The launch of the Fidelity Digital Dollar (FIDD) on February 4, 2026, marks a watershed moment not only for Fidelity Digital Assets but for the global financial landscape. This is a premier instance of a traditional finance (TradFi) giant—managing trillions in assets—issuing its own digital dollar to compete directly with crypto-native leaders like Tether and Circle.

Regulatory Foundation: The Genius Act

The successful rollout of FIDD is inextricably linked to the Genius Act (Guiding and Establishing National Innovation for U.S. Stablecoins), passed in July 2025. This legislation established the first comprehensive legal framework for stablecoins in U.S. history.

Key Genius Act requirements met by Fidelity:

- 100% Reserving: Every FIDD is backed by actual U.S. dollars or short-term U.S. Treasury bills.

- Holder Priority: In the event of issuer insolvency, stablecoin holders have priority claims over all other creditors.

- Transparency: Mandatory monthly publication of reserve compositions (Fidelity aims to exceed this by providing daily net asset value disclosures).

Comparing FIDD with Market Leaders

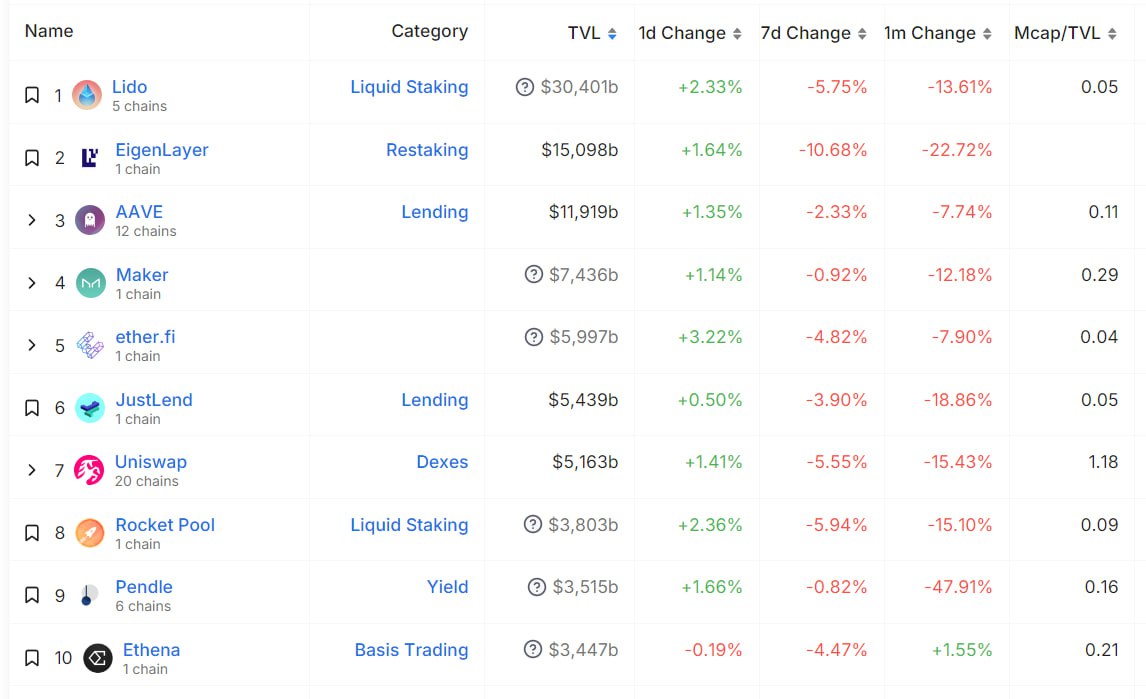

Fidelity is stepping into a territory dominated for years by USDT (Tether) and USDC (Circle). However, FIDD holds unique strategic advantages.

| Feature | FIDD (Fidelity) | USDC (Circle) | USDT (Tether) |

| Issuer | National Trust Association (OCC) | Private Co. (US Regulated) | Private Co. (Offshore) |

| Auditor | PwC | Deloitte | BDO Italia |

| Core Advantage | Integration with retirement/brokerage accounts | High DeFi ecosystem trust | Massive global liquidity |

| Regulatory Status | Full Genius Act Compliance | US Licensed | Limited US Regulatory recognition |

Why This Matters for Investors

The launch of FIDD addresses the primary concern of institutional investors: counterparty risk. Utilizing a stablecoin from an institution with an 80-year legacy allows large funds to migrate capital onto the blockchain without the fear of sudden freezes or opaque reserve management.

Technical Capabilities of FIDD:

- 24/7 Liquidity: Instant settlement of trades even during weekends when traditional banking systems (SWIFT/FedWire) are offline.

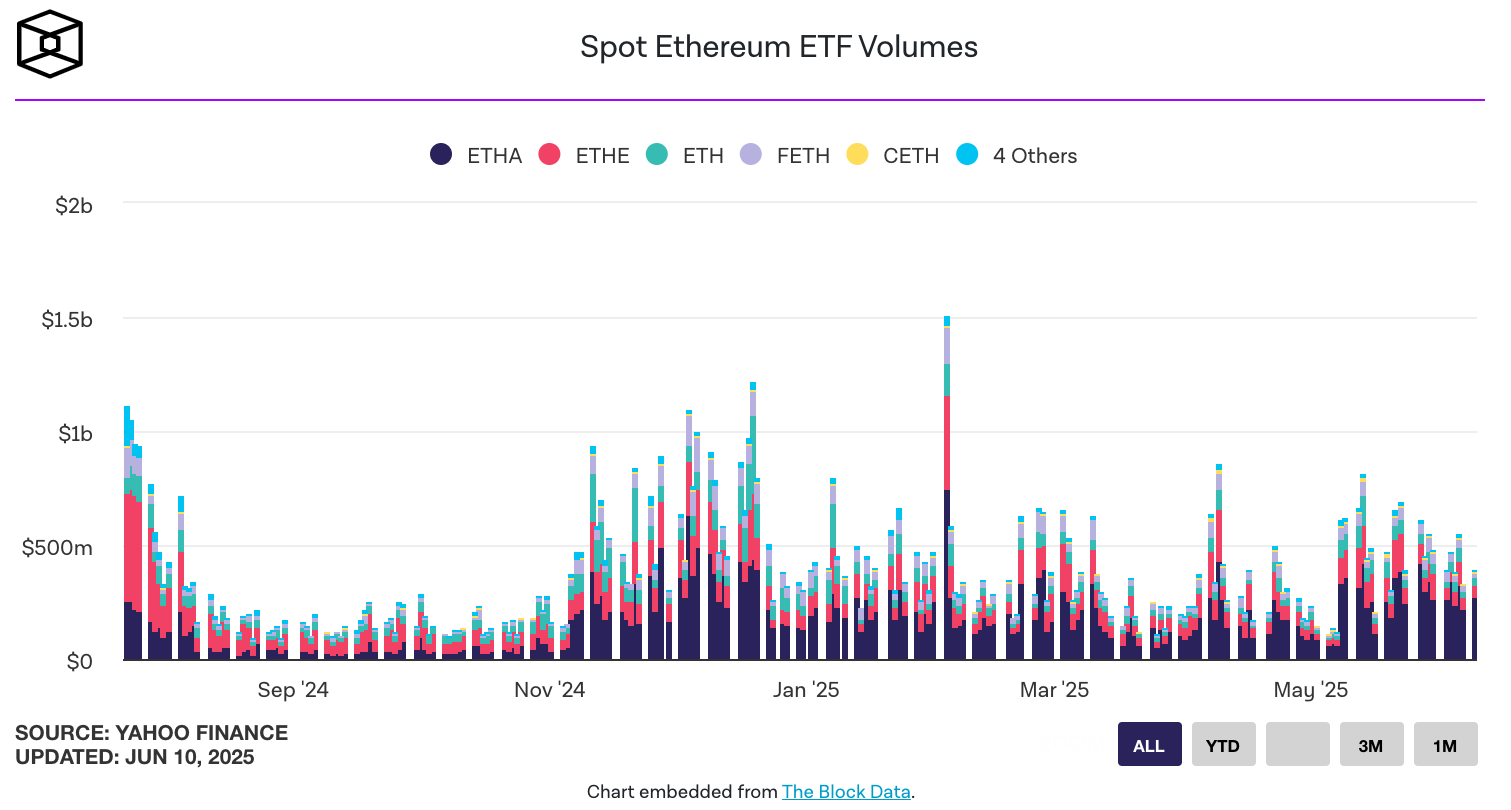

- Ethereum Ecosystem: Launched on the Ethereum mainnet, FIDD is compatible with lending protocols (Aave, Compound) and decentralized exchanges (Uniswap).

- Institutional-Grade Security: Custody is managed through Fidelity Digital Assets’ infrastructure, which carries OCC approval.

Future Outlook

Currently, FIDD’s market capitalization stands at approximately $60 million—a modest start in a $300 billion market. However, analysts anticipate explosive growth as capital migrates from Fidelity’s massive retail client base, who can now hold “digital cash” directly within their brokerage apps.

“We haven’t just created another token. We have built a bridge between the world of traditional finance and a blockchain-based future,” summarized Mike O’Reilly, President of Fidelity Digital Assets.