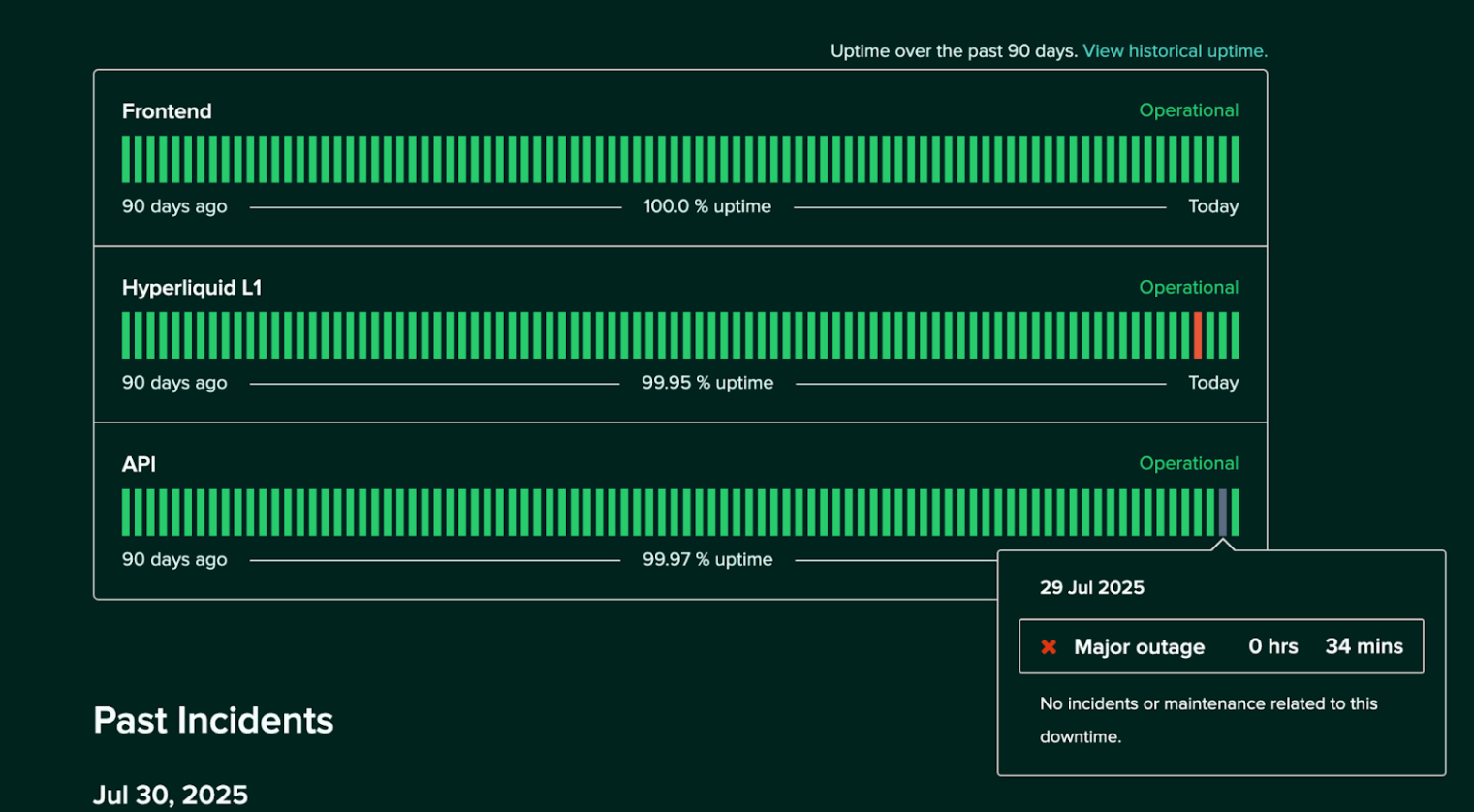

On July 29, 2025, Hyperliquid, one of the leading decentralized platforms for trading perpetual futures, experienced a temporary outage caused by a sudden surge in traffic. The issue with the API servers led to delays in order transmission, causing concern among users and traders.

Cause of the Outage

The outage occurred between 14:10 and 14:47 UTC, when the platform encountered unexpected load on its API servers, resulting in their overload. This caused delays in transmitting orders to the nodes, hindering the timely execution of trades. Hyperliquid’s developers quickly ruled out any possibility of a hacker attack or exploitation of vulnerabilities. They reassured users that the incident was purely caused by technical issues unrelated to external threats.

In an official statement, the platform noted: “From 14:10 to 14:47 UTC, there was a delay in transmitting orders to nodes due to an overload of the API servers caused by a sudden surge in traffic. This was not related to a hacker attack or exploitation of vulnerabilities. The issue has been fixed, and we continue working on improvements.” Hyperliquid also promised to implement additional protective measures to prevent similar outages in the future.

Impact on Traders and the Market

One of the negative consequences of the outage was an increase in complaints from traders whose orders were not executed on time. Some users noted that funding rates turned negative, which impacted their strategies and led to losses. During the incident, asset prices on the platform deviated from market values by approximately $9, causing further difficulties for traders relying on accurate market data.

The issue also affected other users of Hyperliquid. For example, the BasedApp trading application, which uses Hyperliquid technology and is supported by major investment funds like Delphi, Hashed, and Spartan, prevented users from placing orders for several minutes. A representative of BasedApp confirmed the incident in a comment to The Block, stating that the problem was due to temporary technical difficulties on the platform. Within 30 minutes after the first reports, the issue was resolved, and the service returned to normal operation.

Hyperliquid’s Response and Solutions

The Hyperliquid team responded quickly. First, they confirmed the issue in the official Discord channel, where users could follow the progress of the resolution. The developers stated that the root cause of the outage was the overload of the API server, which failed to handle the sudden increase in traffic. Within 30 minutes of the initial reports, the issue was resolved, and all systems returned to normal.

However, the developers noted that the incident prompted them to reassess their platform’s technical infrastructure. In particular, they outlined their goal to introduce additional protective mechanisms to prevent similar outages in the future. This will, in turn, help ensure even greater stability and reliability of the platform during active market movements.

Market Reaction and Token Price Impact

Following the outage, the market reacted swiftly. According to data from CoinGecko, the price of the HYPE token, a part of the Hyperliquid ecosystem, dropped by almost 2%. At the time of writing, the token was trading at $43.32, which represents the minimum price over the past 24 hours of $42.59. Despite the short-term decline, long-term market indicators remain positive, and many analysts believe Hyperliquid will quickly recover its position.

About Hyperliquid: A Key Platform for Perpetual Futures Trading

Hyperliquid is one of the leading decentralized platforms for trading perpetual futures with leverage. The platform operates on its own blockchain, HyperEVM, which ensures high transaction speeds and low fees. Unlike centralized exchanges, Hyperliquid operates based on smart contracts, minimizing risks for traders and enabling futures trading in a decentralized environment.

A key feature of Hyperliquid is its ability to provide high-speed trading and low fees, which attracts traders looking for more favorable trading conditions compared to traditional centralized platforms. Despite the temporary technical difficulties, Hyperliquid continues to maintain its reputation as a reliable and promising platform for futures trading.

Conclusion

The outage on the Hyperliquid platform, caused by a sudden traffic surge, served as an important lesson for the developers. The platform was able to restore its services quickly, and despite the temporary inconvenience to users, it remains one of the leaders in the decentralized futures trading market. In response to the incident, the developers have promised to make changes that will ensure stability and reliability in the future while reducing risks for traders.