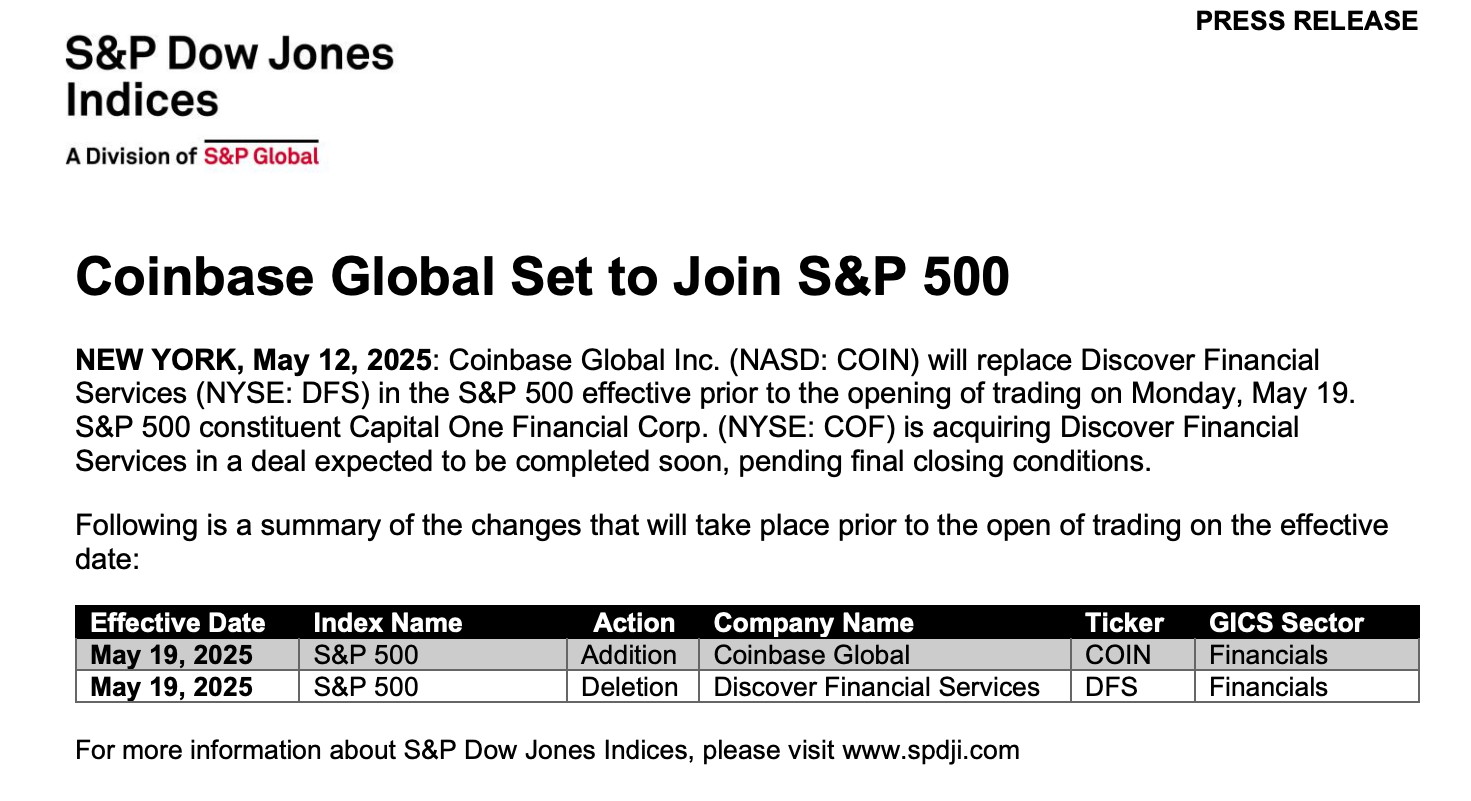

Coinbase, the largest publicly traded cryptocurrency exchange in the United States, will officially join the S&P 500 index on May 19, 2025, replacing Discover Financial Services. This milestone marks a historic moment not only for the company itself but for the entire crypto industry, signaling deeper integration into the traditional financial system.

The S&P 500 index includes the 500 largest publicly traded companies in the U.S. by market capitalization and serves as a key benchmark for investors. Coinbase’s inclusion will expose its shares to massive institutional capital inflows, as index-tracking funds such as the SPDR S&P 500 ETF will now be required to hold COIN shares.

Market Reaction

Following the announcement, Coinbase stock (ticker: COIN) surged by 7.9%, closing at $207.22 per share. The company’s market capitalization rose to $52.78 billion. Despite the jump, the stock is still trading below its all-time high of $343, reached in December 2021.

Since the beginning of 2025, COIN shares had declined by 16.54%, but the S&P 500 inclusion may serve as a catalyst for a sustained recovery and renewed investor confidence.

Strategic Developments

Coinbase has been actively expanding its footprint across both retail and institutional markets. Recent key initiatives include:

- Tokenized Securities: In March 2025, CFO Alesia Haas revealed that Coinbase is in discussions with the U.S. Securities and Exchange Commission (SEC) regarding the potential launch of tokenized securities trading. This could mark a major step toward bridging traditional finance with blockchain technology.

- Federal Bank License: In April, Coinbase confirmed rumors that it is exploring the possibility of applying for a U.S. federal banking license. This move would enable the company to offer a wider range of financial services, including lending, deposits, and settlement.

- Acquisition of Deribit: In May, Coinbase announced a $2.9 billion deal to acquire Deribit — the world’s leading platform for trading Bitcoin and Ethereum options. This acquisition is expected to significantly strengthen Coinbase’s presence in the crypto derivatives market.

Industry Significance

Coinbase’s inclusion in the S&P 500 is a landmark moment, representing formal recognition of the crypto industry by traditional financial markets. It demonstrates that digital asset companies can compete on par with legacy financial giants and become integral to the global financial ecosystem.