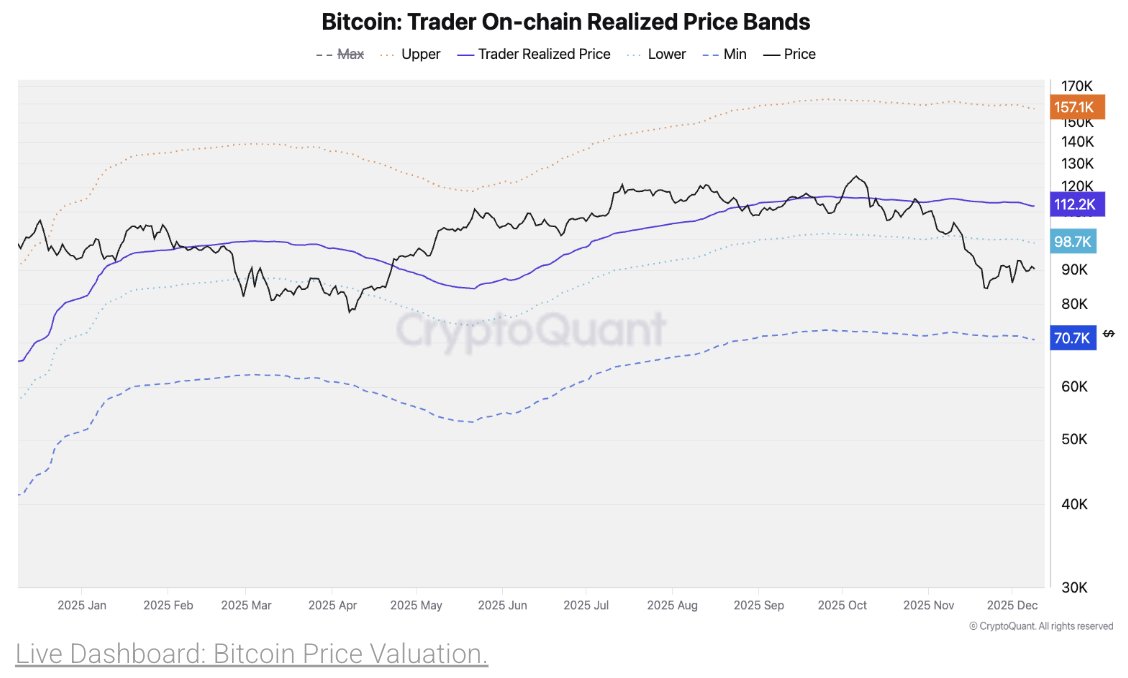

Analysts believe bitcoin (BTC) could rise to the $112,000 area within the next one to three months. The key condition for this scenario is a softer monetary policy from the US Federal Reserve, according to CryptoQuant.

The market is waiting not only for a possible rate cut, but also for more dovish forecasts on inflation and the pace of policy easing next year. This forms a foundation for the continuation of the bullish trend in the crypto market.

Conditions for Bitcoin to Reach $112,000

According to experts, for bitcoin to move toward the $112,000 target zone, it must overcome two important price barriers:

- $99,000 – the lower boundary of the realized price range

- $102,000 – the yearly moving average

These levels act as key resistance zones. After testing the $99,000 area, further price action will largely depend on traders’ behavior: whether they start actively taking profits or continue to hold positions.

If selling pressure remains moderate, the rally has room to extend.

Declining Seller Activity as a Growth Driver

CryptoQuant notes that the main factor behind bitcoin’s current rise is decreasing seller activity:

- daily inflows of coins to centralized exchanges dropped from 88,000 BTC (on November 21) to 21,000 BTC

- the share of deposits from large players (whales) fell from 47% to 21%

- the average transaction size declined from 1.1 BTC to 0.7 BTC

Another key signal is the capitulation of some investors. Since November 13, large holders have locked in a net loss of about $3.2 billion. Historically, such periods of realized losses often indicate exhaustion of selling pressure and frequently precede a new phase of price growth.

NUPL: A Signal in Favor of Bitcoin Accumulation

Analyst Darkfost drew attention to the net unrealized profit/loss ratio (NUPL) for bitcoin. The metric has now dropped to its lowest level since October 2023.

What NUPL Shows

NUPL reflects the difference between market capitalization and realized capitalization, helping to assess:

- overall investor sentiment

- the volume of unrealized profit on the market

The current value of the ratio is 0.39. According to Darkfost, this level is still higher than the readings seen during previous corrections in the current cycle.

Why This NUPL Zone Matters

The analyst highlights this area as key for two reasons:

- Investors tend to hold coins as long as they remain in profit. This reduces the risk of panic selling.

- In a broader bullish trend, current NUPL levels look attractive for renewed accumulation.

Darkfost emphasizes that caution is still necessary. However, the overall picture points to a potential entry zone similar to previous accumulation phases in this market cycle.

In his words, “it’s time to accumulate, not capitulate.”

Ethereum’s Upside Potential: Rally Without Overheating

Alongside bitcoin, analysts are closely watching the second-largest cryptocurrency by market cap — Ethereum (ETH). Expert ShayanMarkets notes that the current ETH rally is notably different from earlier price spikes seen this year.

Low Funding Rates as a Feature of the Current Move

During previous sharp moves up, funding rates on derivatives rose to extreme levels, signaling:

- strong euphoria in the market

- a high share of speculative leveraged positions

- formation of local tops in overheated conditions

This time the situation is different:

- after rebounding from the $2,800 area, Ethereum’s price is recovering,

- yet funding rates remain relatively low,

- the derivatives market is not showing the same level of hype or aggressive use of leverage.

This suggests that the main driver of growth is spot accumulation, not short-term speculation in futures.

What This Means for the ETH Trend

According to ShayanMarkets:

- the current move reflects market recovery, not a final blow-off top;

- Ethereum still has room to grow, if buyer interest strengthens;

- to kick off a full-scale bullish trend, the market will likely need higher funding rates, confirming traders’ willingness to actively participate in the move.

At the same time, the analyst warns: without an influx of new volume and growing demand, the upward impulse in ETH may struggle to break key resistance levels.

Summary

- CryptoQuant analysts see a scenario where bitcoin could move toward $112,000, provided the Fed shifts to a softer policy.

- Key resistance zones for BTC are located around $99,000 and $102,000.

- Falling exchange inflows and investor capitulation point to weakening selling pressure.

- The NUPL metric suggests a zone favorable for bitcoin accumulation if the broader bullish trend continues.

- Ethereum’s current rally is driven mainly by spot demand rather than leveraged speculation, leaving potential upside if interest and volumes continue to grow.