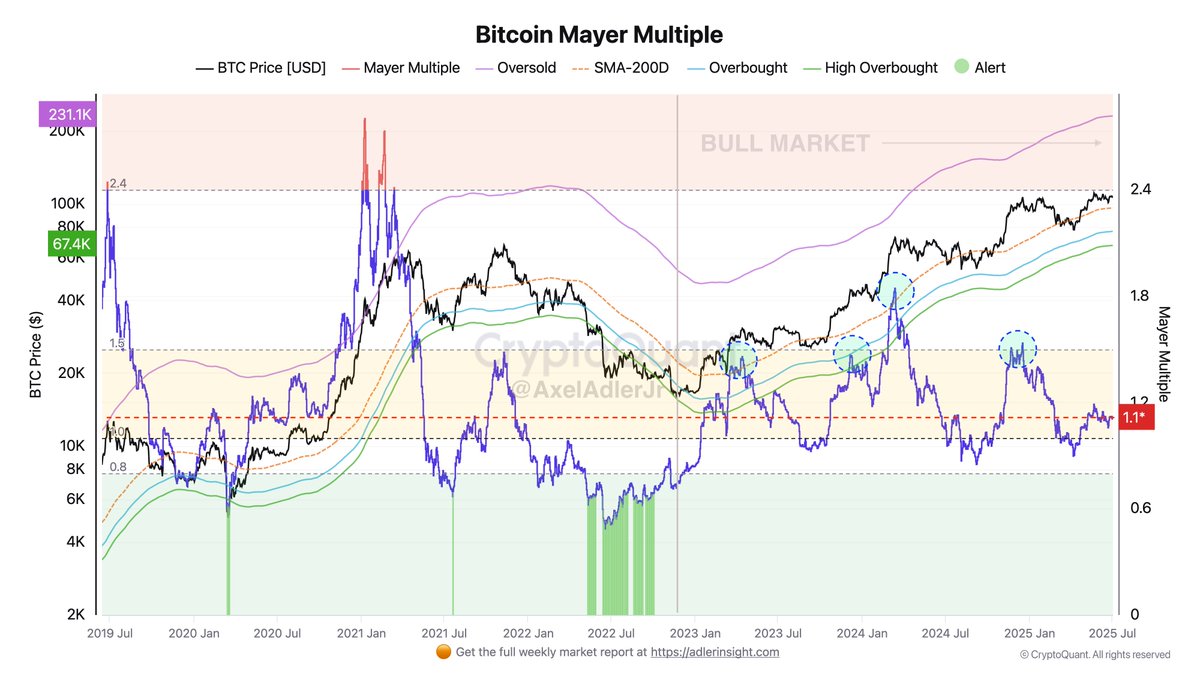

Despite Bitcoin recently reclaiming the $100,000 mark, Ju described the market as “sluggish” and unstable. Most on-chain indicators, he noted, are hovering in a gray zone and offer little in the way of clear investment signals.

Still, he stressed that the misjudgment does not diminish the value of on-chain analytics as a tool. “Data remains objective. The key lies in how we interpret it. This is a reminder of the importance of comprehensive analysis and adaptable thinking,” he stated.

Ju concluded by pledging to enhance CryptoQuant’s analytical framework by incorporating more nuanced factors that reflect real-world dynamics — including the growing integration of crypto with traditional finance, regulatory developments, and macroeconomic trends.

He also expressed gratitude to the community for its constructive feedback and support, adding that transparency and accountability are essential elements of a mature analytical culture.