Circle, the U.S.-based fintech company behind the USDC stablecoin, has taken a significant step toward expanding its presence in the financial sector by applying for a national trust bank charter from the Office of the Comptroller of the Currency (OCC), Reuters reports.

New Opportunities Without Traditional Banking Functions

If approved, the charter would allow Circle to operate as a national trust bank serving institutional clients. This status would enable the company to provide custodial services—such as safekeeping of crypto and other digital assets—and manage USDC reserves. However, the license would not permit Circle to accept cash deposits or issue loans like traditional banks.

Focus on Trust and Regulatory Alignment

Circle CEO Jeremy Allaire emphasized that the move aligns with the company’s long-term strategy of maintaining high standards for trust, transparency, and regulatory compliance:

“Circle has long aspired to meet the highest standards of trust, transparency, governance, and compliance. Becoming a public company is a key part of that. Becoming a national trust bank is the next logical step,” he said.

While a portion of Circle’s USDC reserves will continue to be held at major commercial banks, the new structure would allow for greater autonomy and direct oversight of those assets.

Expanding Into Tokenized Asset Custody

In addition to crypto custody, Circle plans to offer services for tokenized versions of traditional financial instruments such as stocks and bonds—securities issued and managed on blockchain networks.

“If we’re able to secure approval as a national trust bank, it will give us the foundation upon which leading global institutions can confidently build,” Allaire added.

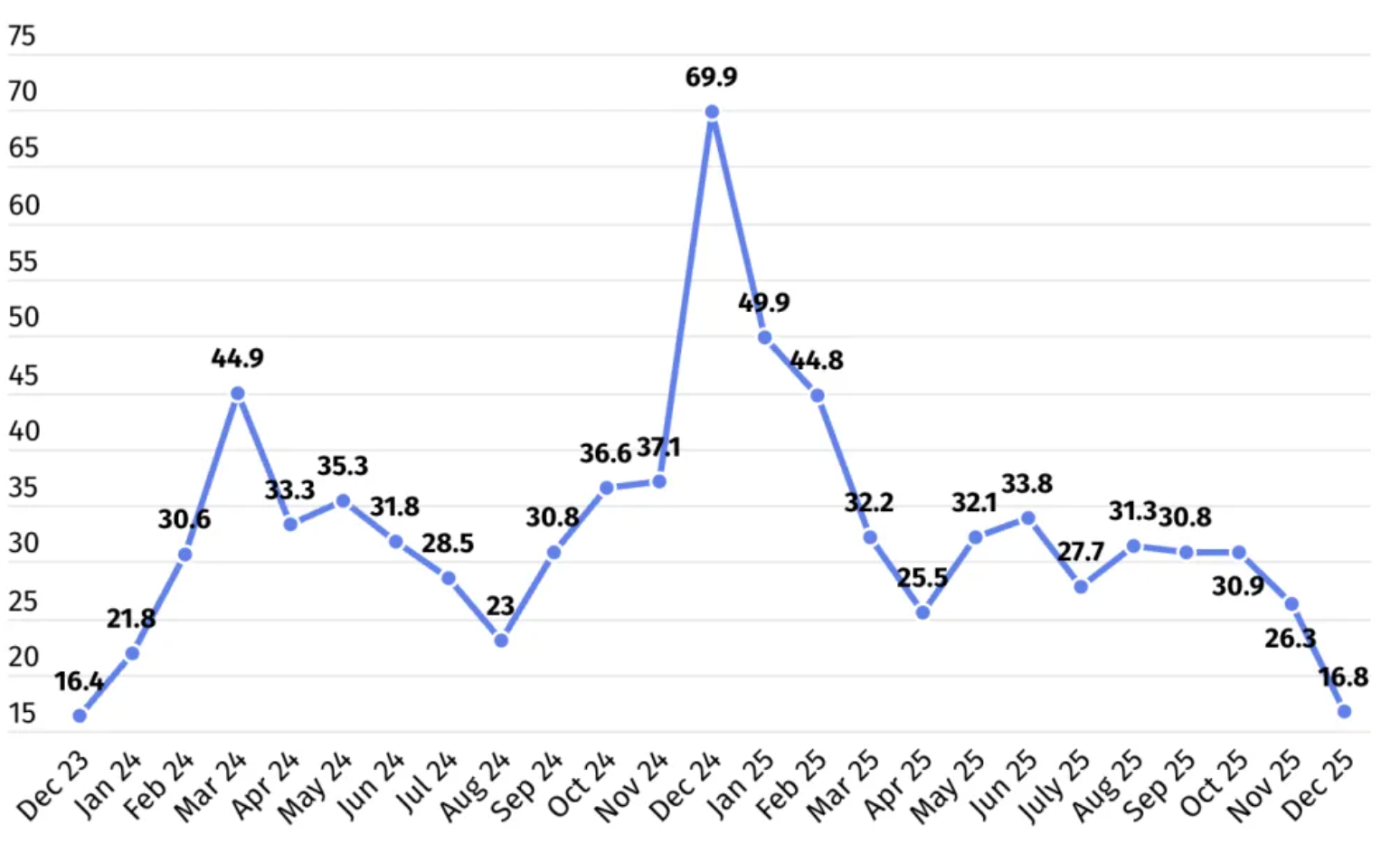

Stock Performance

Following the announcement, Circle’s stock (CRCL) is valued at $181. However, the company’s shares have dropped approximately 30% over the past week, reflecting market volatility and investor reactions.

Background

Earlier in June, Allaire predicted a coming “stablecoin revolution,” arguing that developers have yet to fully grasp the potential of programmable money.

The national trust bank application reinforces Circle’s ambition to play a central role in building a regulated, legally sound infrastructure for digital finance in the U.S. and beyond.