The Bitcoin market is receiving more and more confirmation in favor of a continued bullish trend. Both derivatives metrics and institutional news point in this direction. At the same time, some analysts emphasize that amid Fed uncertainty and macroeconomic risks, cryptocurrencies may remain in a consolidation phase for a while.

CoinCare’s signal of a continuing bull market

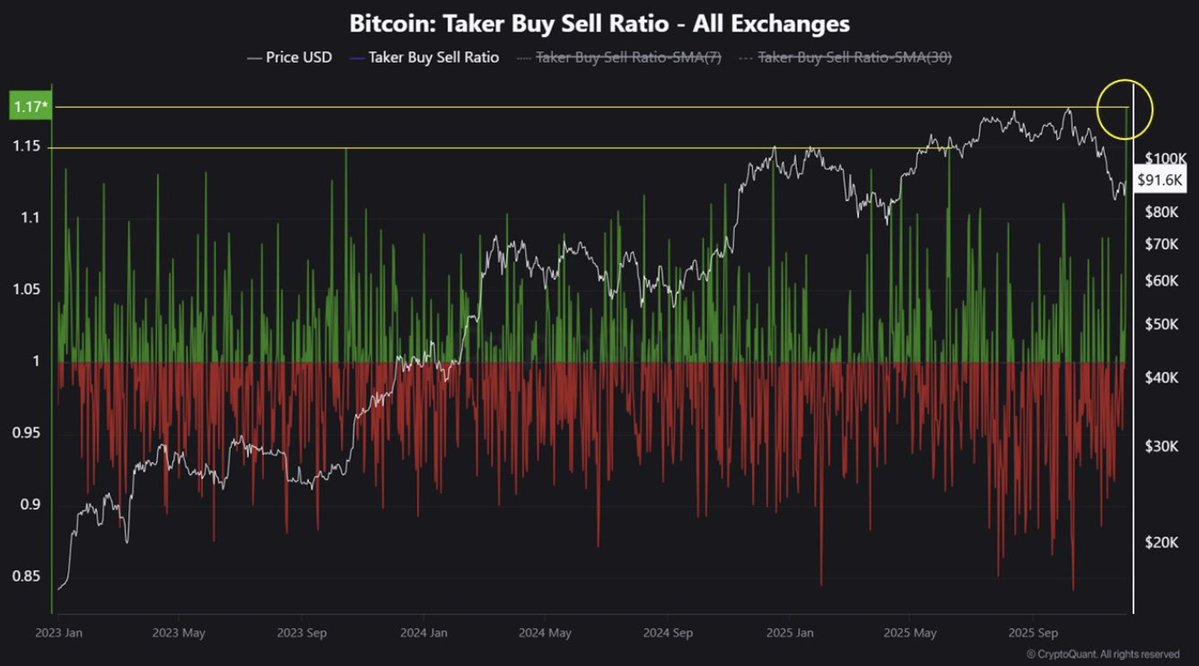

An analyst under the nickname CoinCare drew attention to an important indicator:

the ratio of market buy and sell orders for bitcoin on exchanges has risen to 1.17 — its highest level since January 2023.

This metric tracks the balance of aggressive orders in the perpetual futures market.

- A value above 1 indicates buyer dominance.

- The current spike, according to the analyst, has become the strongest expression of bullish sentiment over the entire observation period.

CoinCare notes that similar readings are usually seen in the early or middle phase of an uptrend, when new liquidity is actively flowing into the market and participant demand strengthens.

Vanguard’s role and bitcoin ETFs

The key driver of the current optimism, according to the analyst, is Vanguard’s decision to open access to spot bitcoin ETFs.

- More than 50 million clients of the broker gained access to the product.

- This expanded the market’s reach and strengthened confidence among institutional investors.

In CoinCare’s view, the structural adoption of ETFs is one of the most important long-term growth factors: it brings large capital into the market and reinforces bitcoin’s status as a recognized financial asset.

Liquidity and macroeconomics: early stage of a rally?

The analyst also noted that the macro environment supports a positive scenario:

- Liquidity stress indicators, in his words, have already bottomed out.

- Market conditions are gradually easing.

Historically, the most powerful bitcoin rallies have tended to occur not at the point of maximum liquidity, but at the initial stage of its recovery. That is why CoinCare concludes that the bull phase is far from over, and the market has room for further expansion as institutional players return.

At the same time, the analyst stresses that risks cannot be ignored.

He points to:

- financial instability related to Japan;

- the absence of a clearly confirmed reversal in global macro trends.

All this indicates the persistence of systemic risks that may increase volatility.

QCP Capital: a market in wait-and-see mode

Against the backdrop of local optimism in derivatives, analysts at QCP Capital see a different picture: in their view, the crypto market is currently in a “pause mode.”

Key points from QCP:

- The market is experiencing a shortage of strong macroeconomic drivers.

- In an environment of uncertainty about the Fed’s next steps, digital assets, in their opinion, will continue a sideways movement.

- They expect the consolidation phase to last until clear signals from regulators appear.

A similar “standstill” is also visible in the equity and FX markets, which are waiting for the upcoming FOMC meeting.

The Fed factor: a potential catalyst

QCP Capital believes that the main catalyst for markets will be the upcoming personnel and policy changes at the Federal Reserve:

- Prediction markets estimate the probability of Kevin Hassett being appointed the next Fed chair at around 85%.

- An official decision is expected early next year.

- Current chair Jerome Powell will leave his post in May, and several other key officials will step down in early 2026.

According to the analysts, the renewed committee may take a more “dovish” stance, meaning a bias toward looser monetary policy.

Another specific feature of the upcoming FOMC meeting is its “non-standard” nature:

the Fed will not have fresh inflation or employment data at hand. Nevertheless:

- The futures market is already pricing in about a 90% probability of a 25 bps rate cut as a preventive measure.

- Investors are gradually shifting their focus from specific inflation prints to the Fed’s overall policy trajectory.

Grayscale’s view: potential to break out of classic cycles

It is also worth noting that back in November, analysts at Grayscale allowed for the possibility of bitcoin rising in defiance of the classic four-year cycles.

This implies that:

- the historical patterns of halvings and post-halving phases remain important reference points,

- but the market is increasingly driven by institutional demand, ETFs and macro factors, which can shift the usual timing of these cycles.

Conclusion

Overall, the picture looks like this:

- CoinCare sees a strong bullish signal from derivatives and liquidity, and views institutional ETF adoption as the foundation for further growth.

- QCP Capital emphasizes a phase of waiting and consolidation until there is clarity on the Fed and personnel changes at the regulator.

- Grayscale allows for a scenario in which bitcoin could move beyond the usual four-year cycles.

Thus, in the short term the market may remain range-bound, but structural factors — ETFs, institutional interest and easing financial conditions — support the case for a continued bull phase in the medium and long term.