The recent conflict between U.S. President Donald Trump and billionaire Elon Musk had a significant impact on the cryptocurrency market, causing Bitcoin’s price to drop. As a result of their argument, the price of the leading cryptocurrency fell nearly 3%, dropping to $100,000.

On May 5, Musk criticized Trump’s economic initiatives, stating that they would lead to a recession in the second half of 2025. In response, Trump posted on Truth Social, threatening to cancel federal contracts with Musk, claiming it would save billions of dollars for the government budget.

Musk replied with a statement about suspending the operation of SpaceX’s Dragon spacecraft, but later retracted that statement. This exchange of remarks between two influential figures in politics and business had a resonant impact on the market.

At the time of writing, Tesla’s stock, which is owned by Musk, is trading at $284.7, showing a 14.26% decline over the past day, according to Google Finance.

Bitcoin Price and Market Consequences

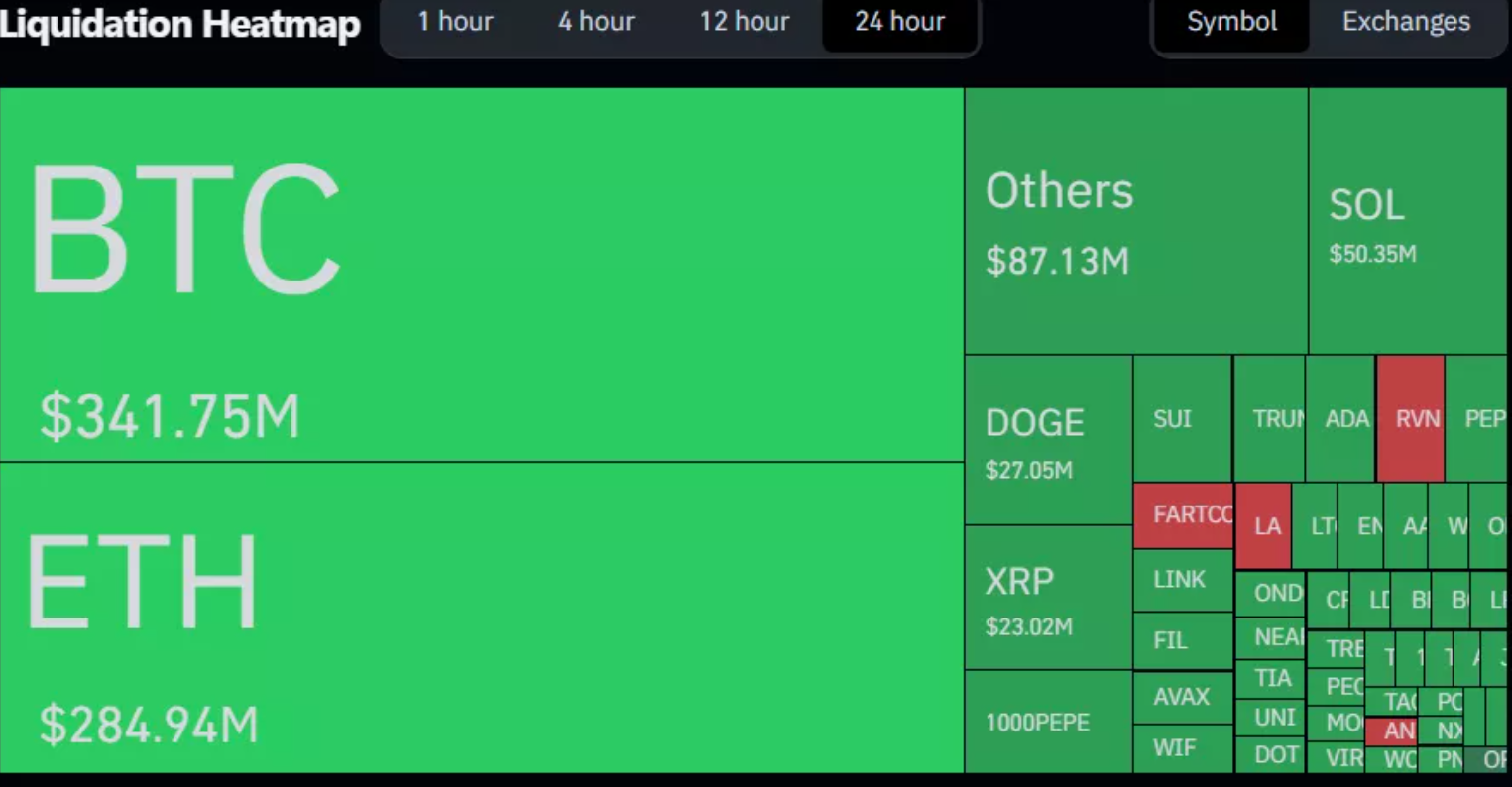

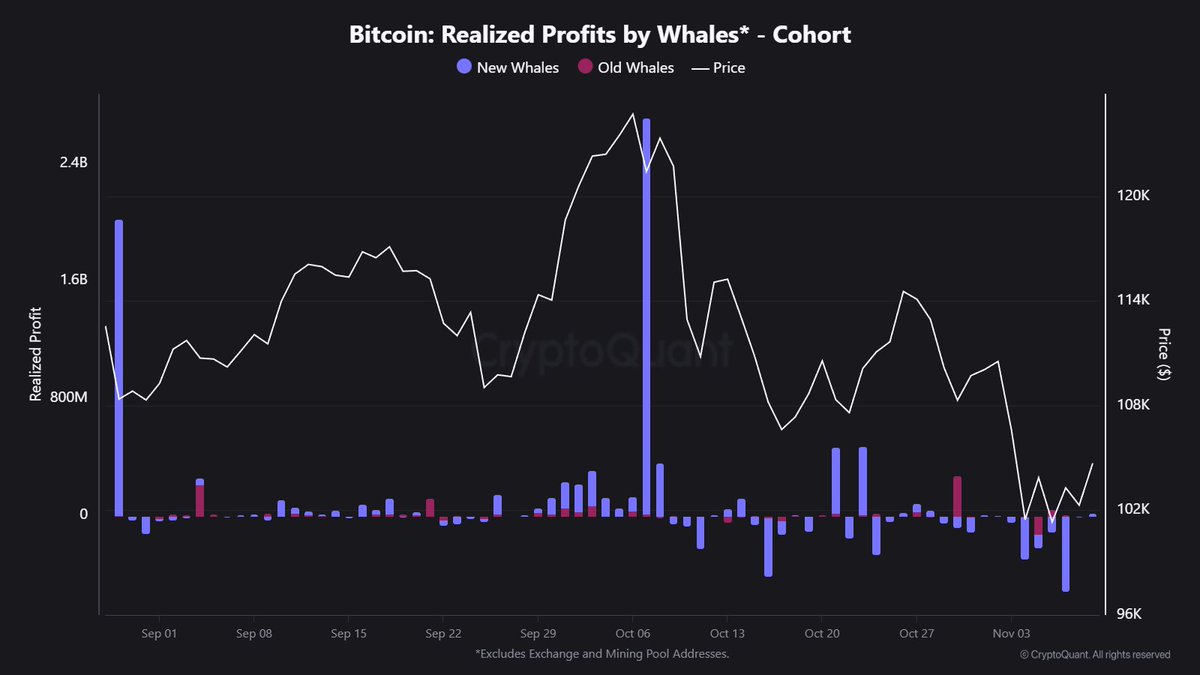

The feud between Trump and Musk also impacted the state of the cryptocurrency market. Following their argument, Bitcoin’s price dropped from $105,915 to $100,500, before recovering to $103,200, according to CoinGecko. This drop led to the liquidation of long positions in Bitcoin amounting to $341.75 million in one day, as reported by Coinglass.

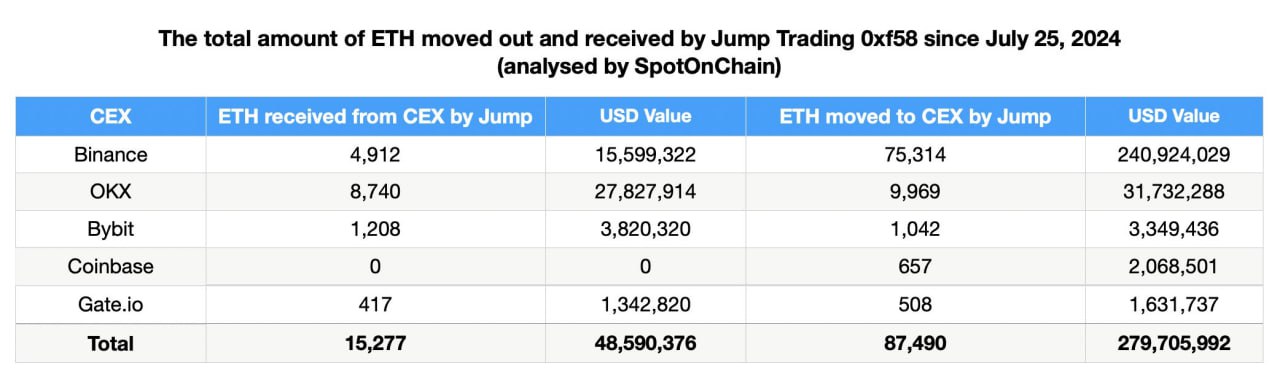

Additionally, the negative impact on the market led to a 4% decline in the total market capitalization of digital assets, which also affected other cryptocurrencies. Ethereum lost 5.6%, XRP dropped 2.8%, and Solana fell by 3.2%. The Fear and Greed Index dropped to 45 points, indicating that the market was in the “fear” zone.

Previous Events

For context, it is worth noting that on May 23, Bitcoin’s price also dropped by more than 3% in one hour after Trump threatened to impose 50% tariffs on EU goods. This led to additional negative pressure on digital assets.

Cryptocurrency Community’s Reaction

The Trump-Musk feud sparked a flurry of discussions among members of the cryptocurrency community. Some experts express concerns that such conflicts between key figures with substantial influence on financial and technological markets may increase volatility in the cryptocurrency market. Others believe that cryptocurrencies like Bitcoin, by their nature, are not dependent on political disagreements and that their price may recover after short-term fluctuations.

Many analysts warn that the upcoming U.S. presidential elections and continued political figures’ involvement in the economy could further increase volatility in cryptocurrencies. It is crucial for investors to remain cautious in the face of high uncertainty.

The Future of the Crypto Market

The conflict between Trump and Musk highlights how political statements and personal disagreements can impact global financial markets, including the cryptocurrency sector. It is expected that such conflicts will continue to put pressure on cryptocurrencies in the short term, while investors will be closely monitoring the situation and its impact on long-term trends.

Analysts recommend maintaining crypto assets in portfolios with consideration for risks associated with political and economic uncertainties. Despite short-term drops, many remain optimistic about the long-term potential of cryptocurrencies, especially Bitcoin, which continues to lead the digital asset space.

Conclusion

Conflicts between major political and business figures can have far-reaching consequences not only for traditional financial markets but also for innovative and high-risk assets like cryptocurrencies. In this context, cryptocurrency investors must be prepared to respond quickly to news and factors affecting the market in order to minimize losses and seize opportunities for long-term investment.