The current correction in the cryptocurrency market has split investors into two camps. While some watch the red charts with anxiety, others — primarily major players — are seizing the moment. Bitwise is convinced: we are witnessing a rare “second chance” for those who feared they had “missed the boat.”

The Bitwise Perspective: A Generational Shift in Investor Psychology

In a recent conversation with CNBC, Bitwise CEO Hunter Horsley noted a sharp contrast in how current prices are perceived. For long-term holders, the drop below the psychological $70,000 mark has been a source of uncertainty. However, for institutional investors, the situation looks entirely different.

“Institutions are seeing prices on the board that they thought were gone forever and would never return,” Horsley emphasized.

Key Takeaways from Bitwise:

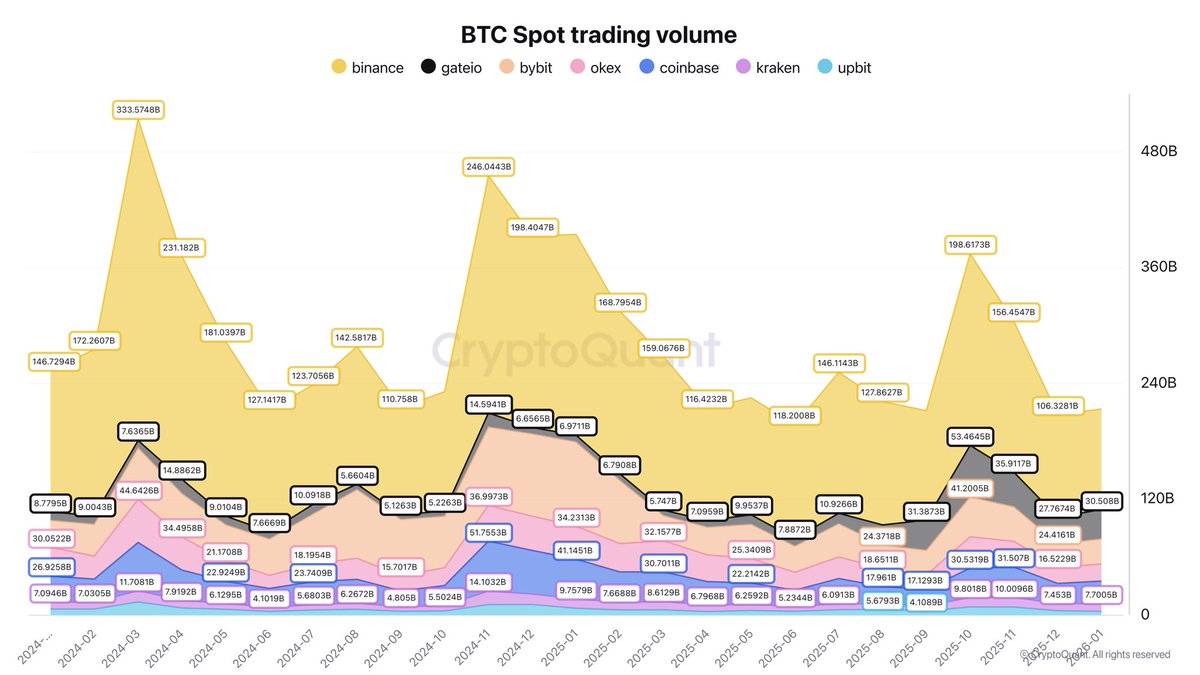

- Capital Inflow: Despite the general panic, Bitwise clients directed a net $100 million into crypto instruments as the price dipped below $77,000.

- Macroeconomic Pressure: Bitcoin is currently behaving like a classic macro asset. In times of instability, investors sell off anything with high liquidity to cover their positions.

- An Anomalous Moment: Horsley admits the timing of this drawdown is unusual, given the recent strides toward regulatory clarity and growing interest from “big money.”

A Different Scenario: CryptoQuant’s Words of Caution

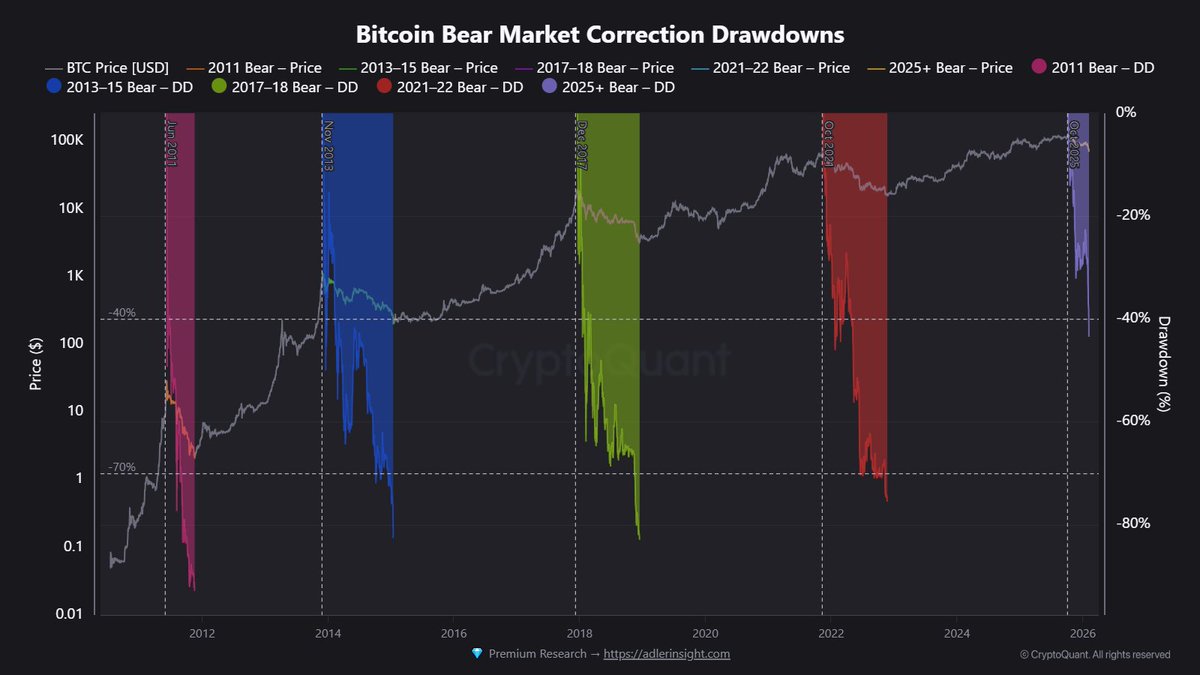

Not all experts share this short-term optimism. Analysts at CryptoQuant point out that the current price is only about 50% off its all-time high.

They suggest that the “bottom” could potentially be much deeper — reaching a 70–80% drawdown from peak values. However, they urge investors to look beyond just the price:

- The Time Factor: The primary risk right now is not just the price, but the duration of the “capitulation” phase.

- A Test of Endurance: What matters is how long the asset remains at these lower levels before a new growth cycle begins.

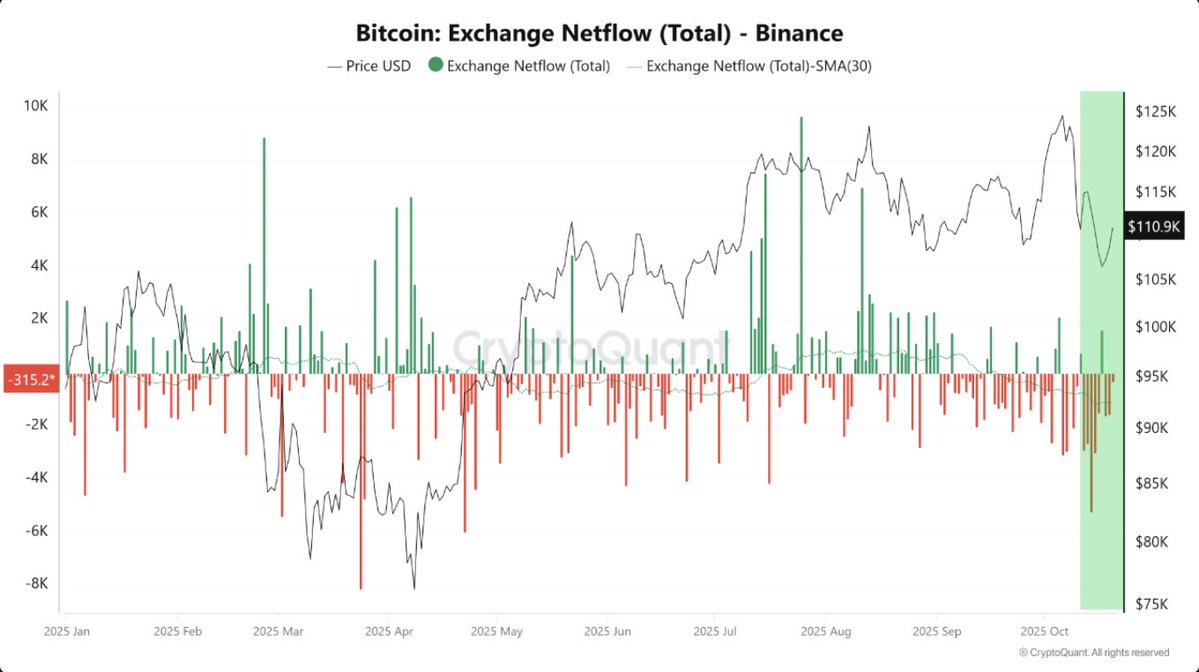

Technical Analysis: “Smart Money” is Already Moving

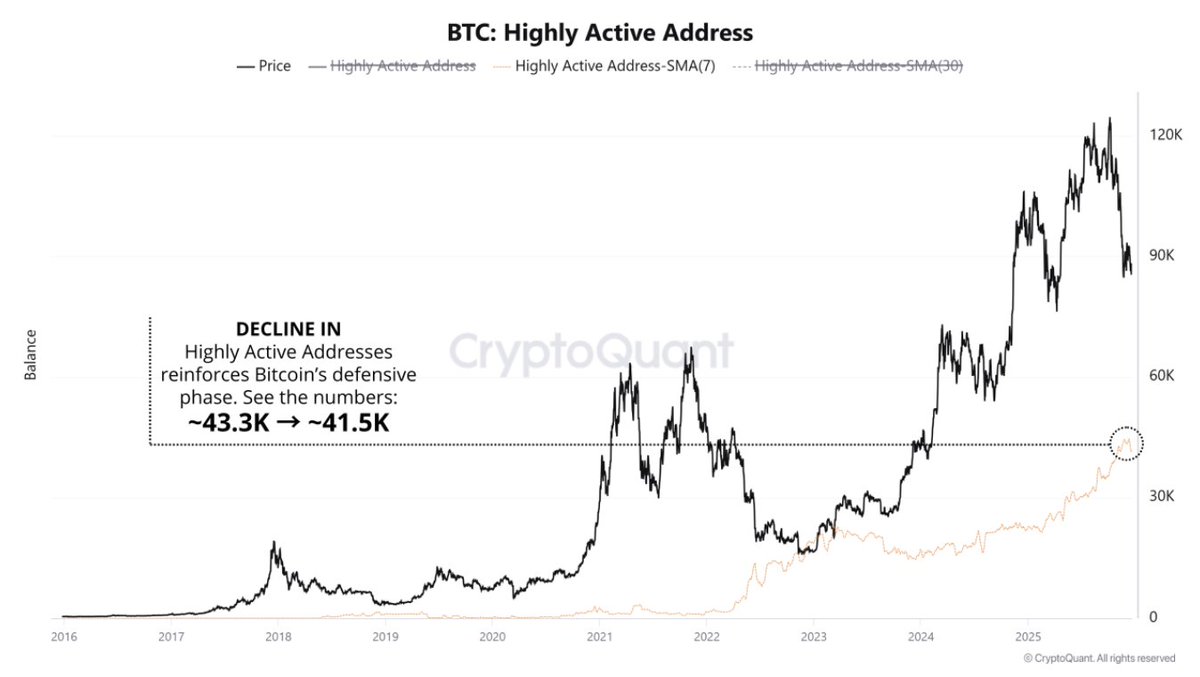

Trader and MN Trading founder Michaël van de Poppe believes the bear market is nearing its end. His argument is based on the ratio of Bitcoin supply currently in profit versus loss.

Comparisons to Previous Cycles

According to van de Poppe’s analysis, current indicators are identical to those seen at the end of prolonged corrections in 2018 and 2022.

“I don’t expect a further crash. A brief consolidation is likely, after which the market will find a floor at higher levels. Smart people are buying now. The foolish are leaving,” the analyst concluded.

Investor Summary

The market is currently in an asset redistribution phase. While short-term holders are shedding “risky” assets, large funds are utilizing this volatility to build positions that seemed impossible to enter at these prices just a month ago.