The market is showing two notable signals at once: FLOW has plunged following news of a hack, and on Ethereum, the queue to enter staking has, for the first time in months, become larger than withdrawal requests.

FLOW Loses 40% After a $3.9M Exploit

The FLOW token fell by roughly 40% after reports of a hacking incident in which attackers reportedly stole about $3.9 million. Such events typically trigger a wave of selling as investors react to heightened ecosystem risk.

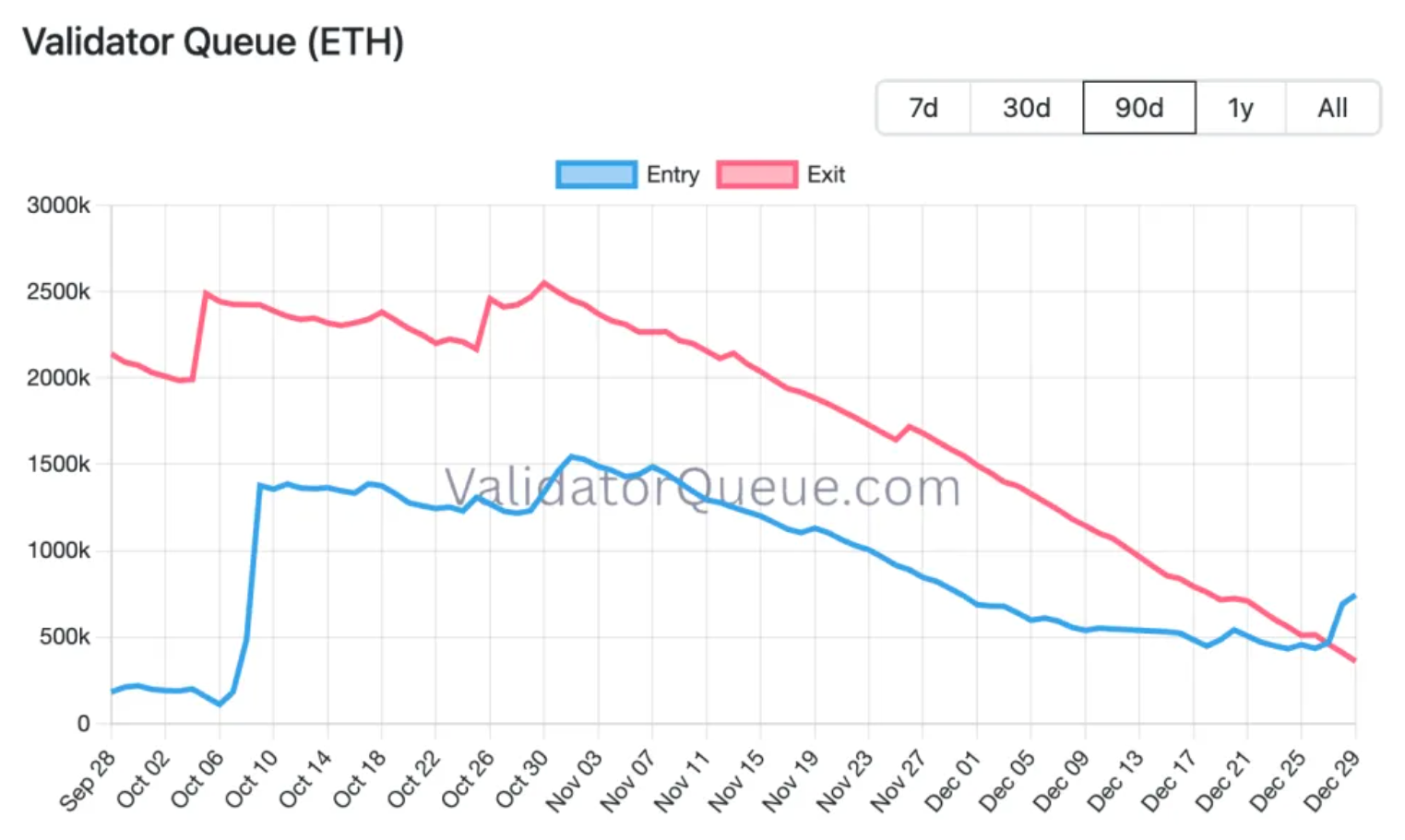

Ethereum Staking Queue Is Now Twice the Withdrawal Queue

A trend reversal has been observed on Ethereum: the staking entry queue has significantly overtaken the exit (withdrawal) queue. This is the first time since July, according to Validator Queue data.

At the time of observation:

- around 745,619 ETH are waiting to be deposited into the staking contract (about 13 days of waiting time);

- about 360,518 ETH are waiting to be unlocked (about 8 days).

The shift occurred on December 27, when both indicators matched at roughly 460,000 ETH, after which the staking queue began to pull ahead.

What It Could Mean for ETH Price

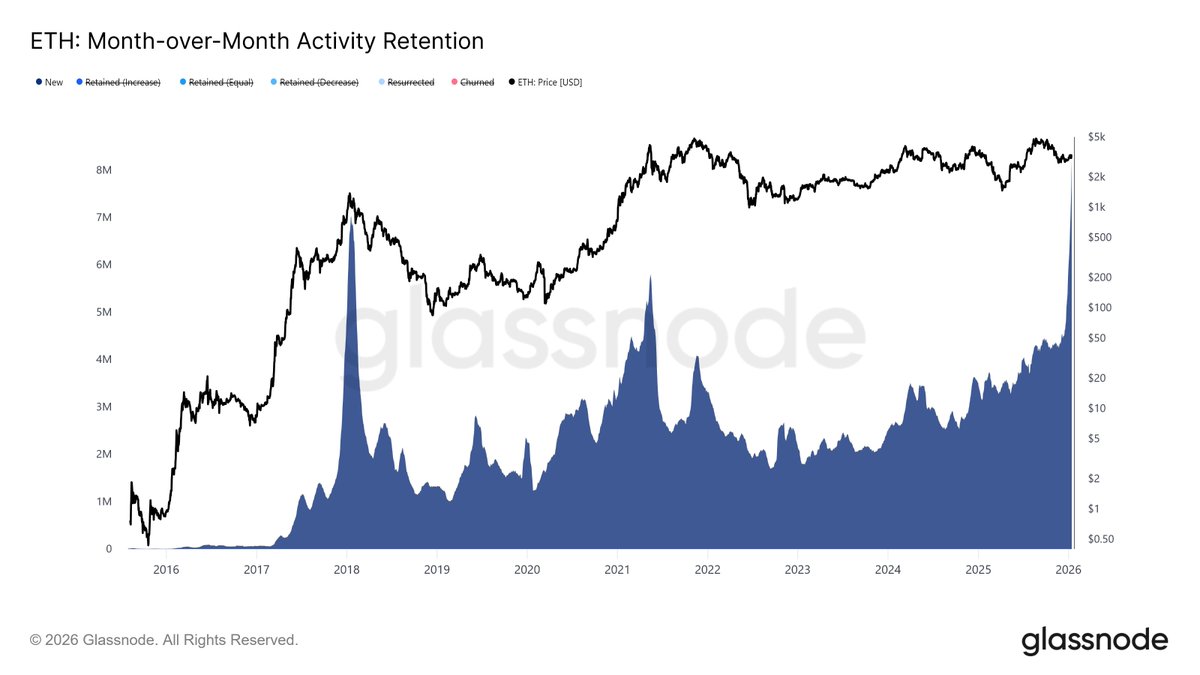

Abdul, DeFi lead at the L1 network Monad, noted that a similar turning point happened in June. After that, Ethereum’s price, he said, doubled and reached an all-time high of $4,946 by August.

He expects that at the current pace the withdrawal queue could drop to zero by January 3, which may reduce selling pressure on ETH:

“In this context, Ethereum’s outlook looks promising,” Abdul said.

At the time referenced in the source text, ETH is trading around $3,000 and is up about 2.5% over the past day amid a rally in precious metals and a weaker U.S. dollar.

Whales: Who Is Staking So Much ETH?

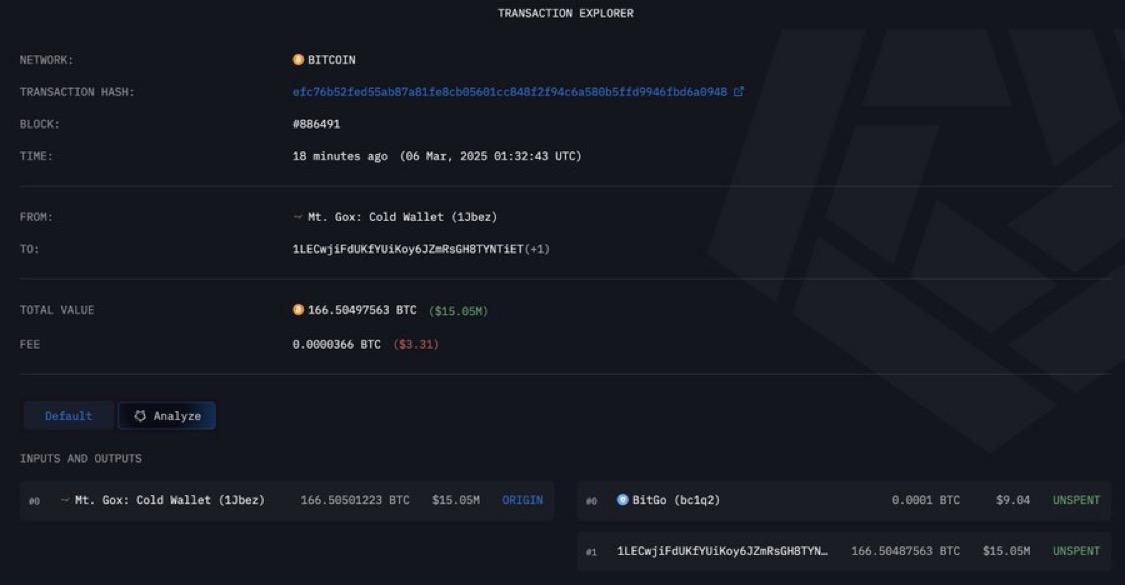

Smart Economy podcast host Dylan Grabowski linked the queue changes to aggressive accumulation by large “treasury-style” buyers such as BitMine, followed by staking.

On-chain data supports this idea: Lookonchain reports that since December 27, BitMine has staked 342,560 ETH, worth roughly $1 billion based on the figures in the text.

Three Possible Reasons Behind the Imbalance

Researcher Ignas outlined three possible drivers of the staking-vs-withdrawal imbalance:

- DeFi deleveraging. Higher borrowing rates on Aave forced leveraged participants using stETH as collateral to unwind positions.

- Operational rebound. Staking provider Kiln began returning previously withdrawn assets back to the network.

- Technology factor. The Pectra upgrade improved staking UX and removed earlier limits on the maximum number of validators.

Context

Back in September, Ethereum co-founder Vitalik Buterin explained why the ETH staking withdrawal queue exists: it helps smooth out sharp withdrawal flows and supports overall network stability.