Circle raised $1.1 billion in its IPO, nearly doubling initial expectations. The offering of USDC shares on the New York Stock Exchange (NYSE) was oversubscribed 25 times, according to Bloomberg citing informed sources. As a result, the final valuation of the company stood at $6.9 billion, with a fully diluted value (FDV) of $8.1 billion.

Circle and its investors, including CEO Jeremy Allaire, sold 34 million Class A common shares at $31 each. Trading of the shares under the ticker CRCL will begin on June 5.

Originally, the company aimed to raise around $600 million with a price range of $24 to $26 per share, which would have valued it at $5.4 billion. However, the offering was increased to $896 million with a valuation of $7.2 billion at the last minute.

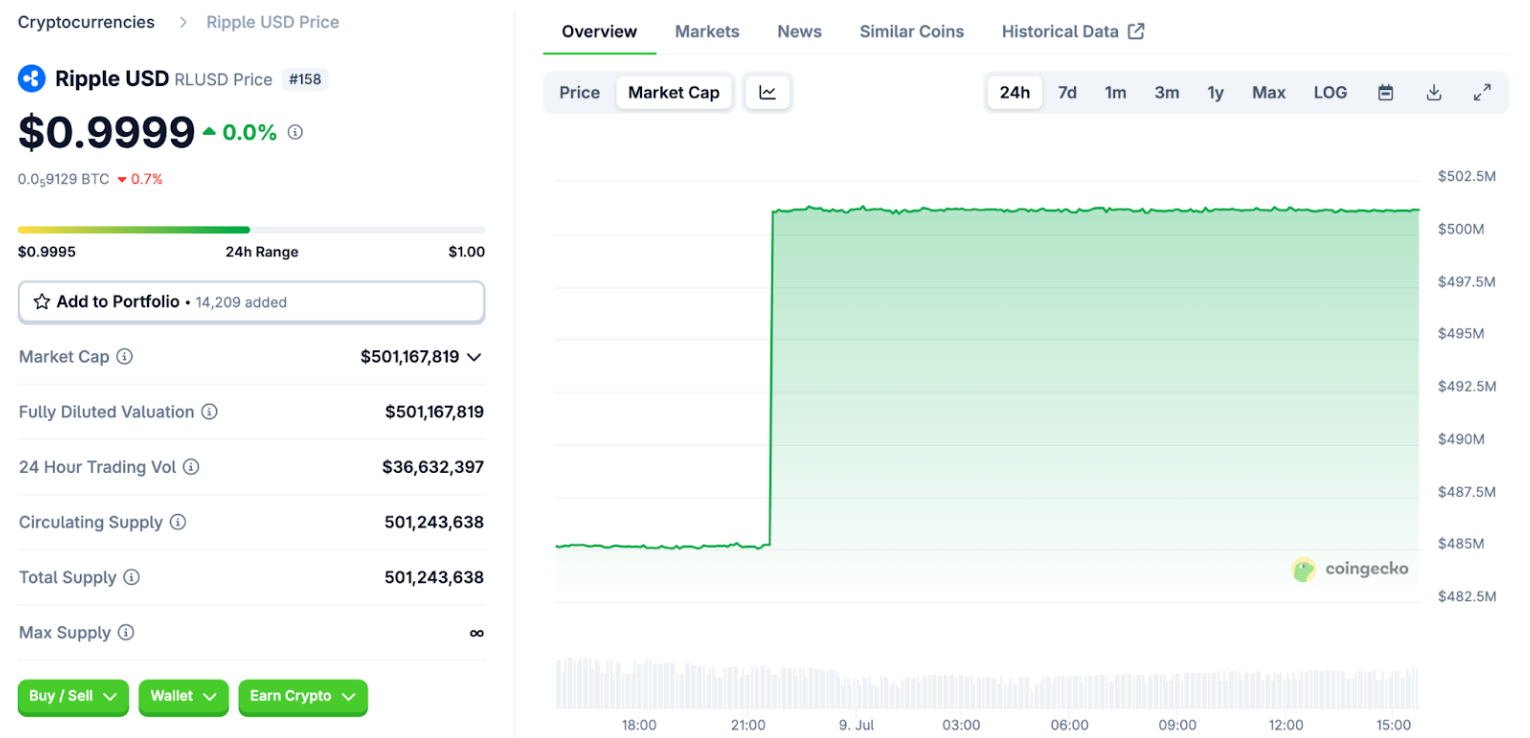

The IPO was delayed multiple times. In April 2023, it was postponed due to market uncertainty and the revision of trade tariffs proposed by US President Donald Trump. Later, rumors circulated that Circle might abandon the IPO and sell the company for $5 billion. Potential buyers such as Coinbase and Ripple were mentioned, but the deals did not materialize.

Coinbase and Circle had previously worked together in the Center consortium, which was responsible for issuing the USDC stablecoin. However, in August 2023, the consortium was dissolved, and Circle became the sole issuer of the coin.

Timeline of Events

In 2021, Circle announced plans to go public via a merger with Concord Acquisition Corp., with its shares expected to list on the NYSE under the ticker CRCL. However, by the end of 2022, the company terminated the deal due to the FTX collapse and worsening conditions in the digital assets market.

Circle’s pre-merger valuation was $4.5 billion, but by February 2022, it had risen to $9 billion. However, due to economic challenges, the closing date for the deal was pushed to 2023.

In early 2023, Circle confirmed it was still committed to its IPO plans, and by November of that year, it revived its public offering plans. In January 2024, it filed a confidential IPO application.

Stablecoin Market Situation

By June 2025, the total market capitalization of stablecoins surpassed $250 billion. Leading the market is USDT from Tether with $153 billion, followed by USDC from Circle with $61.4 billion. Citigroup forecasts that the market capitalization of stablecoins could reach $3.7 trillion by 2028.

Circle conducted its IPO amid regulatory changes for stablecoins. On May 19, 2025, the US Senate advanced the GENIUS Act, aimed at creating a legal framework for dollar-backed cryptocurrencies. This bill requires stablecoins to be fully backed by US dollars or highly liquid assets, and issuers with a market cap over $50 billion will be required to undergo annual audits.

In May 2025, media reports revealed that several major financial institutions, including JPMorgan, Bank of America, CitiGroup, and Wells Fargo, were in discussions about launching a joint stablecoin.