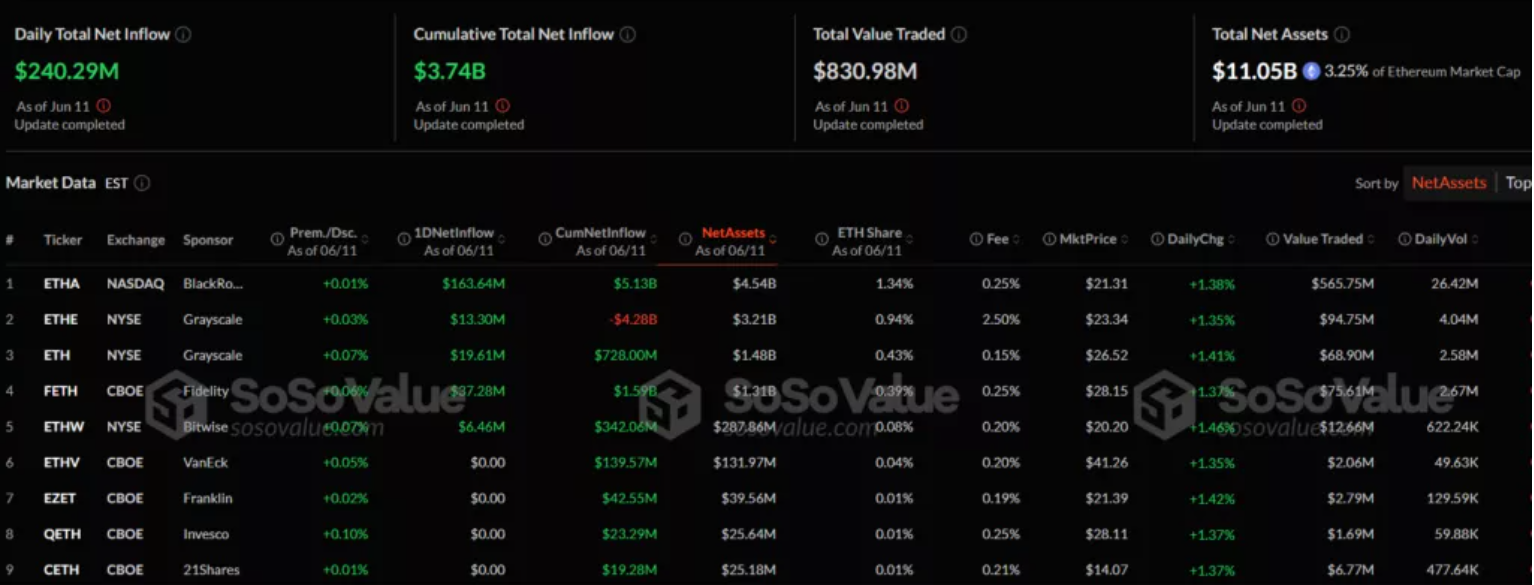

In the past 24 hours, the net inflow into spot Ethereum-based exchange-traded funds (ETFs) reached $240.29 million, surpassing Bitcoin-based ETFs, which saw an inflow of $164.57 million. This marks the first time that Ethereum funds have outpaced Bitcoin products in daily investor demand.

The cumulative net inflow into Ethereum-based structures now stands at $3.74 billion. Notably, this positive trend has been observed for 18 consecutive trading days.

The largest single inflow over the past 24 hours came from ETHA by BlackRock, which saw $163.64 million. The FBTC by Fidelity fund followed with an inflow of $37.28 million.

The total assets under management (AUM) in Ethereum-based funds now total $11.05 billion, or 3.25% of Ethereum’s market capitalization.

Regulatory Support and Institutional Interest

According to Nick Rak, Research Director at LVRG, Ethereum’s appeal has been growing due to recent comments from the SEC about potential regulatory relaxation for DeFi:

“Ethereum is increasingly seen as an undervalued asset, especially given the new records for Bitcoin and altcoins observed last year.”

SEC Chairman Gary Gensler has also emphasized the importance of the right to self-custody of assets, stressing that this is a “fundamental American value” that should be preserved in the digital world as well.

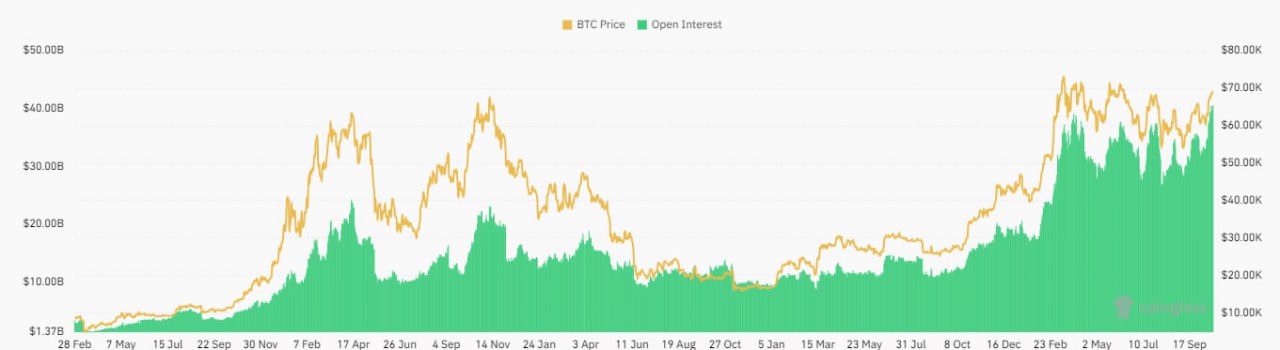

Growth in the Derivatives Market

At the same time, there has been an uptick in activity in the derivatives market. Ethereum-based derivatives trading volume reached $108.8 billion, compared to $87.94 billion for Bitcoin. This indicates growing demand from traders and institutional participants.

Comparison with Bitcoin ETFs

Bitcoin funds still dominate in terms of total AUM, which stands at $131.85 billion, or 6.09% of Bitcoin’s market capitalization. The leader in this segment remains IBIT by BlackRock, with $72.55 billion under management. The total net inflow into Bitcoin ETFs since their approval has reached $45.22 billion.

ETH Price Dynamics

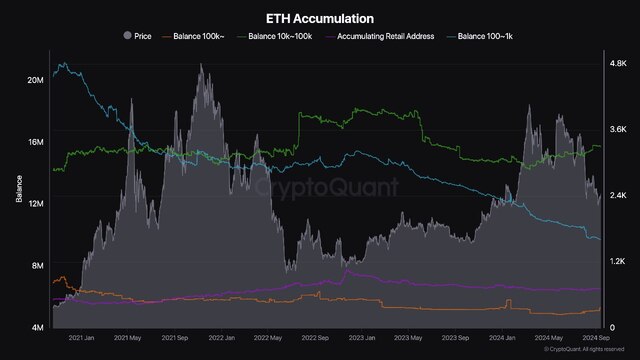

Amid the growing interest, Ethereum’s price hit $2900 on June 11, matching levels seen in February. However, as of writing, the asset is trading around $2770, according to CoinGecko.