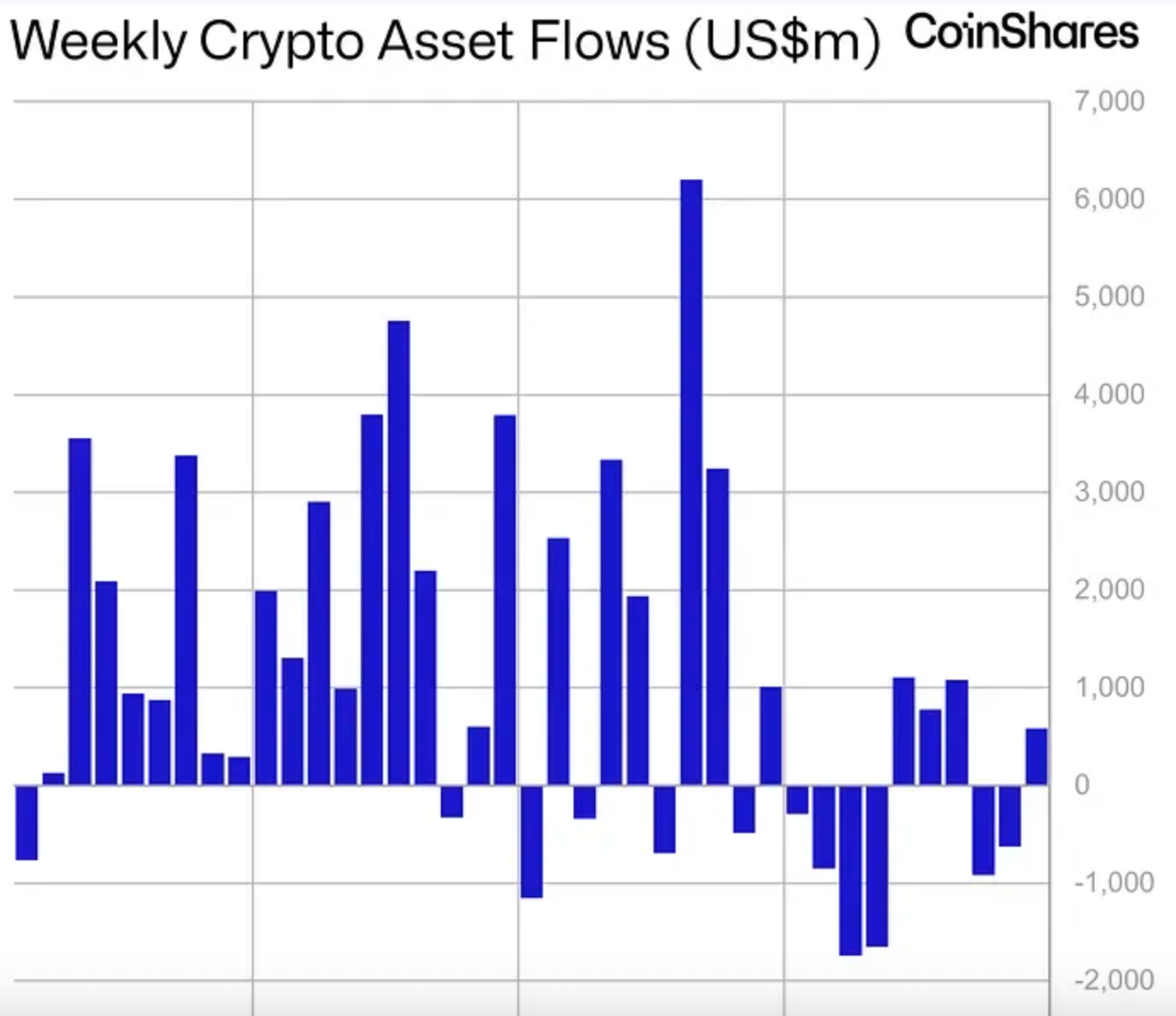

By the end of 2025, cryptocurrency exchange-traded products (ETPs) attracted $47.2 billion in net inflows—one of the highest results on record. This is stated in a CoinShares report. The figure came only slightly below the all-time high of $48.7 billion posted in 2024.

The U.S. Remains the Leader, While Europe and Canada Accelerate

The United States once again became the main driver of demand: investors allocated $42.5 billion to crypto funds. However, this result was 12% lower than the previous year.

Germany showed the most significant turnaround. In 2025, inflows reached $2.5 billion, compared with an outflow of $43 million in 2024.

Canada demonstrated a similar shift: digital-asset products brought in $1.1 billion after a loss of $603 million a year earlier.

Switzerland posted more moderate growth: inflows increased by 11.5% to $775 million.

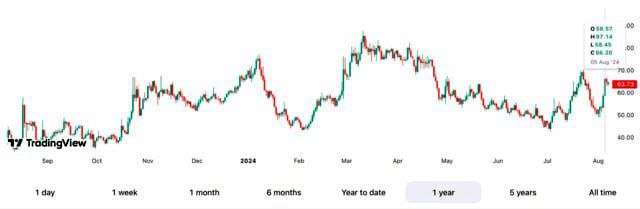

Bitcoin Slows Down, Altcoins Surge

Over the past 12 months, inflows into bitcoin funds dropped sharply: they fell 35% to $26.9 billion, down from $41.7 billion in 2024.

At the same time, products based on the leading altcoins showed strong growth:

- Ethereum ETPs attracted $12.7 billion (+138%).

- XRP products recorded $3.7 billion in inflows (+500%).

- Solana products drew $3.6 billion (+1000%).

Meanwhile, investor interest in other digital assets beyond bitcoin weakened: inflows declined to $318 million, which is 30% lower than last year.

Early 2026: Inflows Return After a Weekly Outflow

The first week of 2026 started on a positive note: total inflows into exchange-traded crypto products rose to $582 million.

For comparison, the previous week saw investors withdraw $446 million, highlighting a quick shift in short-term sentiment.

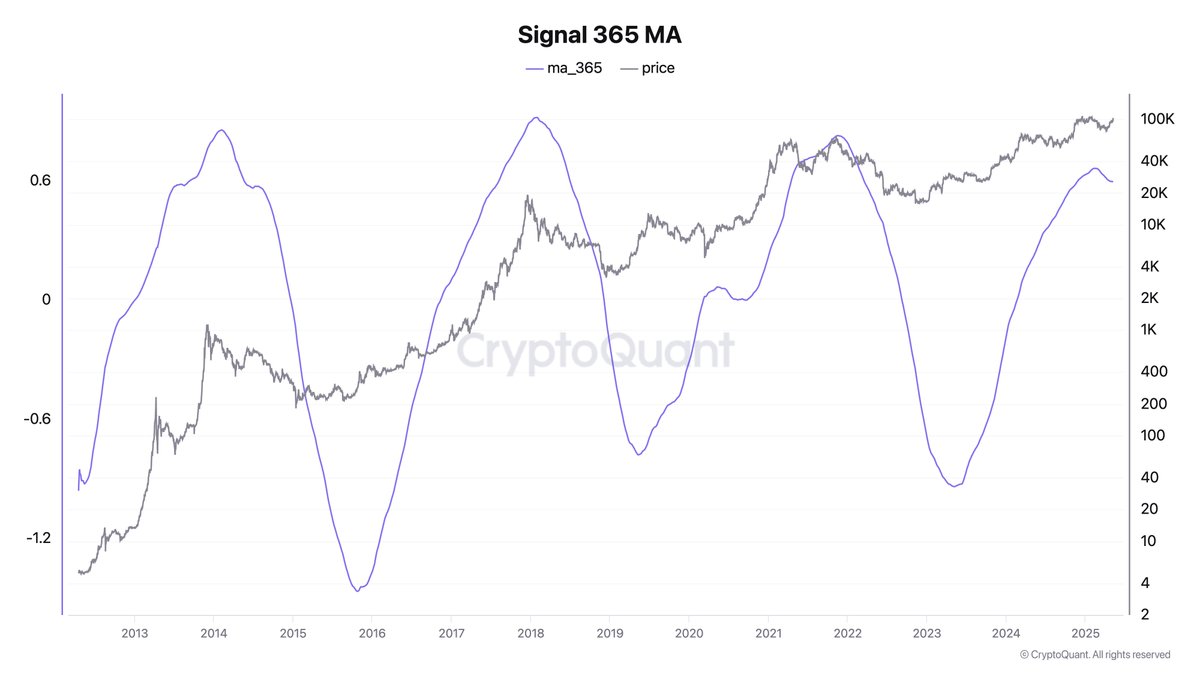

What This Means for the Market

The 2025 results confirm that overall interest in crypto ETPs remains close to historic highs, but the structure of demand is changing. While bitcoin-focused products slowed, part of investor attention shifted toward major altcoins—primarily Ethereum, as well as XRP and Solana.