January 20, 2026 — The cryptocurrency market is currently displaying a complex dual dynamic. While on-chain analysts detect signs of “healing” in the market’s internal structure, external macroeconomic factors are forcing investors to adopt a cautious stance.

1. Fundamental Indicators: Spot Market Recovery

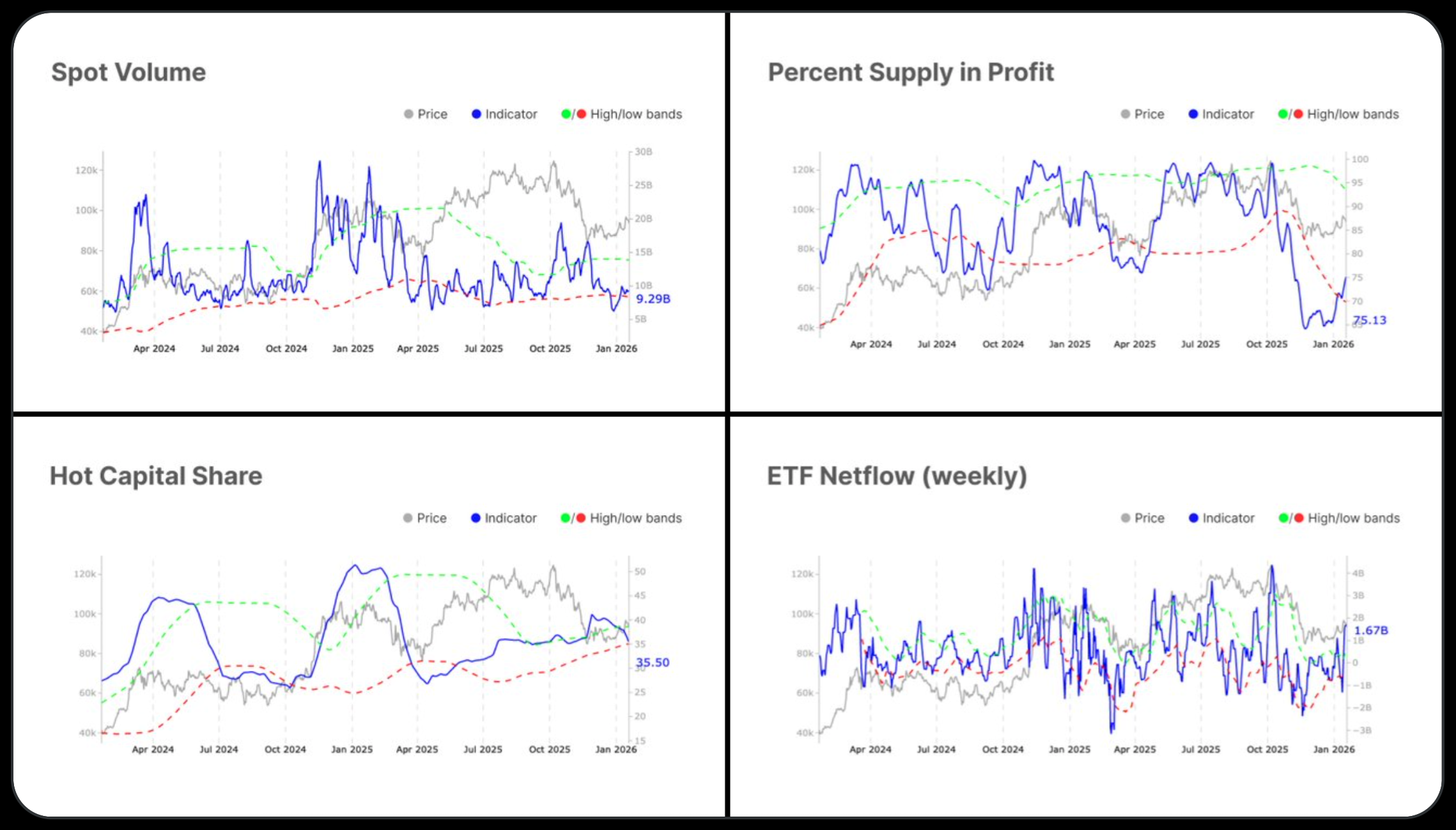

Analysts at Glassnode have noted a gradual improvement in the first cryptocurrency’s market health. Despite demand remaining “fragile and uneven,” several key shifts have been identified:

- Rising Trading Activity: Transaction volumes on spot exchanges are beginning to trend upward.

- Easing Sell Pressure: The buy-sell imbalance has broken through upper statistical boundaries, signaling a tightening of coin supply.

- Institutional Dip-Buying: According to Gracie Lin (CEO of OKX Singapore), the market has “digested” the profit-taking from late 2025. Institutional players continue to use ETFs to buy up price dips, viewing Bitcoin more as a portfolio hedge than a speculative asset.

2. Price Action and Investor Psychology

At the time of writing, Bitcoin is trading at $91,142. A brief 2% intraday dip triggered a cascade of liquidations totaling $335 million, highlighting lingering volatility.

Key Sentiment Metrics

Experts are tracking a rare shift in investor behavior:

| Metric | Current Value | Context |

| Sentiment Index | 44.9% | Dropped from an “overheated” 80%. A reading below 50% indicates a decrease in risk appetite. |

| Net Profit/Loss | Negative | For the first time since October 2023, holders are realizing net losses on a 30-day basis. |

| Cycle Phase | Consolidation | Swissblock analysts compare the current climate to 2022, suggesting we are in a liquidity accumulation phase ahead of a potential rally. |

3. Geopolitics: “Digital Gold” vs. Physical Bullion

The primary driver of current volatility is the aggressive trade rhetoric coming from Washington. President Donald Trump’s threats to impose new tariffs on European allies—linked to the dispute over the sale of Greenland—have sparked a “flight to safety.”

- Gold and Silver: Precious metals are hitting all-time highs. Gold has surpassed $4,700 per ounce for the first time, while silver reached a record $95.

- BTC/Gold Ratio: This ratio has fallen more than 50% from its peak. Bitfinex analysts note that historically, such levels often precede a period where Bitcoin begins to outperform gold.

“The market has shifted into a ‘risk-off’ mode. Aggressive tariff rhetoric creates a strong headwind for cryptocurrencies and other risk assets,” noted Farzam Ehsani, CEO of Valr.

4. ETF Dynamics: A Streak Interrupted

U.S. spot Bitcoin ETFs have broken a four-day streak of inflows (which totaled $1.8 billion). On January 19, the instruments saw a net outflow of $394.68 million. This confirms a temporary shift in investor priorities toward profit-taking and a “wait-and-see” approach amidst global uncertainty.

Summary

The market is currently “digesting” the gains seen at the end of 2025. While the technical structure of the spot market is improving, a sustained upward move will likely require the Sentiment Index to return above the 50% threshold and a stabilization of the geopolitical landscape.