The world’s largest cryptocurrency could reach the $160,000–200,000 range by the end of the year. Analysts from CryptoQuant have published this forecast, highlighting several fundamental factors that support the ongoing bull trend.

Demand Dynamics and Whale Activity

Since July spot Bitcoin purchases have been growing at a pace of about 62,000 BTC per month. Similar dynamics were previously observed before seasonal rallies in the fourth quarters of 2020, 2021, and 2024.

Institutional investors and so-called “whales” have also intensified their activity. According to experts, large holders are expanding their positions at an annualized rate of 331,000 BTC, significantly exceeding figures from past years:

- 238,000 BTC — in Q4 2020,

- 197,000 BTC — in 2021,

- 255,000 BTC — in 2024.

Exchange-traded funds (ETFs) play an important role as well. Last year, U.S. ETFs acquired 213,000 BTC in just one quarter, which was 71% higher than in the previous three months. Analysts believe a similar scenario could unfold again in the near term.

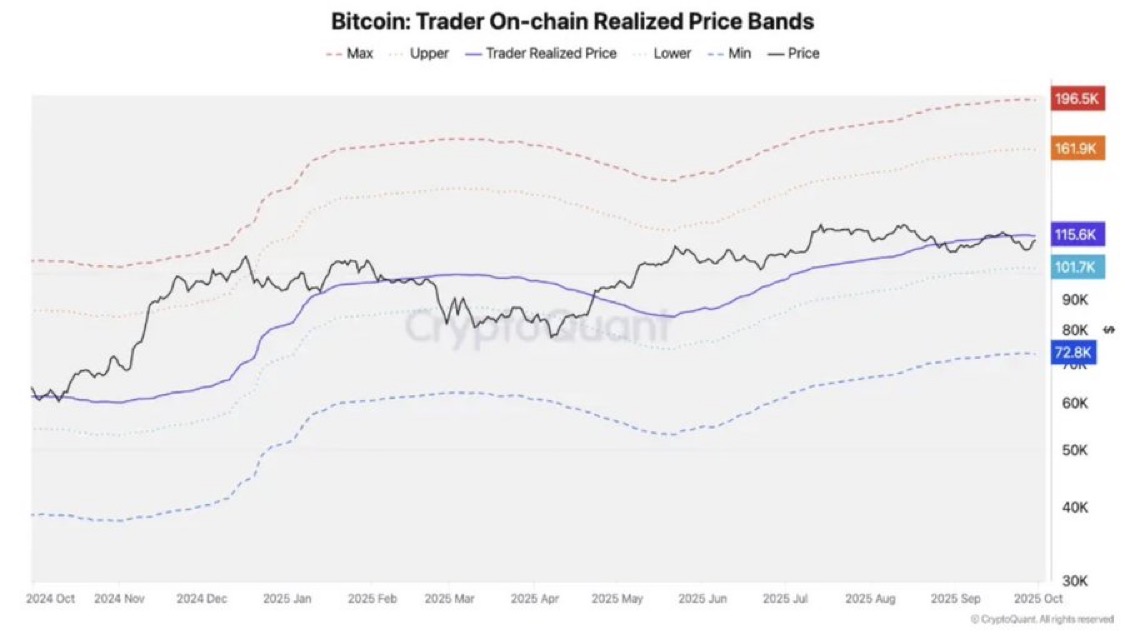

Technical Benchmarks and Market Signals

Experts note that Bitcoin has broken through the key realized price level of $116,000 and consolidated above it at around $117,300. This is interpreted as a transition into a full-fledged bull phase. For the current quarter, analysts have set a target range of $160,000–200,000.

Additional confirmation comes from technical indicators. CryptoQuant’s “bull strength index” stood between 40–50 at the end of the third quarter — the same range seen last year, when Bitcoin rallied from $70,000 to $100,000.

Factors Supporting the Trend

Analysts point to three main factors that reduce selling pressure:

- Stable growth in Bitcoin demand.

- Increasing stablecoin liquidity.

- Declining unrealized trader profits, which makes profit-taking less attractive.

Long-Term Holders and the Market Cycle

According to CryptoQuant contributor Crypto Dan, the growth cycle is still far from over. Typically, at the peak of a cycle, long-term investors start actively selling assets, especially coins held for over a year. Currently, however, this process is happening gradually, suggesting potential for another growth impulse.

Seasonality and Outlook

Another argument for a bullish scenario is seasonality: researchers at XWIN Research emphasized that the fourth quarter has historically been the strongest period for Bitcoin rallies.