Bitcoin outflows from Binance are accelerating as investors shift to accumulation, while spot Bitcoin and Ethereum ETFs record strong inflows. Analysts from CryptoQuant, Glassnode, and PlanB share insights on what this means for the crypto market.

Selling Pressure Eases as Investors Choose to Hold

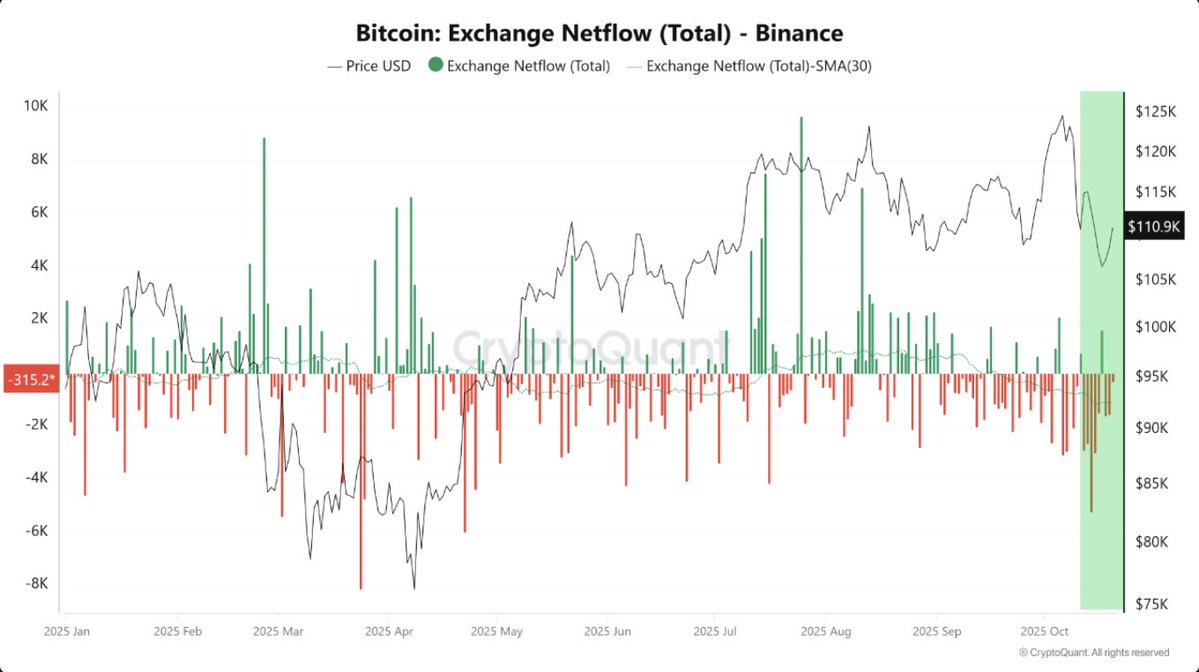

The cryptocurrency market is showing signs of easing selling pressure. According to CryptoQuant analyst Burak Kesmeçi, Bitcoin’s net flow on Binance has turned negative — meaning users are withdrawing more coins than they deposit.

Kesmeçi highlighted the importance of the 30-day moving average (SMA30) of this metric, which smooths out short-term fluctuations and reveals the underlying trend. In recent weeks, the indicator has consistently stayed in negative territory, signaling a phase of accumulation — investors are holding onto their assets in anticipation of future growth rather than selling them.

“When investors move their coins off exchanges, it shows growing confidence in the asset and expectations of a price increase,” explained Kesmeçi.

Glassnode: Declining Open Interest Strengthens the Market

Additional data from Glassnode supports this trend. The open interest in Bitcoin futures — the total value of open derivative contracts — has dropped by around 30%. This reduction suggests that speculative positions are being closed and excess leverage is leaving the market.

Such market “deleveraging” often precedes a healthier and more sustainable uptrend. At the same time, funding rates remain neutral, making the market less overheated but also more vulnerable to sudden price swings and mass liquidations.

Bitcoin ETFs Back in the Green: Capital Returns

Meanwhile, the ETF market is showing renewed strength. On October 21, U.S. spot Bitcoin ETFs recorded a net inflow of $477.19 million, reversing a multi-day streak of outflows totaling more than $1 billion.

- BlackRock’s IBIT led the pack with $210.9 million in inflows.

- ARKB by Ark & 21Shares followed with $162.8 million.

- Fidelity’s FBTC ranked third with $34.15 million.

These inflows indicate a return of institutional capital to the market, bolstering investor confidence and liquidity.

Ethereum Follows Suit: Institutional Demand Rising

The positive sentiment extends to Ethereum, where spot ETH ETFs saw a combined inflow of $141.66 million. The FETH fund by Fidelity attracted the largest share — $59 million, followed by products from BlackRock, Grayscale, and VanEck.

This steady inflow demonstrates growing institutional recognition of Ethereum as a valuable long-term investment asset.

Outlook: Bullish Trend Remains Intact

Renowned analyst PlanB, creator of the Stock-to-Flow (S2F) model, believes that the fundamentals remain bullish for the crypto market. Despite recent price corrections, indicators such as increased accumulation, reduced leverage, and rising ETF inflows support the case for further market growth.

“We’re witnessing a typical consolidation phase before the next upward move. The core market metrics remain strong,” said PlanB.

Conclusion

The combination of factors — declining selling pressure, investor accumulation, reduced speculative activity, and renewed institutional investment — points to a strengthening Bitcoin and Ethereum market.

If current trends continue, the crypto market could enter a new growth phase in the coming months.