Texas Governor Greg Abbott has signed Senate Bill 21 (SB 21) into law, officially approving the creation of the state’s first autonomous bitcoin reserve. This move signals a growing interest among U.S. state governments in leveraging cryptocurrencies to diversify financial holdings and hedge against inflation risks.

According to the bill, the bitcoin reserve will operate independently of Texas’s general treasury system, providing the state with an additional layer of financial resilience and flexibility. The reserve will be managed by State Comptroller Glenn Hegar, who is responsible for overseeing fiscal transparency and state funds.

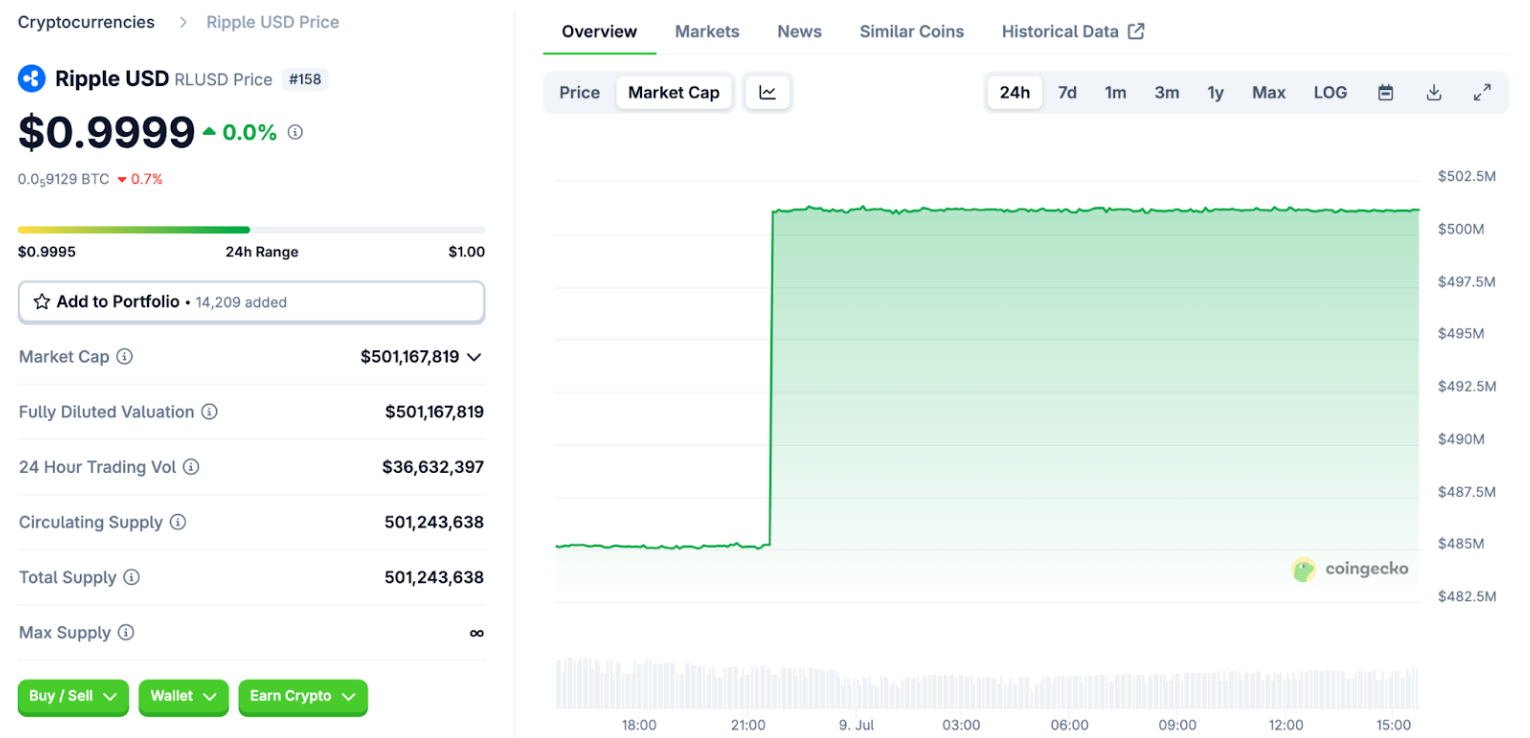

The law permits inclusion in the reserve of only digital assets with a market capitalization exceeding $500 billion — a threshold currently met solely by Bitcoin. This requirement reflects the lawmakers’ intention to maintain reliability and avoid the volatility associated with smaller, less-established tokens.

However, the reserve’s growth won’t rely solely on direct purchases:

- it may also include forks,

- airdrops,

- capital gains,

- and donations from individuals and institutions.

This design allows for sustainable and scalable asset accumulation over time.

The law mandates the release of a detailed report every two years outlining the reserve’s performance and status — a step toward greater transparency and accountability to both the public and potential investors.

Alongside SB 21, Abbott signed House Bill 4488 (HB 4488), which protects designated funds like the bitcoin reserve from being reallocated to the state’s general revenue, even if fiscal priorities shift. This ensures the reserve remains autonomous and insulated from political interference.

Notably, despite the potential historic significance of SB 21, it was not included in the official press release listing major bills signed by the governor — even though Abbott approved over 600 new laws on the same day, spanning various political, economic, and social domains.

With this legislation, Texas becomes the third U.S. state — after Arizona and New Hampshire — to approve a state-level bitcoin reserve, signaling a new wave of regional crypto-sovereignty in the face of federal regulatory ambiguity.

Meanwhile, other attempts to establish state-backed bitcoin reserves have stalled. In May, Florida lawmakers dropped two bills that would have allowed public funds to be invested in bitcoin. Similar proposals have also failed in Oklahoma, Montana, Pennsylvania, North and South Dakota, and Wyoming.

This new law could set a precedent for other states seeking alternative tools to protect their financial reserves amid rising inflation, global instability, and concerns over the long-term strength of the U.S. dollar.