Ethereum co-founder Vitalik Buterin believes the network behind the world’s second-largest cryptocurrency is steadily moving toward solving the “blockchain trilemma” — the challenge of achieving scalability, decentralization, and security at the same time. According to him, the key drivers are the development of zkEVM and the rollout of PeerDAS.

Buterin predicts that the first nodes of a new type will appear as early as 2026, along with higher gas limits. Between 2027 and 2030, zkEVM is expected to become the “primary validation standard” for Ethereum.

The next step: distributed block building

A long-term goal for the ecosystem is a transition to distributed (decentralized) block construction. This, Buterin notes, would reduce centralization risks and create more equal participation opportunities for validators and operators worldwide.

“Now that Ethereum has PeerDAS and zkEVM solutions (it’s expected that small parts of the network will use them in 2026), we get: decentralized consensus and high throughput,” Buterin said.

He added that the trilemma is effectively solved: the required technologies are either already running on mainnet or have reached production-level performance, with the main remaining task being to ensure their security and expand adoption.

What is PeerDAS and why it matters

PeerDAS (Peer Data Availability Sampling) is a data-availability sampling technology that became a key element of the recent Fusaka upgrade. Its purpose is to reduce the load on nodes and improve overall blockchain performance by enabling verification of data availability without requiring every node to store and process the full data set.

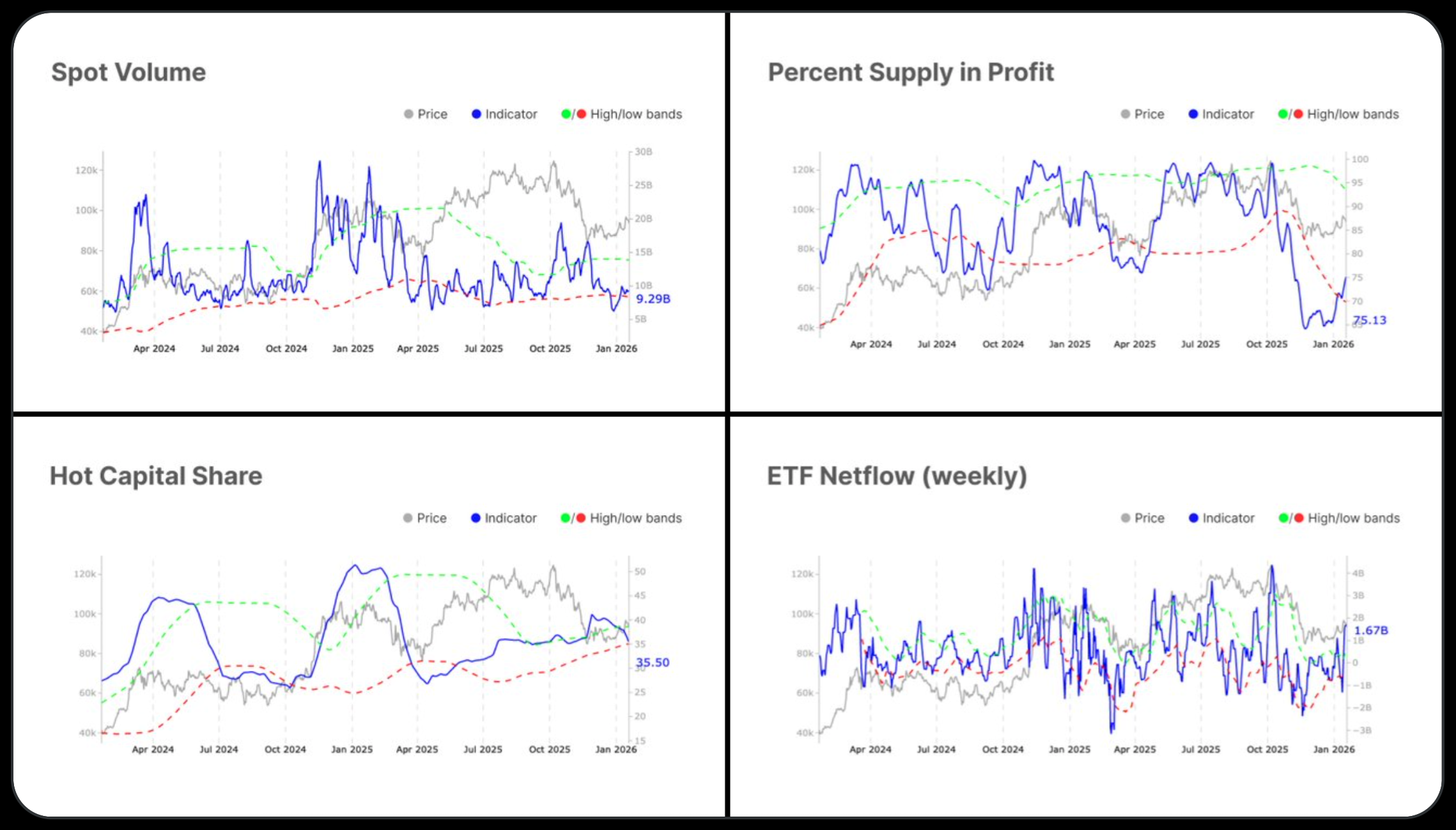

Record on-chain metrics

Ethereum’s network activity remains strong. Alongside record transaction demand, the number of active addresses is also growing.

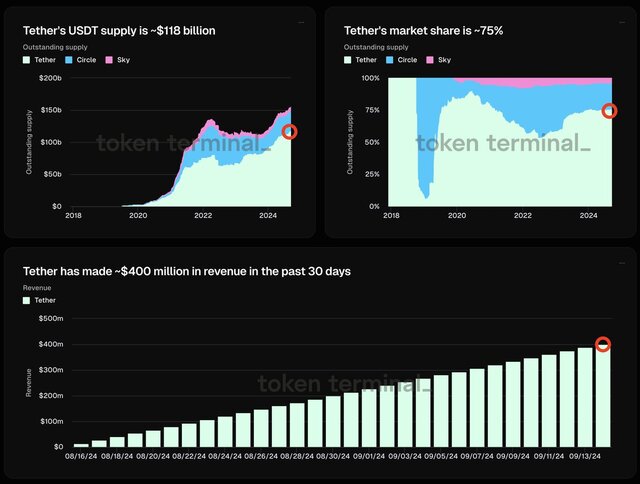

- The volume of on-chain stablecoin transfers set a new record in Q4, surpassing $8 trillion.

- According to Blockworks, stablecoin supply on Ethereum grew by about 43% in 2025 — from $127 billion to $181 billion.

An X user known as BMNR Bullz noted that this trend reflects real usage rather than speculation:

“These are global payments on-chain […]. The infrastructure is already in place, and adoption is accelerating,” he added.

The king of tokenization

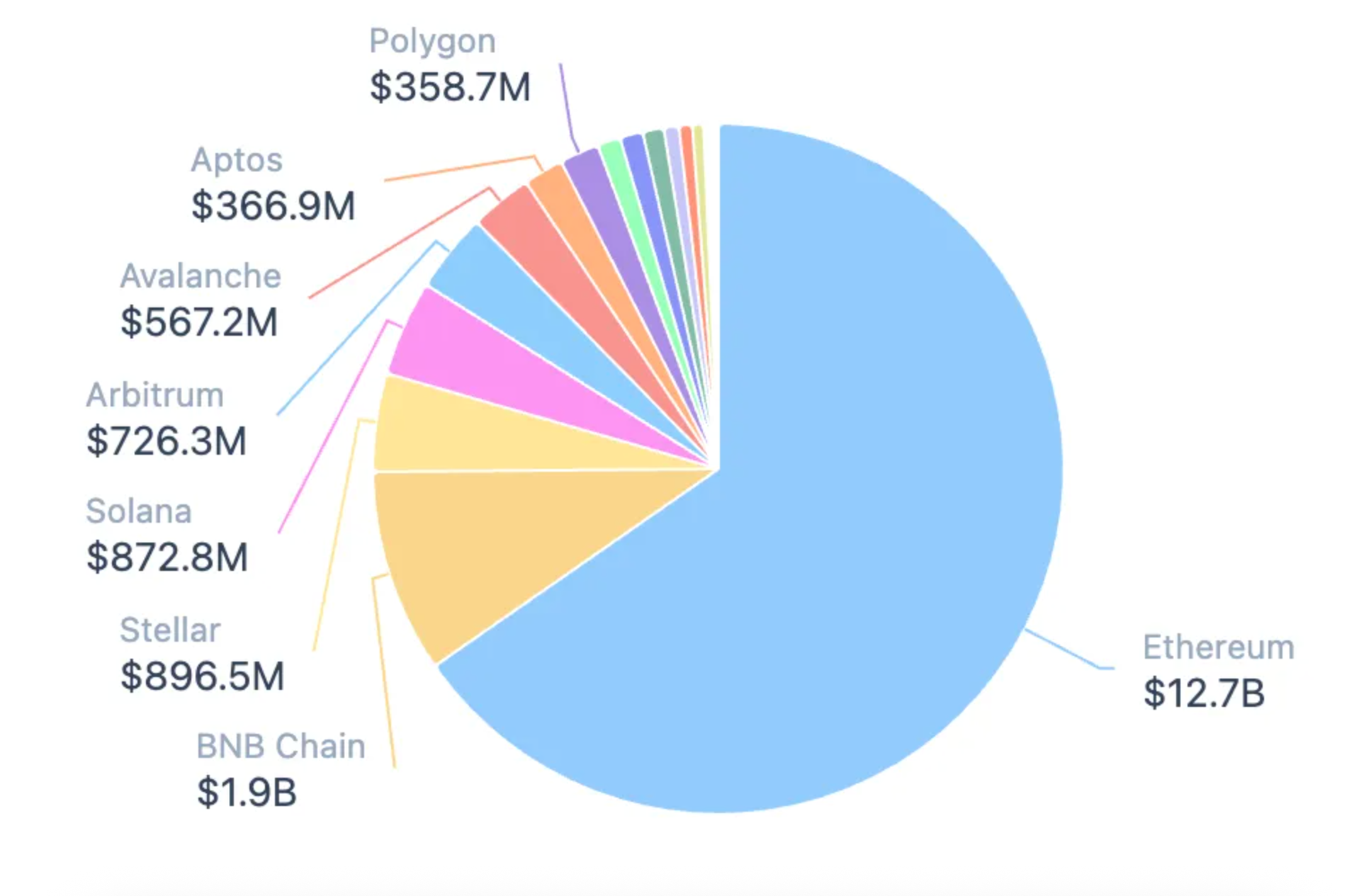

Ethereum also leads in the tokenization of real-world assets (RWA). The network’s share of a market worth more than $19 billion is estimated at around 65%.

Ethereum hosts the largest amount of issued stablecoins — about $170 billion. TRON ranks second with $81 billion, and Solana is third with $14 billion.

Market snapshot

At the time of writing, Ethereum is trading around $3,160. Over the past seven days, the asset is up 4.8%, according to CoinGecko.