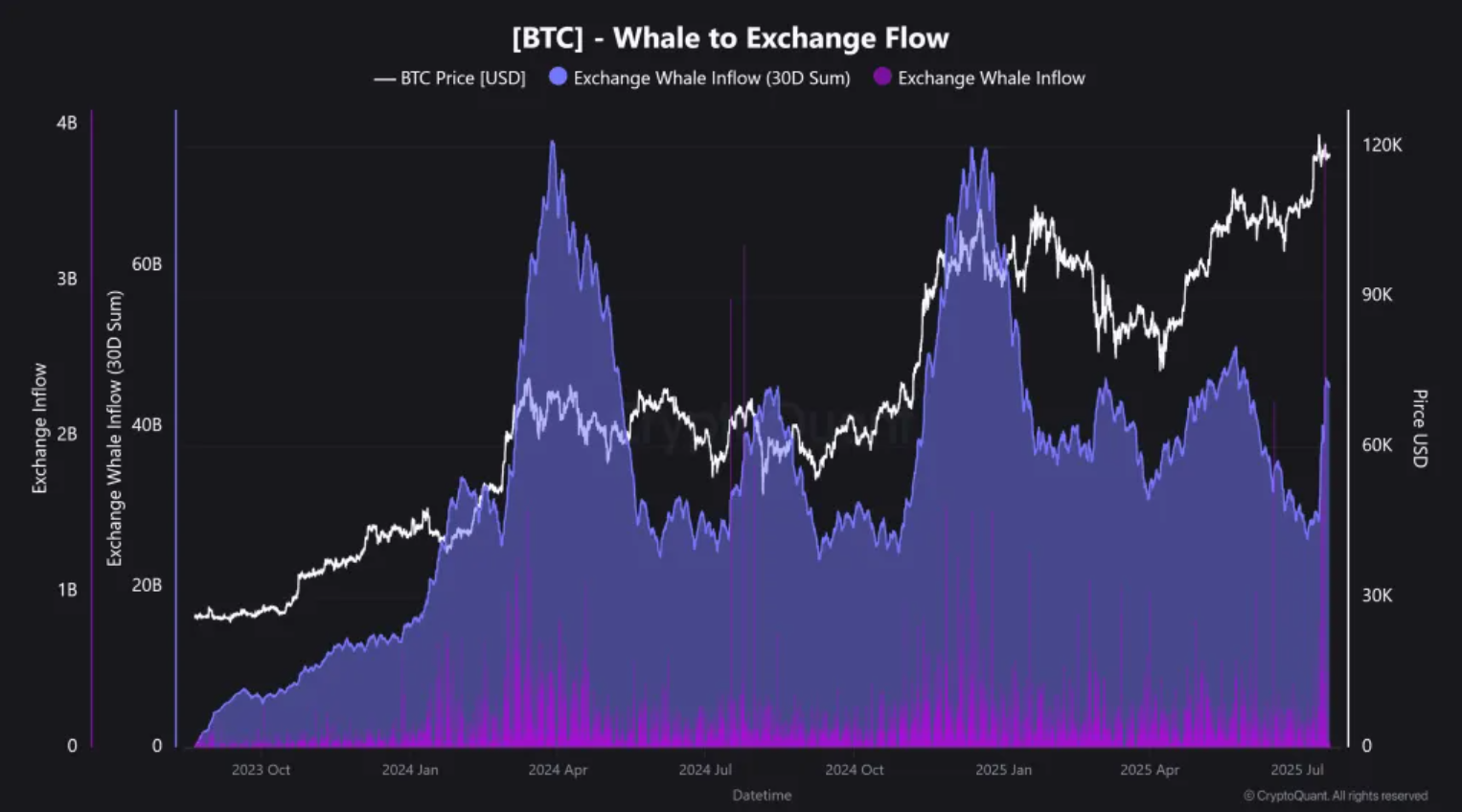

The activity of large Bitcoin holders — so-called “whales” — has significantly increased: between July 14 and 18, BTC inflows to crypto exchanges rose by 60%. According to CryptoQuant contributor Darkfost, this may indicate profit-taking amid rising market capitalization and prices.

Sharp Increase Driven by Large Transfers

According to CryptoQuant data, the average monthly volume of Bitcoin transferred by whales to trading platforms jumped from $28 billion to $45 billion. This surge is likely linked to a recent major transaction involving the movement of 80,000 BTC — one of the largest in recent months. Such movements are often interpreted as a sign that whales may be preparing to sell.

However, Darkfost notes that current inflow levels are still well below historical peaks. During previous market tops, inflows exceeded $75 billion, often preceding correction phases.

Selling Pressure Appears to Be Easing

Despite the recent spike in activity, daily BTC inflows to exchanges have started to decline. If this trend continues, the selling pressure on the market may weaken, creating favorable conditions for further price appreciation.

Coordinated Accumulation Across Wallet Sizes

Glassnode analysts highlight a broad-based accumulation trend among all categories of Bitcoin holders. Even the largest wallets holding more than 10,000 BTC are actively participating in accumulation — a pattern last seen in December 2024.

“This level of alignment across different investor types signals strong confidence in the current bullish trend,” Glassnode noted.

Market Snapshot

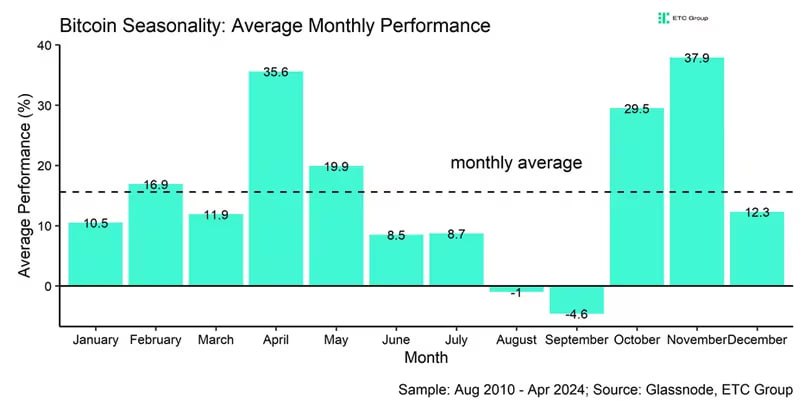

As of writing, Bitcoin is trading at $118,257, showing a modest 0.1% gain over the past 24 hours, according to CoinGecko. However, the asset has declined by about 3% over the past week. Analysts suggest this could be a short-term correction within a broader upward trend fueled by institutional interest.

Conclusion

The increase in whale activity may signal profit realization, but current inflow volumes are not yet alarming. On the contrary, the ongoing accumulation and synchronized behavior across wallet sizes indicate a continued bullish outlook for Bitcoin in the medium term.