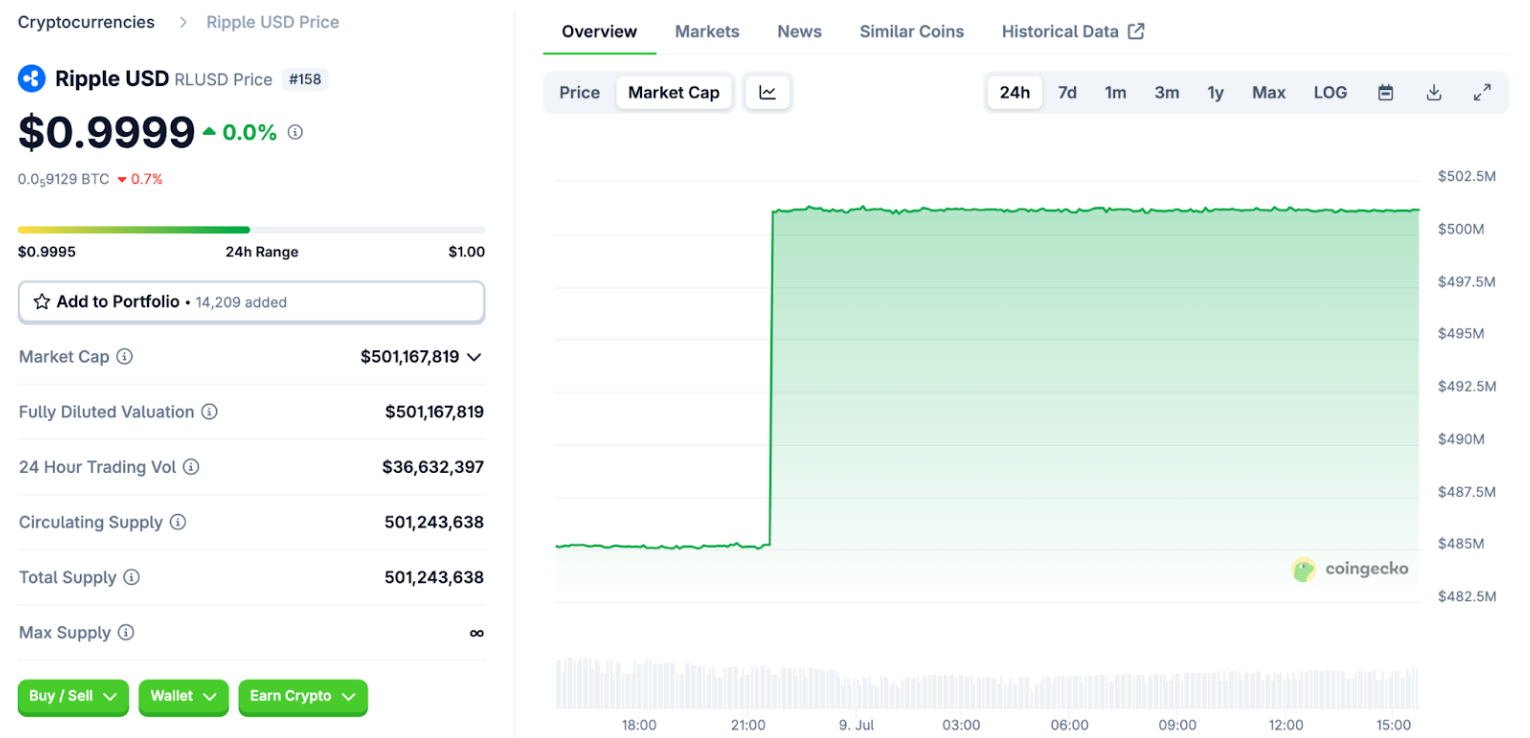

Ripple’s stablecoin RLUSD has achieved a significant milestone, surpassing a market capitalization of $500 million just seven months after its launch. This impressive result highlights the growing recognition and adoption of the asset among crypto investors and large institutional players.

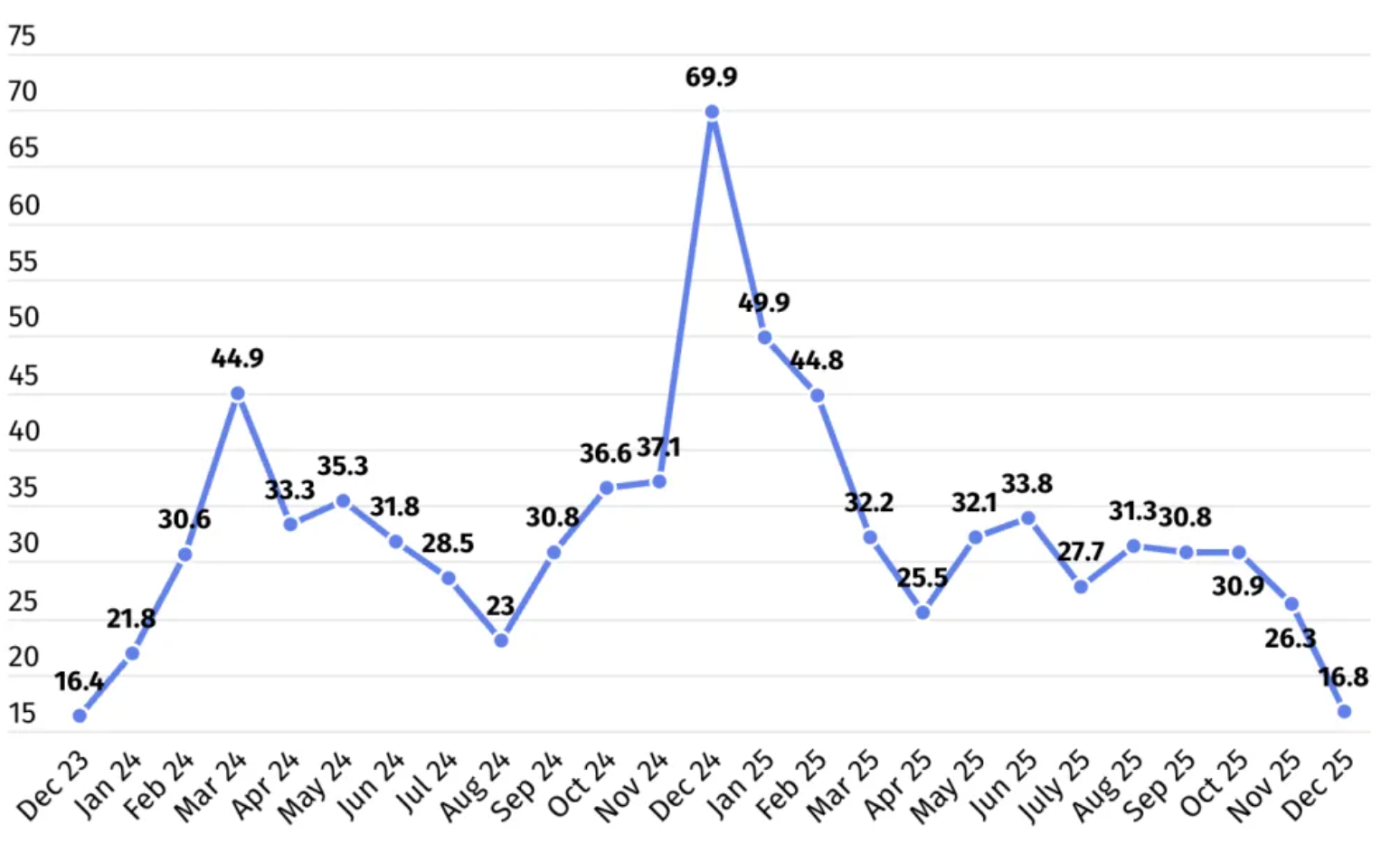

According to CoinGecko, RLUSD has entered the top 20 largest dollar-pegged coins, demonstrating a steady daily trading volume of $36.6 million. This success indicates the increasing demand for stablecoins that serve as reliable and liquid tools for storing value amidst the volatility of traditional financial markets.

Partnership with Bank of New York Mellon

Ripple has also announced a strategic partnership with one of the largest custodians in the world, Bank of New York Mellon (BNY Mellon). The bank will hold US dollars and treasury bills backing RLUSD. This collaboration is a crucial step in strengthening confidence in the stablecoin, as BNY Mellon manages assets worth approximately $52 trillion and is considered one of the most reliable financial institutions.

BNY Mellon began serving crypto clients in 2022 and launched a specialized digital asset division in 2021. This partnership further confirms that Ripple and RLUSD are gaining the trust of traditional financial institutions, attracting large institutional investors, which helps ensure the stability and security of the ecosystem.

Application for a U.S. Banking License

RLUSD’s growing success is also accompanied by Ripple’s submission of an application for a banking license in the U.S. If approved, the company will be able to directly hold client deposits and issue stablecoins under the same federal regulations that govern banks, ensuring additional protection for customers.

This move became possible after the U.S. Office of the Comptroller of the Currency allowed banks to provide services related to digital assets in May 2025. The introduction of new regulations permitting banks to work with cryptocurrencies and stablecoins opens up promising opportunities for Ripple and RLUSD, creating a more stable legal framework for operating in the digital asset market.

General Trends in the Stablecoin Market

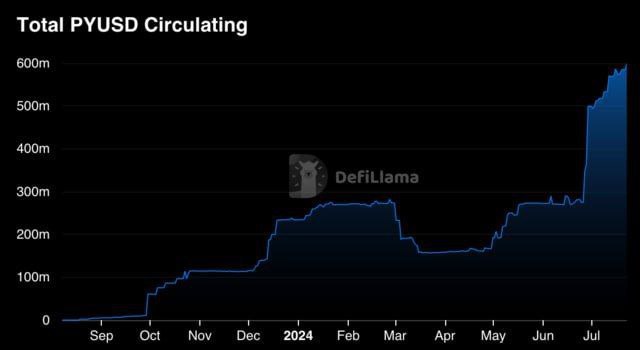

Overall, the stablecoin sector is showing positive growth. The combined market value of all dollar-pegged stablecoins has reached nearly $250 billion, accounting for more than 95% of the total stablecoin market. This confirms that stablecoins like USDC, USDT, and RLUSD are the dominant players in the market, providing liquidity and stability in the crypto economy.

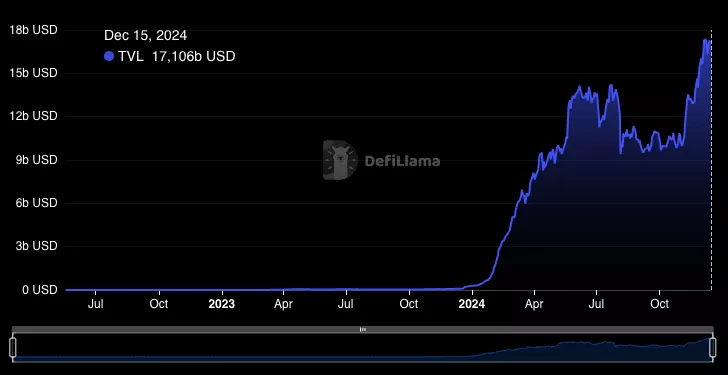

The steady growth in capital and high liquidity of stablecoins plays a key role in the development of DeFi applications, where the use of such assets has become a vital component for borrowing, exchanging, and storing cryptocurrencies.

RLUSD and Its Prospects in the DeFi Market

RLUSD successfully completed beta testing in August 2024, and by December 2024, it received official approval for trading from the New York Department of Financial Services. This approval opens up significant prospects for the active use of RLUSD in the DeFi sector, which continues to gain popularity among users of cryptocurrency platforms.

Ripple’s CEO, Brad Garlinghouse, has emphasized that RLUSD will become the “gold standard for the corporate sector.” This asset is ideal for corporate payments, working with real-world assets (RWA), and use in DeFi. With strategic partnerships and high-security standards, RLUSD has all the potential to become a key player in corporate payments and decentralized finance.

Partnership with Chainlink to Accelerate DeFi Integration

To accelerate RLUSD’s integration into the DeFi sector, Ripple has formed a partnership with the decentralized oracle network Chainlink. Chainlink provides reliable and secure data for smart contracts and DeFi applications, which will significantly speed up the integration of RLUSD into various blockchain platforms and improve its liquidity in the DeFi space.

The partnership with Chainlink will help Ripple increase trust among DeFi developers and users, ensuring wider usage of RLUSD in smart contracts, financial products, and decentralized markets.

Conclusion

RLUSD, Ripple’s stablecoin, continues to gain popularity and strengthen its position in the market. Thanks to strategic partnerships with major financial institutions, the application for a banking license, and the partnership with Chainlink, Ripple is enhancing trust in RLUSD and ensuring its integration into a broader ecosystem of cryptocurrencies and decentralized finance.

Currently, RLUSD is trading at $0.9999, which confirms its stability and trustworthiness. In the coming years, the stablecoin is likely to become a key tool in both the corporate and DeFi sectors, with Ripple continuing to expand its ambitions in the cryptocurrency space.