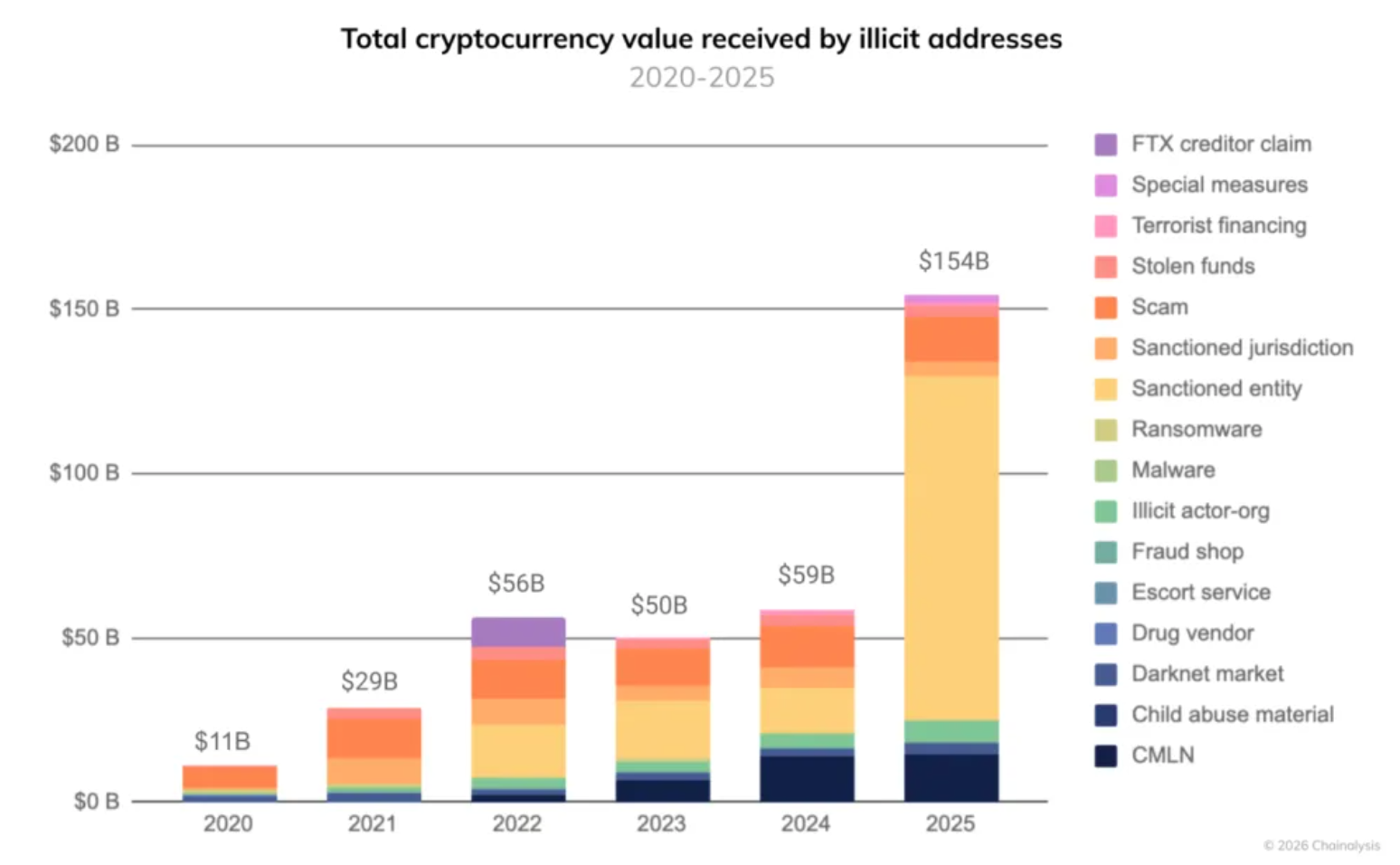

In 2025, more than $154 billion was sent to crypto wallets linked to illegal activity — a 162% increase compared with 2024, according to a Chainalysis report. Despite the sharp rise in absolute figures, analysts emphasize that the share of illicit transactions in total crypto activity remains below 1%.

Below is a closer look at what’s driving the growth, the role of sanctions, and why stablecoins have become the leading instrument in the shadow economy.

Key figures and takeaways

- $154B+ in inflows to illicit crypto wallets in 2025.

- +162% year-on-year (vs. 2024) by inflow volume.

- +694% growth in the segment tied to sanctions-related activity (as described by the analysts).

- <1% estimated share of illicit transactions in overall crypto transaction volume (slightly higher than in 2024).

- 84% — stablecoins’ share as the main tool of the “black” economy in 2025.

Why the figure jumped so sharply

A 162% increase looks dramatic, but it doesn’t necessarily mean “crime doubled” in a straightforward way. The trend is usually shaped by several factors — and some of them reflect structural shifts rather than a surge in mass criminality:

1) Sanctions and state-level activity

Chainalysis notes that the spike is strongly linked to sanctions-related activity, including operations at the country level. In such cases, flows are often large enough to push the overall total significantly higher even if the number of participants does not rise proportionally.

2) A shift in tools: stablecoins became more “convenient”

Stablecoins (for example, those pegged to the U.S. dollar) are practical for payments and transfers:

- less volatility than BTC/ETH;

- easier to use as “digital cash”;

- faster to price transactions and track profit/loss.

According to the researchers, this practicality is making stablecoins increasingly popular not only for legitimate payments, but also in the shadow segment.

3) Growth of the broader crypto market

When overall crypto activity expands, even a small illicit share can grow noticeably in absolute terms. That’s why Chainalysis stresses that the share is still below 1% — meaning the core of the crypto economy remains largely legitimate.

Why “below 1%” is an important caveat

The “under 1%” line provides critical context: it shows the market is not dominated by criminal activity. The illicit segment remains marginal by share, even if it can be highly significant in terms of risk.

It’s also worth noting that such estimates typically rely on:

- identifying addresses (wallets) analysts link to criminal activity;

- clustering (grouping) addresses based on behavioral patterns;

- updating datasets as new information becomes available.

As a result, statistics in studies like this are often revised over time as new links or addresses are uncovered.

Stablecoins vs. Bitcoin: why the “leader” changed

Five years ago, Bitcoin was more commonly described as the main asset used in the shadow economy. In 2025, stablecoins take the lead (84%).

This shift isn’t only about crime — it mirrors broader market trends:

- Payment logic: stablecoins align better with familiar “dollar-denominated” transactions.

- Lower risk: illicit operators aim to minimize losses from volatility.

- Mass infrastructure: stablecoins are widely available in wallets, on exchanges, and in payment scenarios.

“State-linked structures” in illicit turnover: what it means

Another key point in the report is that a significant share of illicit turnover in 2025 may have involved entities believed to be controlled by governments.

The wording matters: “believed to be” indicates analytical attribution (assessment based on indirect indicators and transaction chains), not a legal determination. Still, the trend underscores that crypto infrastructure is used not only by classic fraudsters, but also in more complex geopolitical scenarios.

What this changes for the market and users

For exchanges and the financial sector

- stricter requirements for transaction monitoring and source-of-funds checks;

- a growing role for blockchain analytics and compliance;

- tighter oversight of stablecoin flows as a payment instrument.

For everyday users

- higher odds of freezes/checks when receiving funds from “grey” sources;

- increased value of transparent fund provenance and caution with unknown counterparties;

- rising importance of regulated platforms and clear rules.

Bottom line

Chainalysis highlights two parallel developments:

- a sharp rise in inflows to illicit wallets (in absolute terms), largely driven by sanctions-related activity and large flows;

- the illicit share of overall crypto activity remains low — below 1%.