On July 24, Bitcoin’s price retreated from the key resistance level of $120,000, likely reflecting profit-taking by traders. According to CoinGecko, the leading cryptocurrency is trading at $115,715 at the time of writing, down approximately 2% over the past 24 hours.

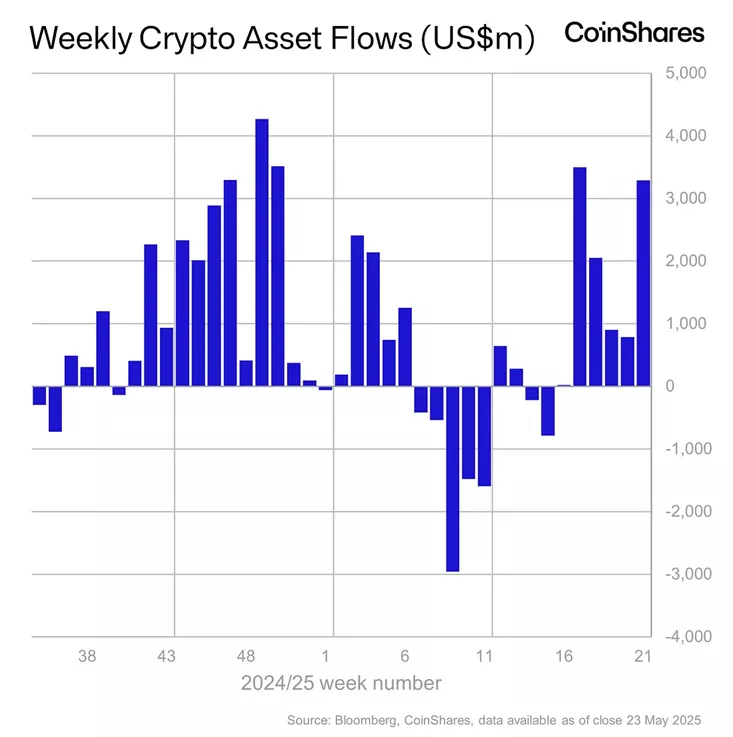

Investors Show Caution

Capital outflows from U.S. spot Bitcoin ETFs reached $285.2 million over the past three days, according to Farside Investors. This suggests a cautious stance among investors following the failed breakout attempt at the $120,000 mark.

Additional pressure may be coming from a decrease in institutional interest and profit-taking after Bitcoin’s strong rally in June and July.

Technical Outlook: Consolidation Continues

Despite the recent pullback, Bitcoin remains above the important support level of $115,000. The asset is currently consolidating between the 20-day simple moving average (SMA) at $115,961 and resistance near $120,000.

Technical indicators still point to bullish momentum. The upward-sloping 20-day SMA and a positive Relative Strength Index (RSI) indicate the potential for continued growth.

Possible Scenarios

- Bullish case: A breakout above the $120,000–$123,218 resistance zone could trigger a move toward $135,729 and potentially $150,000.

- Bearish case: A daily close below the 20-day SMA would signal weakening buying pressure and could lead to a decline toward the support level at $110,530. A break below that level would likely strengthen the bearish outlook.

Analyst Outlook

Glassnode analyst James Check believes that Bitcoin is unlikely to reach the $200,000 mark by the end of 2025. He emphasizes that macroeconomic uncertainties and the behavior of large asset holders could limit further upside in the short to medium term.