The Plasma project, backed by the Bitfinex cryptocurrency exchange, demonstrated incredible popularity by raising the deposit limit in stablecoins to $1 billion in just 30 minutes. This achievement marks an important milestone in the lead-up to the upcoming XPL token sale, which promises to be a significant event in the cryptocurrency space. However, it’s important to understand exactly what happened and how this will affect the project’s future and the cryptocurrency market.

What is Plasma, and why did they increase the deposit limit?

Plasma is an EVM-compatible sidechain of Bitcoin designed to facilitate free USDT (Tether) transactions. The project was created to reduce the load on the main blockchain and improve transaction efficiency, making it attractive to users looking to conduct operations with minimal costs.

Increasing the deposit limit to $1 billion allows a broader group of participants to get involved in the upcoming XPL token sale. This step was necessary to provide more people with access to the project. However, it’s important to understand that deposits, while granting the right to purchase the asset, are not part of the sale itself. The public token sale of XPL has not started yet, and this is just the first step in attracting participants.

How does the token sale work, and what should be known about it?

The XPL token sale is a public offering of tokens that will allow participants to purchase the asset once it is available for sale. However, as mentioned earlier, the deposits of $1 billion are not the sale itself but merely grant access to the future process. The conditions of the public offering remain the same: $50 million will be sold at a fully diluted valuation of $500 million.

The Plasma team clarified:

“This is not a fundraising event for $1 billion. Deposits are not the sale itself; the public XPL token sale has not yet started. All funds will be transferred to the beta version of the Plasma mainnet and will remain fully owned by the depositors.”

This notification emphasizes that the funds collected are not being used to fund the project but to offer users a chance to become part of the platform in the future.

How did they increase the deposit limit, and why is this important?

The decision to raise the deposit limit was made after the project faced several technical and social issues. Some users reported that they were unable to deposit funds due to transactions being intercepted by snipers and bots. To resolve this issue and allow real participants to make deposits, the Plasma team increased the limit and issued a brief notice explaining the reasons for this move.

This step was necessary to prevent a situation where bot and sniper activity harms the interests of real users who wish to participate in the project. The notification about the raised limit was issued to provide real participants with a fair chance to get involved.

What investments has Plasma raised so far?

Plasma has already raised significant sums during its previous funding rounds. The project raised $3.5 million in a round led by Bitfinex, and $20 million in a Series A round. These funds will be used to further develop the project and improve its infrastructure.

Plasma also became the first project on the Sonar platform, a subsidiary ICO platform of Echo, launched by well-known trader Jordan Fish.

What do deposit data show?

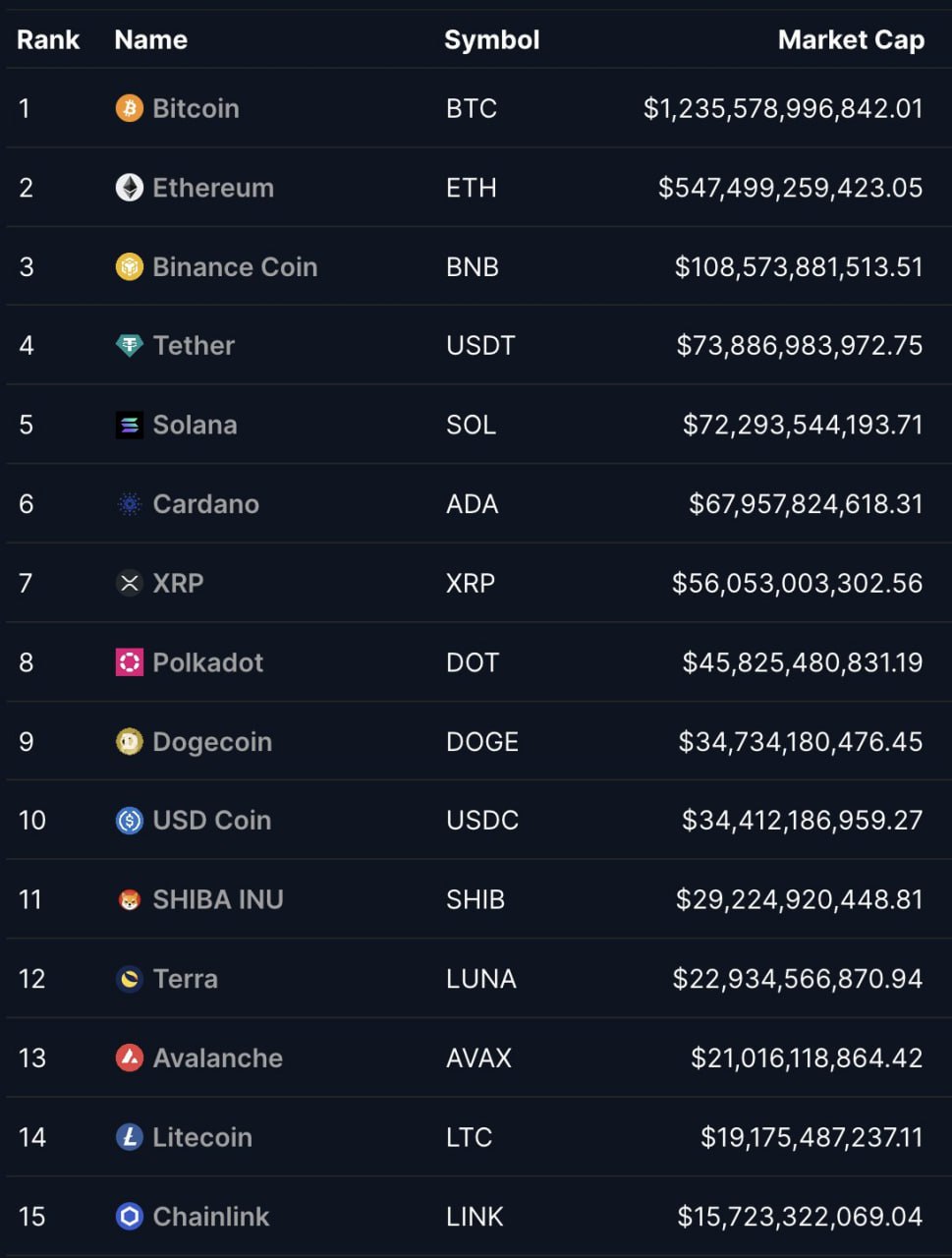

According to analytics platform Arkham, a significant amount of funds are currently held on the Plasma deposit contract. As of the time of publication, the sum in USDC amounts to $558 million, in USDT $396 million, in USDS $16.6 million, and around $3.4 million in DAI. These figures show that the project enjoys significant trust among cryptocurrency investors, and funds will continue to flow into the deposit as the project develops.

Challenges and prospects for the project

Plasma has attracted attention from the cryptocurrency community and investors due to its technological base and the opportunities it provides for faster and cheaper USDT transactions. However, the project also faced issues with sniper and bot interference, which forced the team to act quickly and raise the deposit limit to provide real participants a chance to invest in the project.

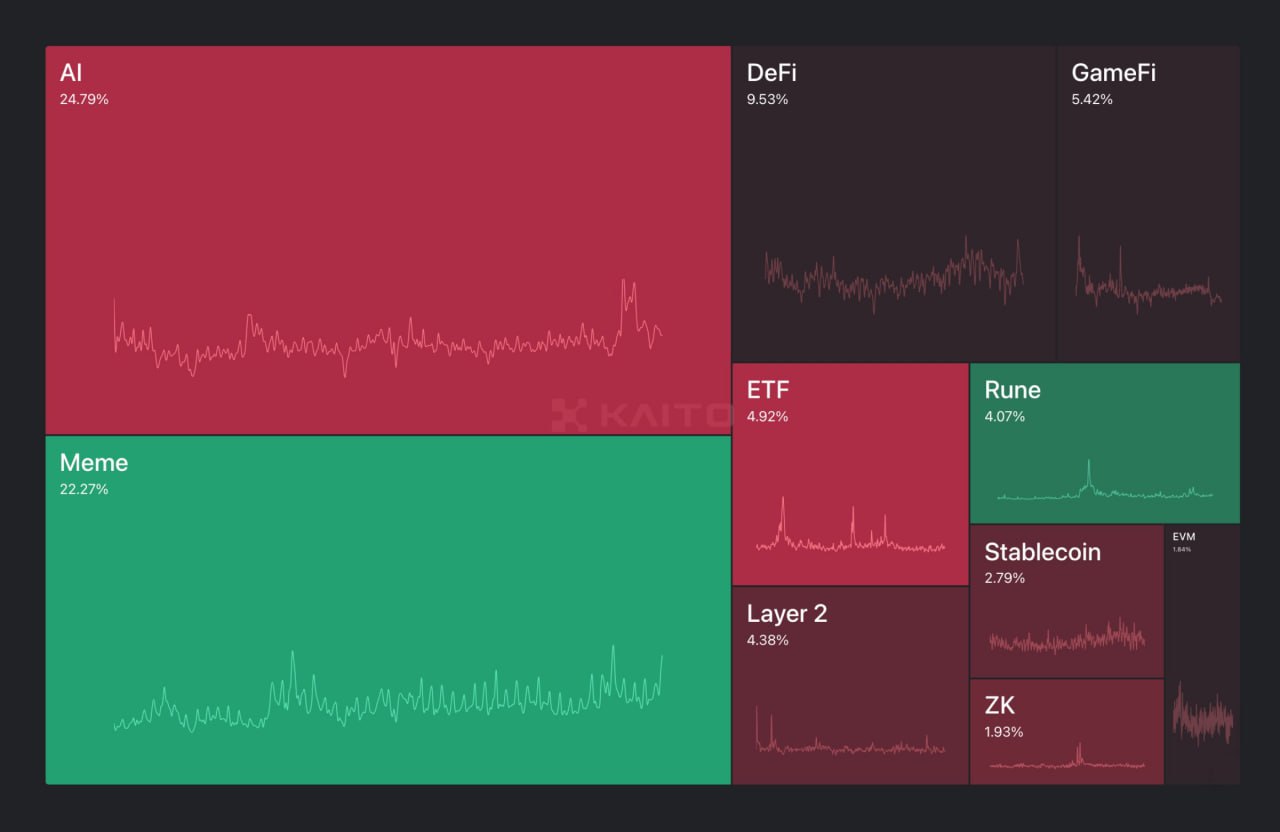

Despite these challenges, Plasma continues to develop and attract attention from investors. For example, the total market capitalization of stablecoins recently surpassed $250 billion, further confirming the growing interest in projects in this space.

Conclusion

Plasma, like many other projects in the cryptocurrency space, continues to evolve, attracting both investment and interest from a wide audience. Raising the deposit limit and addressing access issues were important steps toward the successful launch of the XPL token sale. The Plasma team has shown that they are ready to act quickly and efficiently to ensure opportunities for real participants and prevent fraudulent bot activity. In the near future, further news about the project’s development can be expected.