The release of the June U.S. Consumer Price Index (CPI) report has triggered a strong rally in altcoins. According to the Bureau of Labor Statistics (BLS), inflation accelerated to 2.7%, boosting investor appetite for riskier assets — including cryptocurrencies.

The market reaction was swift: Bitcoin rose a modest 2% to $119,300, while Ethereum jumped 7.9% to $3,238, and Solana climbed 5.4% to $167 (according to CoinGecko). Altcoins responded more sharply to the macroeconomic news than the leading cryptocurrency.

Institutional Interest Fuels Ethereum Rally

As BRN analyst Valentin Fournier pointed out, the CPI data reinforced optimistic market sentiment. Combined with steady inflows into crypto ETFs, this created strong momentum for capital rotation into more volatile but high-potential assets:

“Investors are becoming more confident. With ETF inflows holding steady and general optimism rising, altcoins are catching up — and in some cases, outperforming — Bitcoin.”

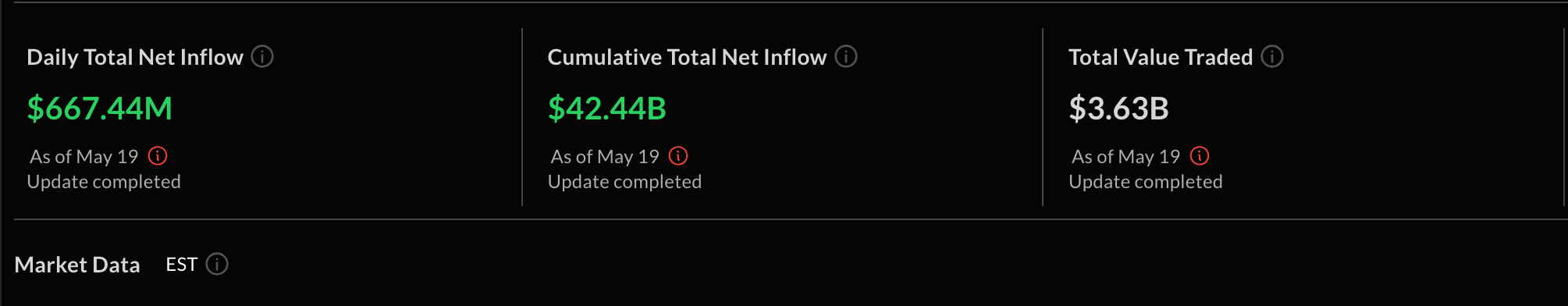

Ethereum led the way, with weekly inflows into ETH-based ETFs totaling $193 million. Investment products linked to Solana also saw modest but notable inflows of $3.3 million — clear signs of growing institutional interest.

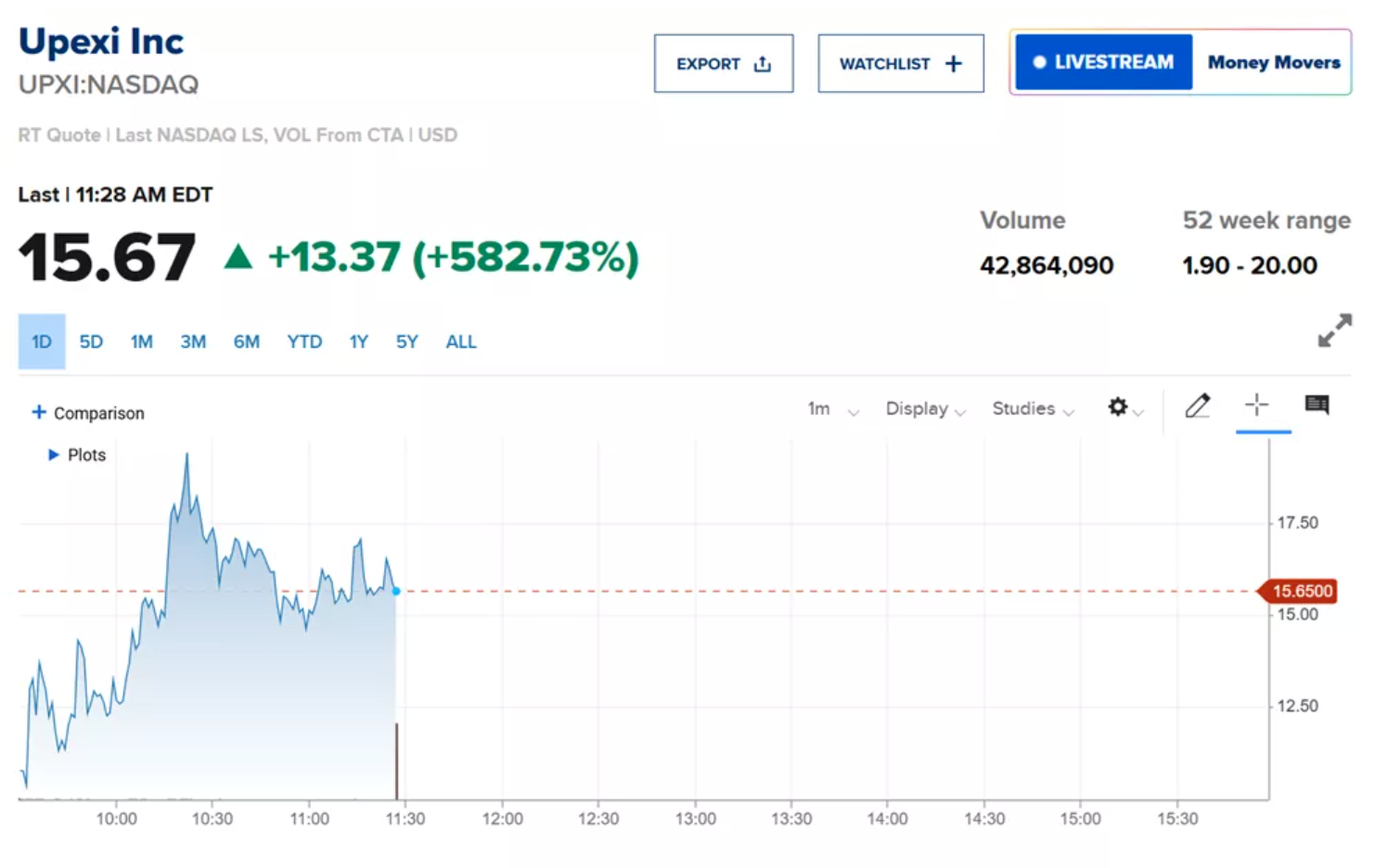

Public companies have also entered the spotlight. SharpLink Gaming became the largest publicly listed holder of ETH, surpassing even the Ethereum Foundation. Over the past week, the company acquired over 50,000 ETH worth more than $73 million, bringing its total holdings to 280,706 ETH. Meanwhile, Nasdaq-listed mining firm BitMine Immersion announced it had raised $67.3 million specifically to purchase Ethereum.

Altseason Index Hits Highest Level Since February

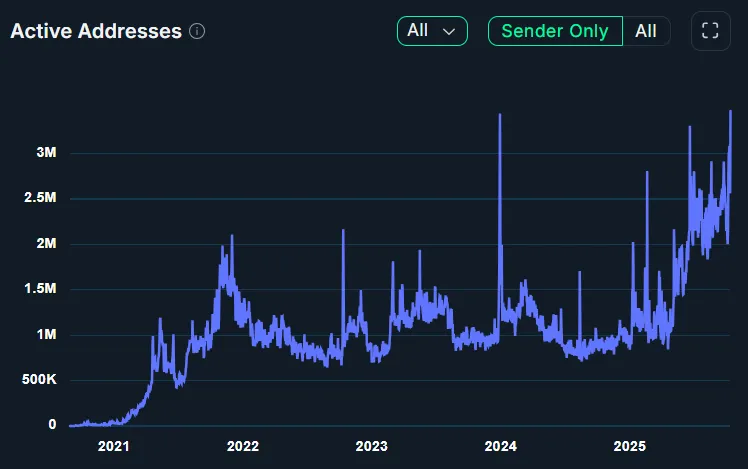

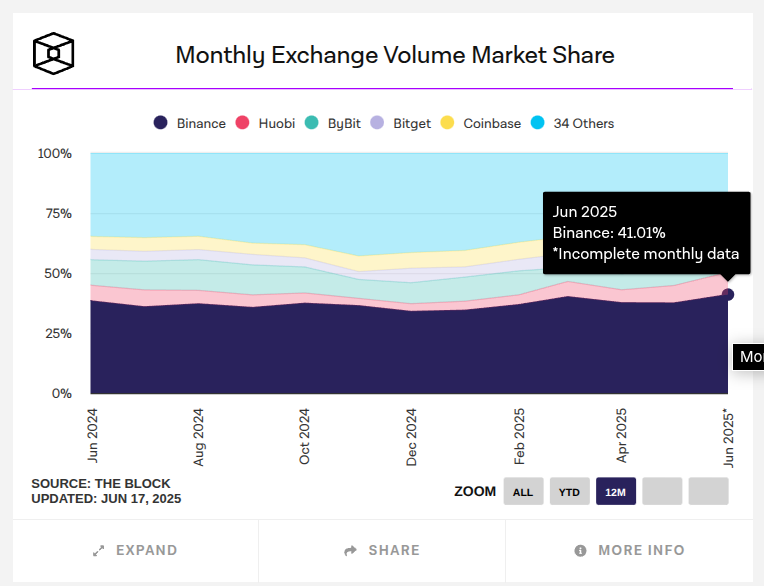

A key indicator of shifting market dynamics — the Altseason Index — has reached its highest point since February. This metric tracks the percentage of top 50 altcoins outperforming Bitcoin, and its recent rise signals a market pivot toward alternative cryptocurrencies.

Earlier this year, CryptoQuant CEO Ki Young Ju declared the beginning of altseason, describing it as “highly selective.” Instead of relying on Bitcoin dominance as a signal, he advised focusing on trading volumes and institutional behavior.

Conclusion: The latest U.S. inflation data has reignited investor interest in crypto, particularly altcoins. Ethereum and Solana have gained strong support from both ETF inflows and corporate buyers. With the Altseason Index surging and institutional activity on the rise, the market appears to be entering a new phase of capital rotation into altcoins.