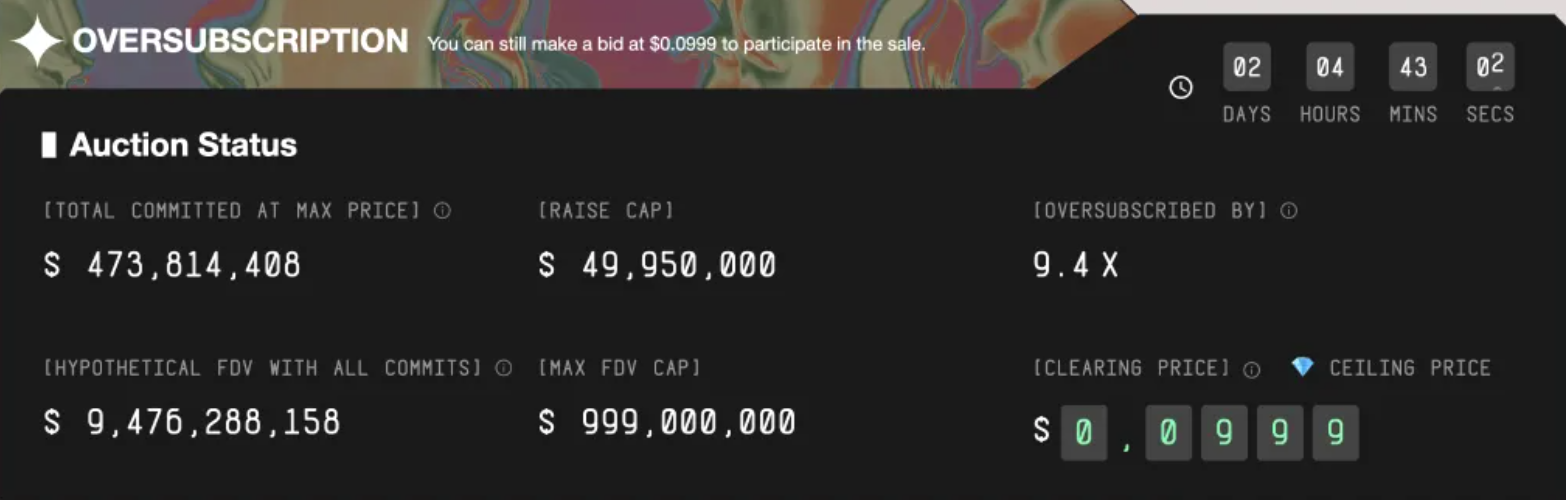

The Layer 2 MegaETH project set a record for the amount of funds raised — in the first 24 hours of its token sale, participants contributed $473 million, nearly ten times the target cap. Data on the results of the sale were published on the official project page.

Offering Terms and Investor Participation

The MegaETH team allocated 5% of the total supply of MEGA tokens for the initial offering, amounting to 10 billion coins. The minimum investment amount is $2,650, while the maximum application is $186,282.

Investors from the U.S. will face a restriction: they will not be able to sell tokens for one year after the launch. Other participants have the option of voluntarily locking their tokens, with a 10% discount offered for agreeing to this lockup.

According to the project team, over 100,000 users underwent KYC verification before the ICO started. Due to the oversubscription, developers are planning to activate a special mechanism to redistribute shares. The key factor for this will be activity in the MegaETH and Ethereum communities. The token sale is set to conclude on October 30, while the MEGA token launch is scheduled for January 2026, according to the project’s whitepaper.

MegaETH’s Technological Ambitions

MegaETH is positioned as an innovative Layer 2 rollup for Ethereum. The team promises to achieve a throughput of up to 100,000 transactions per second through the implementation of parallelization technologies.

In March, the developers launched a public testnet, claiming a performance of 20,000 TPS. If successful, the project could become one of the most scalable solutions within the Ethereum ecosystem.

Analyst Opinions and Risks of Overheating

Santiment analyst Brian Qiu links the success of the MegaETH ICO to “high expectations and social momentum.” According to him, the developers’ promises inspired investors, but such intense interest also carries risks.

“If successful, MegaETH could indeed become a powerful extension of Ethereum, but the current investor activity looks like a red flag — overheating could lead to a correction after the token launches,” said the expert.

According to the Arkham analytics platform, the limit of applications was exceeded just two hours after the token sale started. At least 819 wallets contributed the maximum allowed investment amount.

Market Predictions and Expectations

Users of the Polymarket platform are actively betting on the outcome of the MegaETH ICO. As of this publication:

- 83% of participants believe that the total funds raised will exceed $1 billion;

- 24% are confident that the amount will reach $1.8 billion.

The project is also supported by high-profile names — among the supporters are Ethereum co-founders Vitalik Buterin and Joe Lubin, and the MegaLabs team had previously attracted significant venture capital investment.

Conclusion

MegaETH has become one of the most talked-about token sales of the year, showcasing the market’s interest in scalable Ethereum solutions. However, according to analysts, the hype surrounding the project may be driven more by social enthusiasm than by fundamental technological achievements, making the MEGA token’s market potentially volatile after launch.