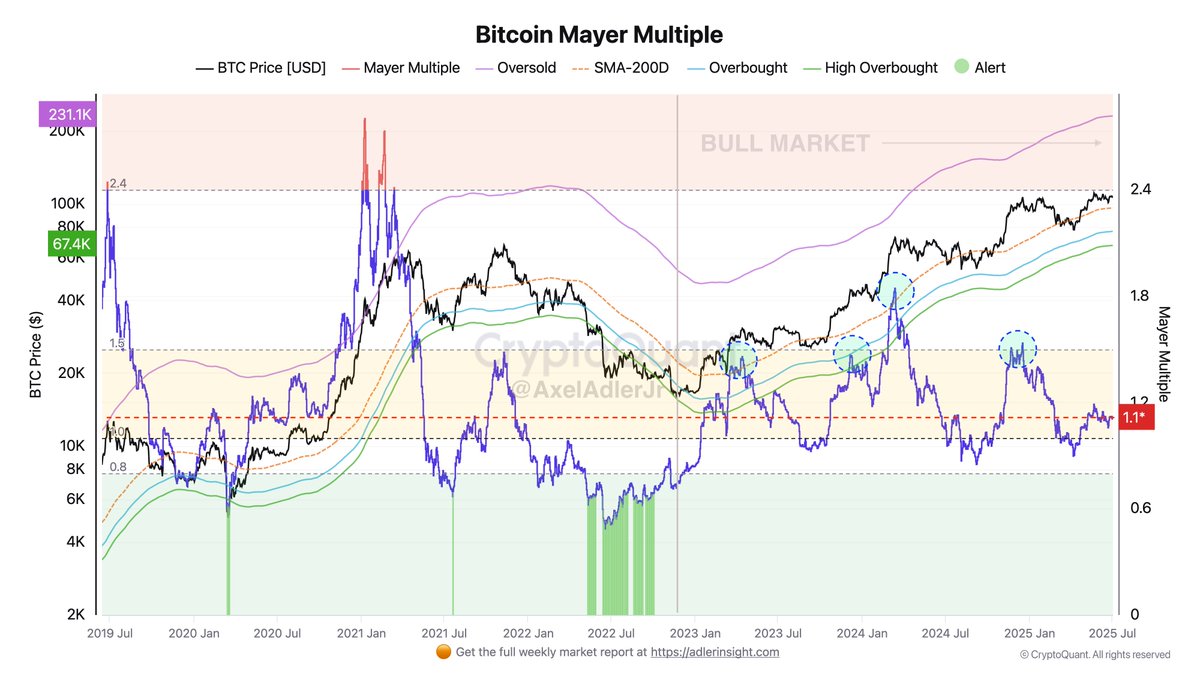

Despite Bitcoin trading near its historical highs, it might still be undervalued according to the Mayer Multiple indicator. This analysis was provided by Axel Adler Jr., a prominent figure at CryptoQuant, who believes that the leading cryptocurrency is far from reaching overbought conditions.

A Closer Look at the Mayer Multiple

The Mayer Multiple is a technical indicator that compares Bitcoin’s current price to its 30-day Simple Moving Average (SMA). As of now, the value stands at 1.1x. According to Adler Jr., this falls into the “neutral zone” (ranging from 0.8x to 1.5x) and is still far from the overbought territory of 1.5x.

In the context of the Bitcoin market, when the Mayer Multiple value reaches 1.5x or higher, it is often considered a signal of overvaluation or an overheated market. At the current value, the indicator suggests that Bitcoin is not in an overbought state, which implies that it might have substantial room for further price growth.

Adler Jr. also noted that the current price level reflects a discount when compared to previous bull markets. This could potentially signal that the market is still in the early stages of its next upward surge, and Bitcoin’s price could see an additional upward push, given its current “undervalued” position.

Supporting Data Aligns

Other on-chain indicators and market metrics seem to support Adler’s conclusions. For instance, the 30 bull market peak signals provided by CoinGlass still show a “hold” recommendation, meaning that the market isn’t flashing sell signals yet. This indicates that investors may still be confident in holding their positions, and the market hasn’t reached its peak euphoria phase.

Additionally, metrics like the Bitcoin NUPL (Net Unrealized Profit/Loss) and the MVRV (Market Value to Realized Value) ratio also suggest that Bitcoin’s price has not yet reached extreme overbought levels typically seen at market tops.

Diverging Views on Market Timing

Despite these signals of undervaluation, market participants have differing views on the timing of the peak of the current cycle.

Popular trader Rekt Capital, known for his in-depth analysis of historical Bitcoin cycles, anticipates that the market peak will align with the next Bitcoin halving event, which is projected to occur in October 2025. Historically, halvings have led to major price increases, and Rekt Capital believes that we could see another significant rally following the event.

On the other hand, analyst Jelle shares a similar view, suggesting that while profit-taking is already beginning in the market, the bullish trend could continue for some time. This view aligns with the idea that Bitcoin is still in the early stages of a new long-term bull market.

However, some analysts, such as CryptoCon, suggest that the current cycle could end sooner, possibly by the end of this year. CryptoCon’s view is based on a shorter-term market outlook, where Bitcoin’s price could face resistance as it nears certain psychological levels or due to changes in macroeconomic factors.

Summer Lull and Market Sentiment

Adding to the complexity of predicting the market’s next move, Glassnode, a blockchain analytics provider, has recently reported what they describe as a “summer lull” in the cryptocurrency markets. This period of subdued activity is often marked by lower volatility and trading volumes, a natural pattern that tends to emerge after major price rallies. During such phases, investors might adopt a wait-and-see approach, leading to less aggressive buying or selling.

Glassnode’s findings indicate that, while the market may be experiencing a temporary calm, it doesn’t necessarily mean that the bull market is over. Rather, it could simply represent a phase of consolidation before the next move.

The Bigger Picture: Is Bitcoin Truly Undervalued?

The key takeaway from the current analysis is that Bitcoin is not currently in a state of extreme overvaluation, despite its price approaching previous all-time highs. Indicators like the Mayer Multiple suggest that Bitcoin’s price could still have significant upside potential in the near future.

However, as always in cryptocurrency markets, timing is everything. While some analysts expect a peak as late as 2025, others believe it could happen sooner. The market’s future will be influenced by a variety of factors, including global economic conditions, investor sentiment, and major technical events like the next Bitcoin halving.

As of now, Bitcoin’s current price might be presenting an opportunity for long-term holders, but caution is always advised when navigating the volatile landscape of cryptocurrency.

The Mayer Multiple indicator suggests Bitcoin remains undervalued and could be poised for further price appreciation. While analysts differ on the timing of the market peak, current data points to a potential for continued growth in the coming months. Investors should keep an eye on upcoming halving events, market trends, and on-chain metrics to stay informed and make educated decisions.