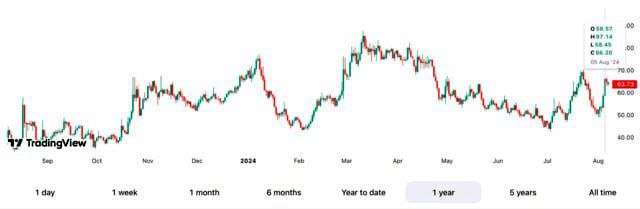

Dogecoin (DOGE), the popular meme-based cryptocurrency, surged by approximately 40% over the past week, reaching $0.27 — its highest price since January. As of this writing, the token is trading at $0.26, reflecting a slight 2.8% pullback in the last 24 hours. Nevertheless, DOGE remains one of the top crypto assets, ranking eighth by market capitalization with a total value of $40.2 billion.

Rising Risk Appetite and Regulatory Momentum

According to Zach Pandl, Head of Research at Grayscale, Dogecoin’s rise is largely driven by traders’ growing appetite for risk. He noted that DOGE’s recent performance mirrors broader trends in the altcoin market and is more reflective of speculative sentiment than fundamental project developments.

Another contributing factor is the recent U.S. legislation on stablecoins signed into law by President Donald Trump. Pandl believes this move brings greater regulatory clarity to the crypto industry, positively influencing investor confidence — including in assets like Dogecoin.

Capital Rotation from Bitcoin and Ethereum

Katie Talati, Director of Research at Arca, explained that many investors are reallocating capital into altcoins after securing profits from Bitcoin and Ethereum’s recent rallies. Dogecoin, with its widespread availability and high liquidity across major exchanges, has become a natural choice for retail investors looking to diversify into smaller-cap assets.

Talati emphasized that DOGE’s accessibility and strong brand recognition play a major role in attracting retail participation, which has driven much of the recent demand.

Institutional Moves: Bit Origin and Dogecoin ETF Applications

Another major catalyst was an announcement by Nasdaq-listed mining company Bit Origin, which unveiled plans to allocate up to $500 million into Dogecoin as part of a new treasury strategy. The firm has already made its first DOGE purchase worth $40.5 million.

This development sparked increased interest among institutional players. Several financial firms have since filed applications with the U.S. Securities and Exchange Commission (SEC) to launch spot Dogecoin exchange-traded funds (ETFs). Bloomberg analysts estimate a 90% probability of approval, fueling further speculation and enthusiasm.

Meme Culture and Community Momentum

Dogecoin also benefited from social momentum surrounding the annual “Dogecoin Day” on April 20, a date celebrated by the crypto community with memes, campaigns, and themed posts. Historically, this day brings a spike in activity and engagement, further boosting short-term price dynamics.