Analysts’ Forecasts

A potential Federal Reserve rate cut could drive Bitcoin’s price to $200,000. This forecast was voiced by Fundstrat Global Advisors managing partner Tom Lee in an interview with CNBC.

According to him, cryptocurrencies, including Ethereum, are highly sensitive to monetary policy, and the Fed’s September 17 meeting may become a turning point for the entire market.

Currently, market participants estimate the probability of a rate cut at 100%. Most investors expect the range to be adjusted from 4.25–4.5% to 4–4.25%, while some are betting on an even deeper easing — down to 3.75–4%.

Cautious Market Sentiment

Despite high expectations, investors remain restrained: in recent weeks, Bitcoin has been trading within the $108,000–112,000 range. Traders have shifted to neutral-to-bearish strategies, anticipating a potential correction.

According to Bitget COO Vugar Usi Zade, the market is now in a “strategic waiting mode.” He emphasizes the maturity of the crypto industry:

“Market participants are increasingly balancing enthusiasm with fundamental factors, creating a healthier ecosystem that is less prone to irrational surges.”

The expert believes that once clearer macroeconomic signals appear, cryptocurrencies will continue their upward trend.

At the same time, Technobit CEO Alexander Peresichan warns that even a rate cut does not guarantee growth. In his view, investors should be prepared for short-term volatility:

“Even a dovish Fed policy can be accompanied by sharp fluctuations, as cryptocurrencies react not only to macroeconomic signals but also to investor sentiment, regulatory news, and liquidity changes.”

Consolidation and Waiting for Impulse

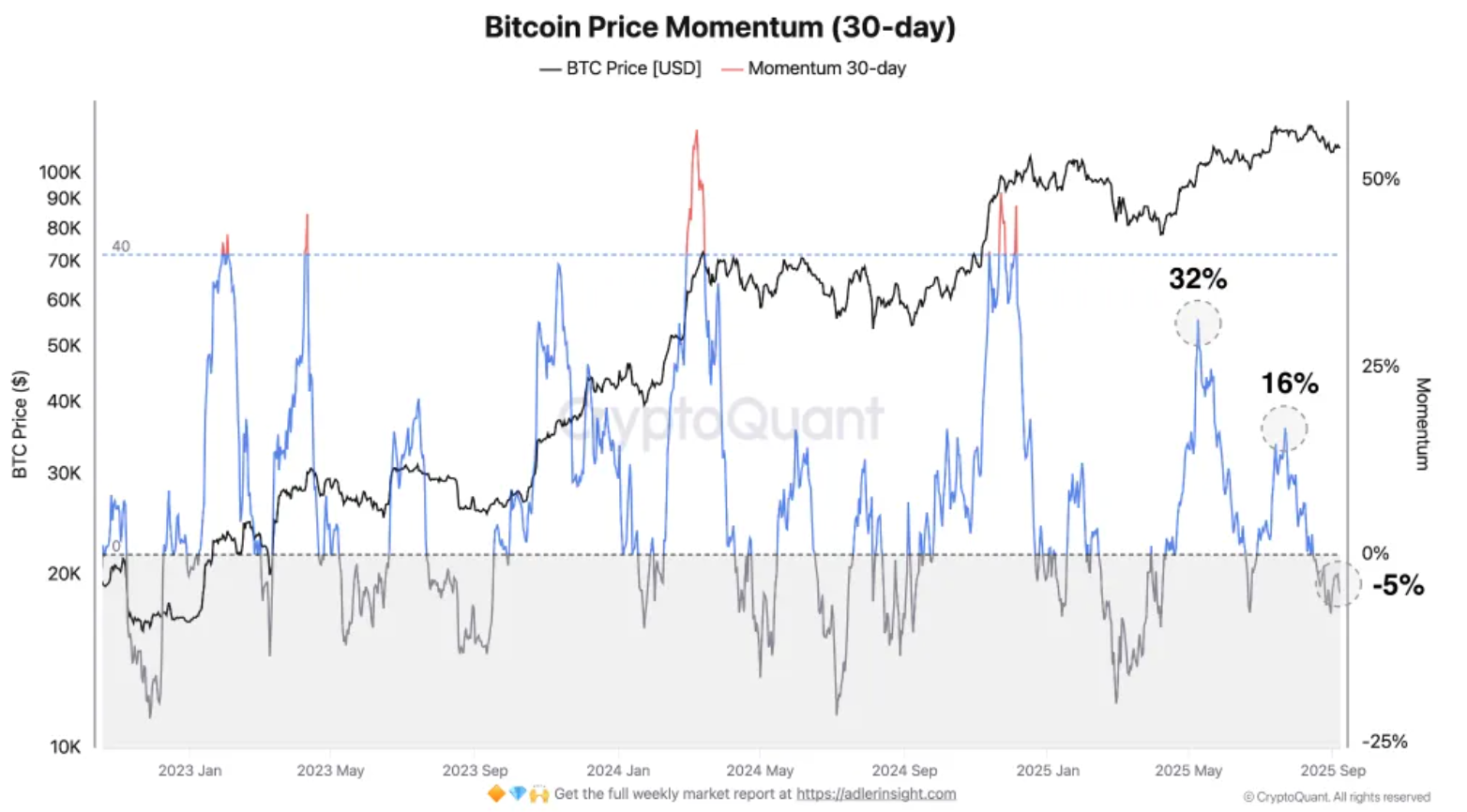

Bitcoin researcher Axel Adler Jr. notes that the market has stabilized: the composite index settled in the neutral zone at 45–50. The reduction in open interest indicates a decline in leveraged trading and a shift toward defensive strategies.

Historically, such consolidation phases have often preceded new growth. A similar scenario occurred in Q2, when stabilization around $80,000 after a correction to $74,000 sparked another rally.

OKX Singapore CEO Gracy Lin also highlights low volatility as a precursor to sharp market moves:

“Bitcoin is trading in one of the narrowest ranges in recent months, while volatility in the crypto industry has dropped to multi-month lows. On the digital asset market, calm rarely lasts long.”

Conclusion

At the time of writing, Bitcoin is trading near $112,200. Experts agree that the upcoming Fed meeting will be a catalyst for the market, but opinions differ: some expect a rapid rally, while others warn of a possible correction.

In any case, the crypto market is entering a phase where even minor changes in monetary policy could trigger significant moves.