The company Strategy has set aside $1.44 billion to ensure “stable and continuous” dividend payments even if the price of Bitcoin falls. This was announced by CEO Phong Le.

According to him, the goal is to protect the company’s dividend policy from crypto market volatility and make payouts more predictable for shareholders.

How the Dividend Reserve Was Formed

The reserve fund was created by selling MSTR shares over the past nine days.

Key objectives of the fund:

- guarantee at least one year of dividend payments;

- later expand this “safety cushion” to cover more than two years of payouts.

Co-founder and chairman of Strategy Michael Saylor explained that the company deliberately built the reserve in US dollars to disconnect dividend flows from short-term Bitcoin price swings.

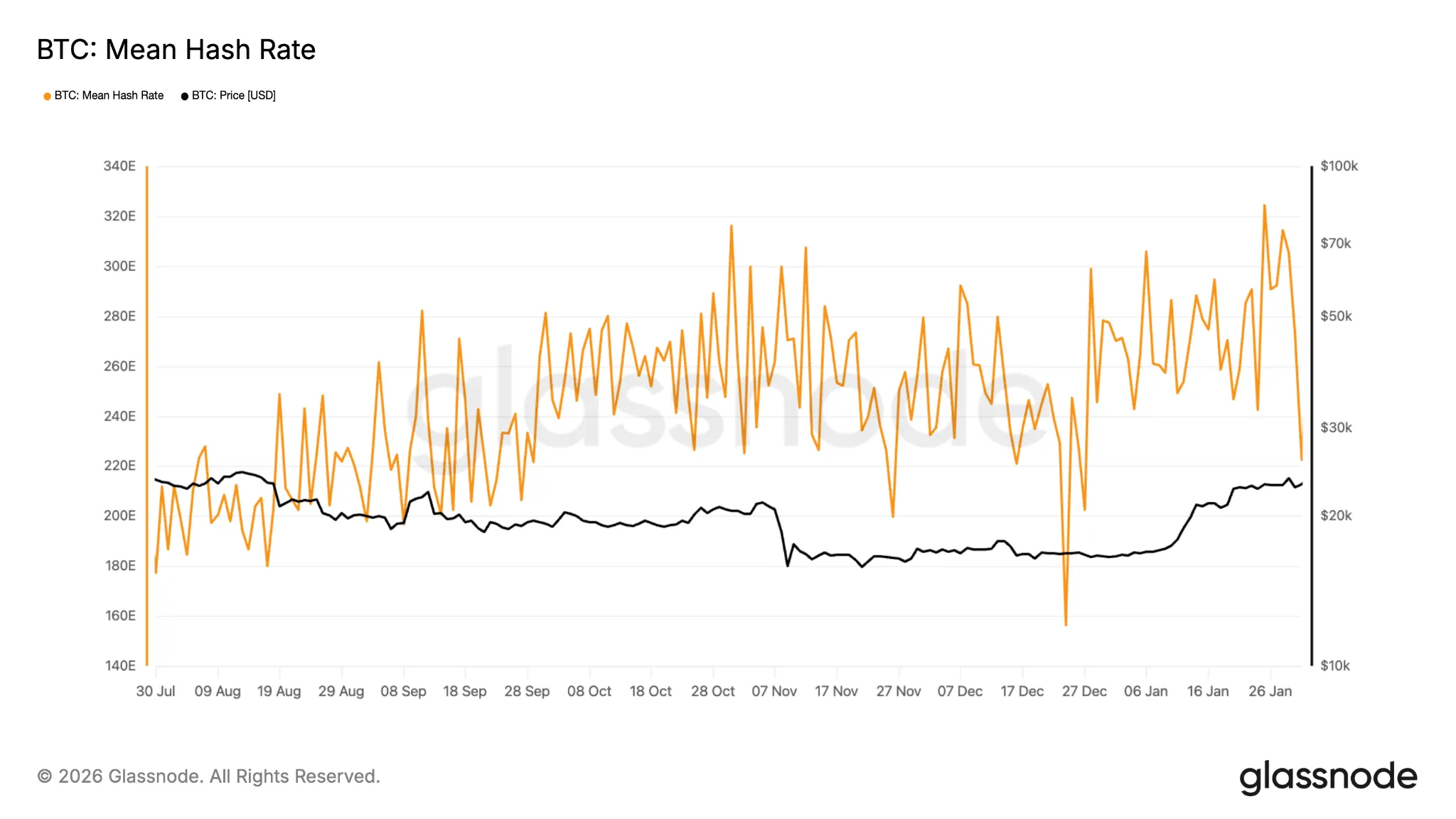

Saylor stressed that Bitcoin is inherently highly volatile, and Strategy’s goal is to offer investors a “digital debt instrument” that is less sensitive to these fluctuations.

Willingness to Sell Part of the Bitcoin Reserve

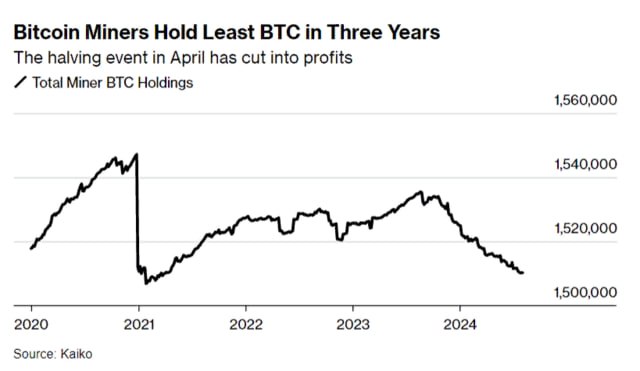

At the same time, the management does not rule out selling part of its Bitcoin holdings.

Phong Le said such a scenario is possible if mNAV falls below 1. According to Saylor, a skeptical narrative has formed around the company: some market participants believe Strategy will not be able or willing to sell BTC to fund its dividend policy.

Saylor called this view mistaken and noted that:

- the firm is legally and operationally ready to liquidate part of its crypto assets;

- the portfolio includes bitcoins with significant unrealized gains;

- even after partial sales, Strategy, in his view, will retain the ability to continue increasing its BTC reserve every quarter.

He added that the process of accumulating Bitcoin can be “virtually endless,” even if the company occasionally takes profit and directs it to dividends.

Strategy’s Current Bitcoin Position

Today, Strategy remains the largest corporate holder of Bitcoin:

- it holds 650,000 BTC on its balance sheet;

- the estimated value of these assets is around $56 billion;

- the company controls roughly 3.1% of Bitcoin’s total supply.

From November 17 to November 30, the firm additionally purchased 130 BTC for about $11.7 million at an average price of roughly $89,960 per coin.

It is notable that for many years Saylor’s principle was “never sell Bitcoin.” But the new dividend strategy effectively means a revision of this approach.

Why the Strategy Changed

The evolution of Strategy’s stance is driven by the demands of its business model:

- the company is obligated to generate dividends for its shareholders;

- the primary funding source is share issuance;

- this mechanism is effective only as long as mNAV > 1.

If that metric drops below the key threshold, the firm must be ready to use other tools, including partial sales of its Bitcoin reserve.

Criticism from Peter Schiff

News of the dollar reserve and the potential sale of BTC sparked heated debate in the community.

Noted gold advocate and crypto critic Peter Schiff declared the “beginning of the end for Strategy.” According to him, the company is now forced not to sell shares to buy Bitcoin, but rather to sell shares for dollars to cover interest and dividend obligations.

Schiff accused Strategy’s business model of being fraudulent and called Saylor “the biggest con man on Wall Street.” He had previously made similar accusations and publicly challenged the Strategy founder to a debate.

Market Reaction and Analysts’ View

Following the recent news, MSTR shares fell nearly 6% to $171.42. The current price is roughly 70% below the all-time high of $543.

Despite this, investment bank Benchmark maintains a positive view on Strategy’s prospects.

Analyst Mark Palmer believes that:

- the company’s stock still offers a compelling way to gain exposure to the crypto market;

- critics “clearly misunderstand” Strategy’s operating model;

- the risk of serious financial trouble, according to his estimates, is real only if Bitcoin falls to around $12,700.

He noted that such crashes have occurred in Bitcoin’s history, but a repeat today would require several large-scale macroeconomic shocks happening at once.

Benchmark reiterated its “buy” rating on Strategy shares with a target price of $705. The forecast assumes Bitcoin will reach $225,000 by the end of 2026.

“Historical Undervaluation” of Strategy Stock

According to CryptoQuant analyst Carmelo Aleman, Strategy’s stock has once again entered a zone of undervaluation relative to the value of its Bitcoin treasury.

Key observations:

- at the current Bitcoin price, the company’s unrealized profit is about 22%;

- MSTR shares have fallen more than the value of its BTC reserve;

- the stock price has reached the lower boundary of a range that CryptoQuant calls the “historical undervaluation zone.”

In previous cycles, reaching this level has often signaled a mismatch between the share price and the company’s underlying value. According to Aleman, the market usually later corrected toward a fairer valuation.

If the historical pattern repeats, the current level of undervaluation could become one of the most significant reversal points in recent years, the analyst wrote.

Bottom Line

Strategy is simultaneously:

- locking in part of its capital in dollars to secure reliable dividends,

- acknowledging the possibility of selling Bitcoin under adverse conditions,

- and continuing to position itself as the largest corporate “HODLer” of BTC.

Against this backdrop, investors face a choice: either see the new policy as a sign of weakness and risk, like Schiff does, or view it as a maturing stage of Saylor’s model — an extra layer of protection for shareholders and a potential entry point into an “undervalued” stock.