The U.S. cryptocurrency market is undergoing a massive transformation. Amidst a shifting political landscape, the Securities and Exchange Commission (SEC) is halting its pursuit of major projects, triggering a “reverse migration” of blockchain foundations from Asia back to the United States.

Zcash Foundation: Investigation Closed Without Charges

The Zcash Foundation, the non-profit organization dedicated to the development of the leading privacy coin, has officially announced that the SEC has concluded its investigation. The regulator notified the foundation that it does not intend to recommend enforcement actions or penalties.

The probe into the foundation’s activities began in August 2023, when Zcash Foundation received a subpoena as part of a broad oversight initiative targeting “certain cryptocurrency offerings.”

“We are pleased to report that the SEC has concluded its review and officially notified us that it sees no grounds for enforcement actions or any sanctions against the Zcash Foundation,” representatives stated.

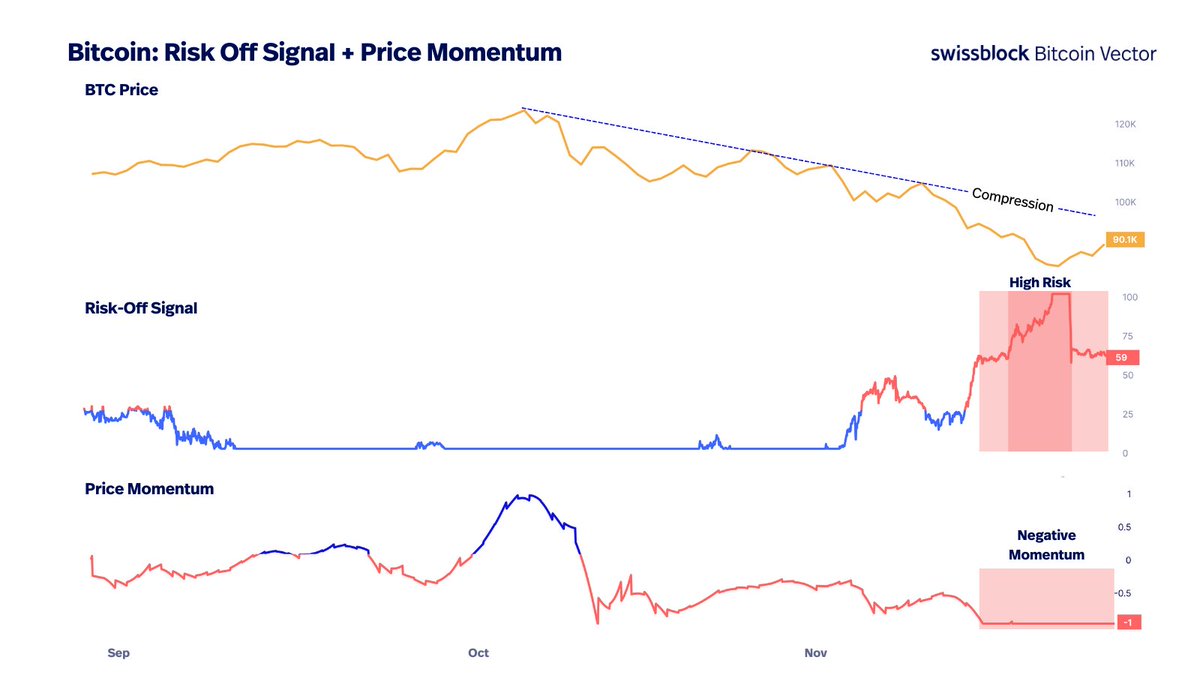

Context and ZEC Price Action

The news comes during a challenging period for the project. In early January, the entire team of Electric Coin Company (ECC) — the primary developers of the cryptocurrency — resigned, sparking a corporate crisis that allowed its rival, Monero, to reclaim its lead in the privacy coin sector.

However, following the positive news from the SEC, the price of Zcash (ZEC) rose by 3.7% over the last 24 hours. At the time of writing, the asset is trading at approximately $432.

A New Course for the SEC: The End of “Regulation by Enforcement”?

The dismissal of the Zcash case is not an isolated incident. Experts attribute the agency’s softening rhetoric to the change in the White House administration. Over the past year under President Donald Trump, the SEC has radically pivoted its policy:

- Dozens of cases dropped against industry giants, including Coinbase and Ripple.

- Investigations terminated into several major DeFi protocols.

- Shift in priorities: A move away from litigation toward establishing clear “rules of the road.”

“Back in the USA”: Algorand and Jito Relocate

The liberalization of the regulatory environment has once again made the United States an attractive jurisdiction for international crypto businesses.

Algorand Foundation

The Algorand Foundation, previously based in Singapore, has announced its relocation to the U.S., accompanied by a refreshed Board of Directors. The organization also plans to launch an Ecosystem Advisory Board for stakers, developers, and other network participants.

CEO Staci Warden emphasized that the foundation is doubling down on areas where blockchain provides the most value: instant global payments and expanding financial inclusion within the American market.

Jito Foundation

The Jito Foundation also announced a “180-degree turn” in its strategy. CEO Lucas Bruder explained the decision to return to the U.S. by citing a more “constructive approach to innovation” following the presidential inauguration.

“With a more constructive approach to innovation, focused on clear laws and safeguards for consumers and market participants, crypto operations, projects, and businesses can and should return to work in the U.S.,” Bruder wrote.

What This Means for the Market

The mass dismissal of SEC cases and the homecoming of major foundations signal the end of the “regulation by enforcement” era. For investors, this translates to reduced legal risks, and for projects, it offers the opportunity to scale legally within the world’s largest economy.