Digital asset investment products saw a massive wave of capital between January 10 and 16, with total inflows reaching $2.17 billion. According to the latest CoinShares report, this marks the highest level of activity since October 2025. However, despite the record-breaking start, investor sentiment shifted abruptly as the week drew to a close.

Bitcoin and Ethereum Lead the Charge

The majority of the capital remains concentrated in the market’s two largest assets, signaling continued institutional confidence despite macroeconomic headwinds.

- Bitcoin: Attracted the lion’s share of capital with $1.55 billion in inflows.

- Ethereum: ETH-based funds saw an influx of $496 million. This interest persisted even as the U.S. Senate discussed the Clarity Act, a bill that could potentially limit the yields of stablecoins.

- Altcoins: Positive momentum was also observed in Solana ($45.5M), XRP ($69.5M), and Sui ($5.7M).

Regional Capital Distribution

The United States remains the undisputed leader in crypto investment volume, dwarfing other regions.

| Region | Inflows (USD Millions) |

| USA | $2,050.0 |

| Germany | $63.9 |

| Switzerland | $41.6 |

| Canada | $12.3 |

The Triumph of Spot ETFs

U.S. spot Bitcoin ETFs recorded a net inflow of $1.42 billion last week—the highest weekly figure since October.

The clear frontrunner was BlackRock’s IBIT fund, which secured $1.03 billion in net inflows. Nick Ruck, Director at LVRG Research, suggested that these ETF inflows signal a resurgence in institutional demand and long-term optimism. Analysts believe that continued accumulation by major players could lead to a supply crunch, supporting a price recovery.

Spot Ethereum ETFs also performed strongly, attracting $479 million over the week, marking their best performance since last autumn.

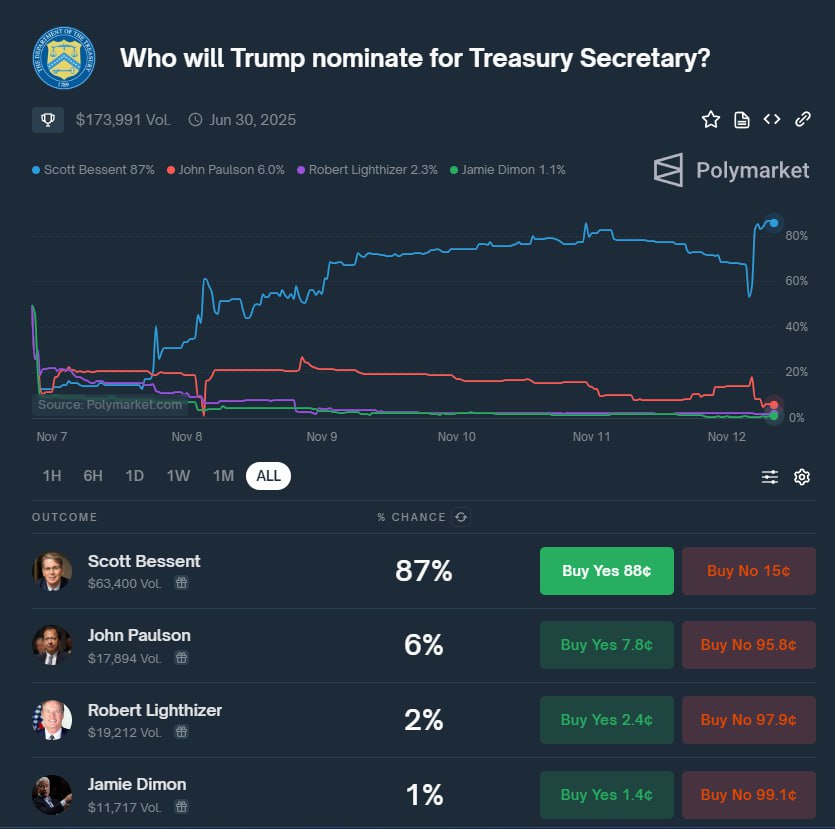

The Flip Side: Liquidations and Geopolitical Friction

Despite the massive inflows, the market hit a “cold patch” by the end of the week. On January 16, daily outflows reached $378 million. Experts attribute this sudden reversal to several external factors:

- Geopolitics: A diplomatic scandal surrounding Greenland.

- Trade Policy: Threats of new trade tariffs.

- Regulatory Uncertainty: Ambiguity regarding the appointment of the next Fed Chair.

“Bitcoin’s retracement to $92,000, despite strong ETF inflows, highlights the heavy influence of the derivatives market. Excessive leverage combined with low liquidity during the reversal triggered a wave of cascading liquidations,” experts explained.

According to CoinGlass, total liquidations over a 24-hour period surpassed $874 million, with the majority ($788 million) coming from “long” positions. This underscores the market’s vulnerability to sharp downward movements driven by high leverage, even when structural institutional support remains intact.

Summary

The cryptocurrency market is currently caught in a tug-of-war between massive long-term institutional inflows and short-term speculative volatility. While institutions continue to accumulate, macroeconomic uncertainty is keeping retail and leveraged traders on edge.