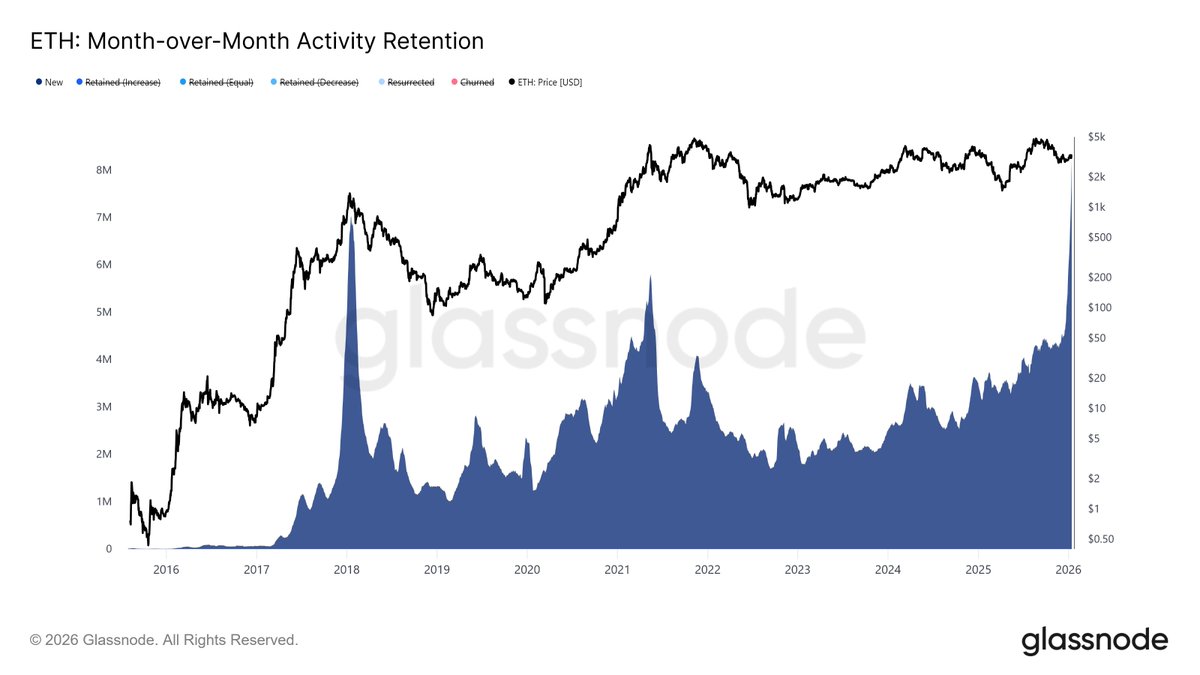

The Ethereum network is demonstrating impressive growth, with the number of new active participants doubling over the past month. Analysts at Glassnode highlight that the current surge is driven by a massive influx of new users rather than activity from long-term holders.

The primary insight from the latest Glassnode report is the surge in the activity retention rate. The number of unique addresses interacting with the blockchain for the first time over a 30-day period has jumped from 4 million to 8 million.

The retention metric is critical for understanding ecosystem health, as it distinguishes a permanent audience from one-time users or bots. Current data confirms that newcomers continue to use the network after their initial transaction, creating a sustainable foundation for future growth.

On-Chain Metrics by the Numbers

According to Etherscan data, a significant psychological milestone was reached on January 15:

- Active Addresses: Over 1 million (more than double last year’s figure of 410,000).

- Daily Transactions: A new peak of 2.8 million (a 125% year-on-year increase).

The Era of Low Fees and L2 Solutions

Experts at Milk Road attribute this surge in activity to a drastic reduction in transaction costs. Layer 2 (L2) scaling solutions have taken on the bulk of the processing load, allowing the Ethereum mainnet (Layer 1) to remain a secure settlement layer without sacrificing speed.

Current transaction costs across the ecosystem:

- Token Swap: ~$0.04

- Cross-chain Transfer: ~$0.01

- DeFi Lending Operation: ~$0.03

This reduction in fees has acted as a catalyst for the mass adoption of stablecoins and microtransactions, transforming Ethereum into a truly scalable financial infrastructure.

Fundamental Analysis: Supply Crunch and ETFs

Analysts emphasize that the positive shifts are evident not only in network data but also in market sentiment. Justin d’Anethan of Arctic Digital notes that short-term indicators have exited the oversold zone. Key growth drivers include:

- Steady capital inflows into Spot Ethereum ETFs.

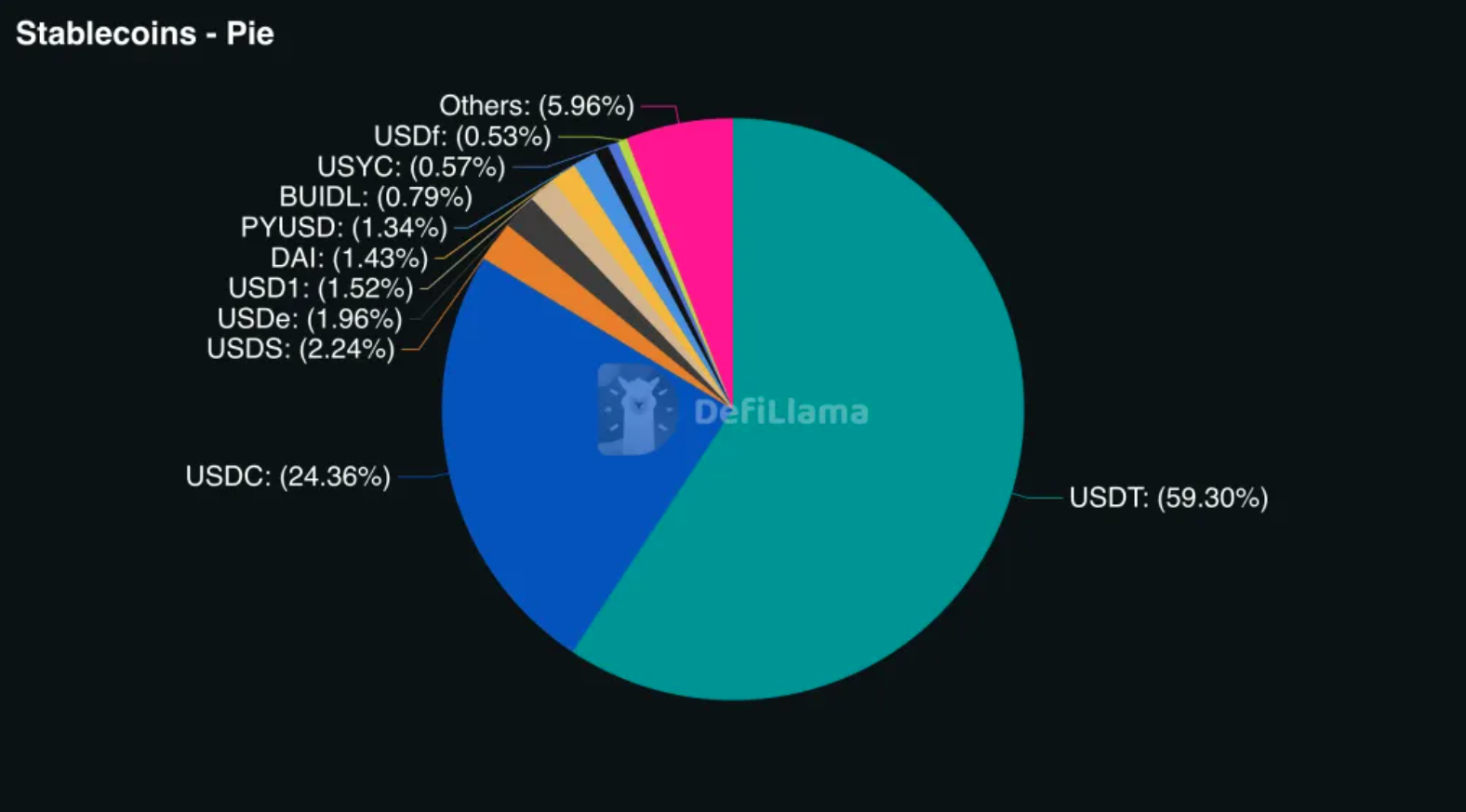

- The rising popularity of stablecoins and native protocols.

- Massive amounts of locked capital: approximately 36 million ETH is currently held in staking.

“Strong on-chain indicators and institutional interest are creating the conditions for a breakout above current resistance levels. We are seeing a ‘liquidity squeeze’ caused by high demand and limited supply,” says Nick Ruck, Director at LVRG Research.

Current Market Outlook

At the time of writing, Ether (ETH) is trading around $3,300. Over the last seven days, the asset has gained 6.1%, according to CoinGecko. Technical analysts suggest that a volatility breakout is likely as early as next week, given the accumulated momentum and the fundamental strength of the network.