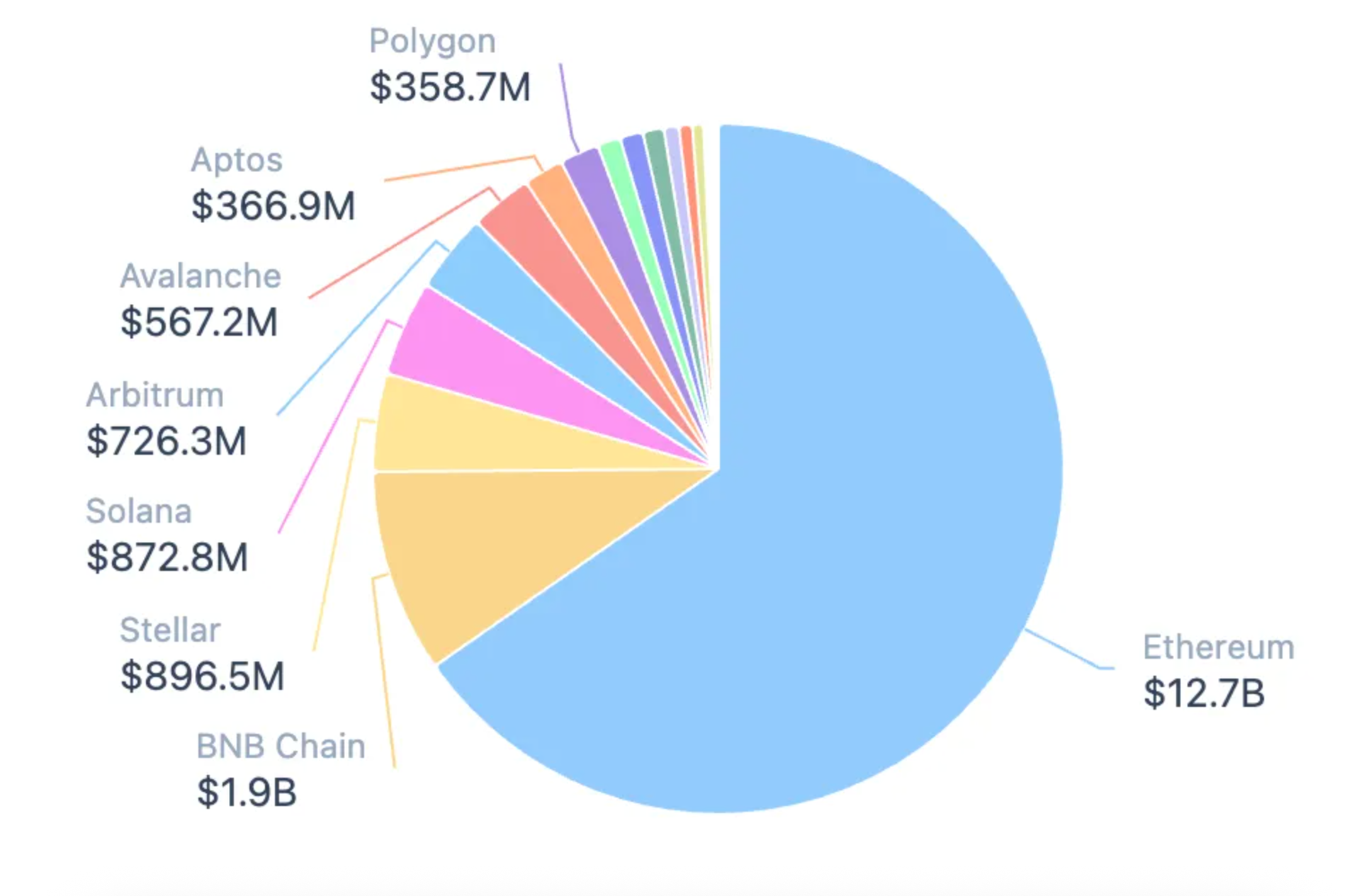

In the current crypto bull cycle, lending protocols in the decentralized finance (DeFi) sector have hit record highs in total value locked (TVL), while decentralized exchanges (DEXs) continue to lose ground.

According to recent data, the combined TVL of DeFi lending platforms has reached $53.3 billion, accounting for 43% of the total DeFi market value of $124.6 billion. In contrast, DEX TVL has dropped to just $21.5 billion, down sharply from its peak of $85.3 billion in November 2021.

Aave leads the sector with over $24 billion in locked assets, surpassing not only its lending competitors but also the entire liquid staking segment.

Experts attribute this shift to the growing appeal of stable, predictable returns from lending products. Henrik Andersson, founder of Apollo Capital, notes that lending has become the only sustainable source of income in DeFi, while DEX liquidity pools suffer from impermanent loss and increasing competition.

Andersson also highlights the rise of intent-based swaps, which source liquidity from centralized exchanges (CEXs), further draining capital from DEX platforms. Additionally, while the “capital-efficient” design of Uniswap v3 enables higher returns with less capital, it also results in lower overall TVL.

Lending protocols such as Aave, Compound, and Spark currently offer annual yields ranging from 1.86% to 3.17% for holders of Ethereum and stablecoins. By comparison, returns in DEX pools are potentially higher but highly volatile and depend on daily trading volumes.

According to Galaxy Digital, DeFi lending’s market share surged to 65% by the end of 2024, overtaking centralized platforms. This shift followed the collapse of major CeFi players like Celsius and BlockFi, which reduced the centralized lending market by 78% from its 2022 peak.

Galaxy further reports that DeFi lending volumes have grown by 960% since late 2022, becoming one of the fastest-growing verticals in crypto.

Analysts predict that the next wave of growth will be driven by institutional adoption and increased regulatory clarity.

Meanwhile, despite the lending boom, the overall DeFi sector saw a 27% decline in TVL in Q1 2025, while NFT trading volume dropped by 24%. At the same time, social and AI-based applications recorded the strongest growth across the Web3 ecosystem, signaling a shift in user demand and innovation trends.