The cryptocurrency market is facing a significant stress test. Lacking fresh catalysts and burdened by persistent sell-side pressure, Bitcoin is struggling to maintain its footing. Alex Thorn, Head of Research at Galaxy Digital, warns that BTC is at risk of sliding into the $56,000–$58,000 range if current conditions persist.

Record Liquidations and a “Red” January

The end of January proved to be a volatile period for the leading digital asset. Between January 28 and 31, Bitcoin plummeted by 15%, hitting a local low of $75,644.

This sharp decline triggered a massive “long squeeze” in the futures market, resulting in over $2 billion in liquidations—one of the largest flushing events in crypto history. Consequently, prices dropped below two critical institutional benchmarks:

- The average purchase price for U.S. Spot Bitcoin ETFs ($84,000).

- The cost basis for MicroStrategy’s holdings ($76,037).

Note: January marked the fourth consecutive “red” month for Bitcoin, a losing streak not seen since the 2018 bear market.

Technical Analysis: Mapping the Downside

Thorn points to a significant “air pocket” in the volume profile between $70,000 and $82,000. Due to this lack of historical support density, the price is likely to test lower boundaries.

If the slide continues, the next key support levels are:

- $58,000 — The 200-week Moving Average ($MA$), a classic indicator of long-term trend health.

- $56,000 — Bitcoin’s Realized Price (the average price at which all coins last moved on-chain).

Historically, these levels have signaled the floor of market cycles and served as optimal entry points for long-term investors. However, with a 38% drawdown from its all-time high, statistics suggest caution: historically, a 40% drop often extends to 50% or more within a three-month window.

Fundamental Headwinds: ETF Outflows and Macro Fears

Several factors are currently stifling a potential recovery:

- Failing “Digital Gold” Narrative: Amid geopolitical instability and debt concerns, investors have pivoted toward traditional safe havens like gold and silver rather than Bitcoin.

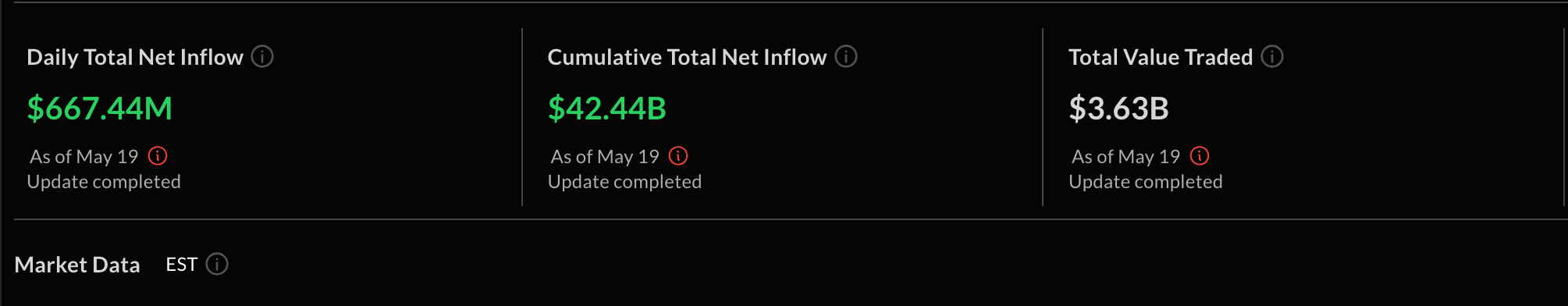

- Institutional Exit: Sentiment has cooled as Bitcoin ETFs saw outflows totaling $2.8 billion over the past two weeks.

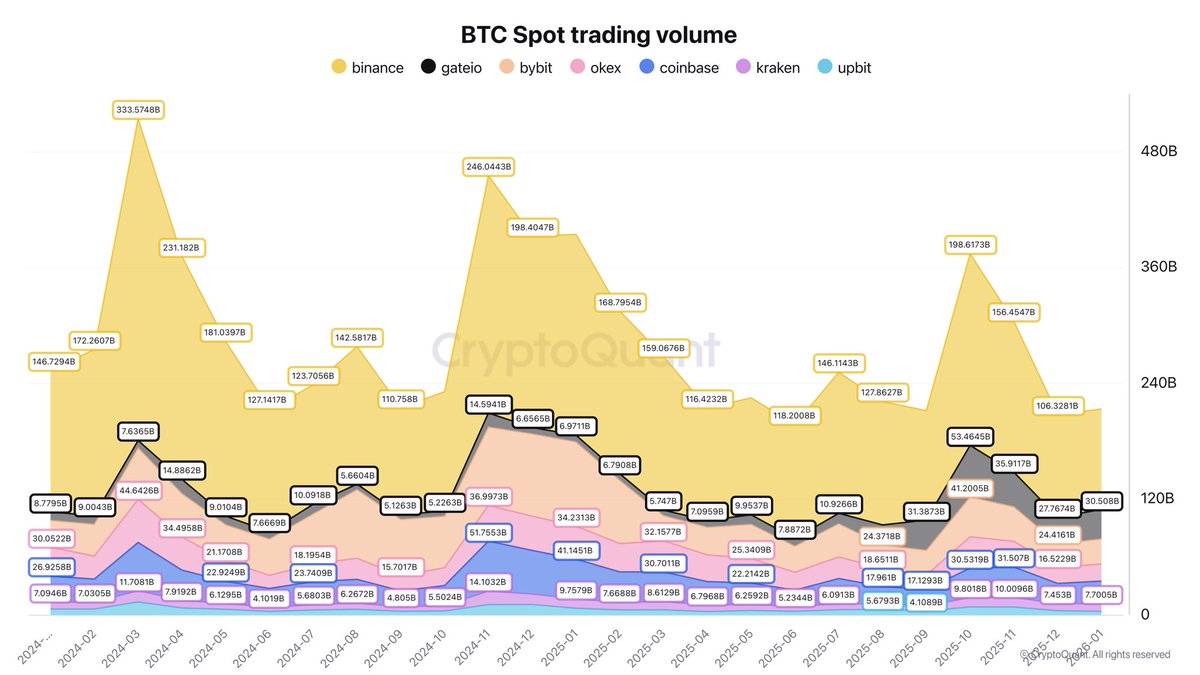

- Drying Liquidity: Analyst Darkfost highlights that spot trading volumes on Binance have nearly halved, dropping from $200 billion in October to $104 billion recently.

- Macro Pressure: Justin d’Anethan of Arctic Digital suggests that uncertainty surrounding Fed policy and the potential appointment of Kevin Warsh could bolster the U.S. Dollar ($DXY$), which typically exerts downward pressure on risk assets.

The Silver Lining

Despite the bearish outlook, there are minor signs of stabilization.

- Holder Resilience: Long-term “HODLers” have slowed their profit-taking, indicating a reduction in internal selling pressure.

- Market Reset: Analysts view this correction as “bitter but necessary medicine” to flush out excessive leverage and speculative froth.

The Bottom Line: Joao Wedson, founder of Alphractal, believes the bottom isn’t in yet. He argues that a true reversal requires a “capitulation event” where short-term holders realize losses below the long-term holder cost basis. Wedson warns that a sustained break below $74,000 could officially transition Bitcoin into a bear market territory.

Market Pulse: At the time of writing, Bitcoin is trading at $78,696 (+2.5% over the last 24 hours).