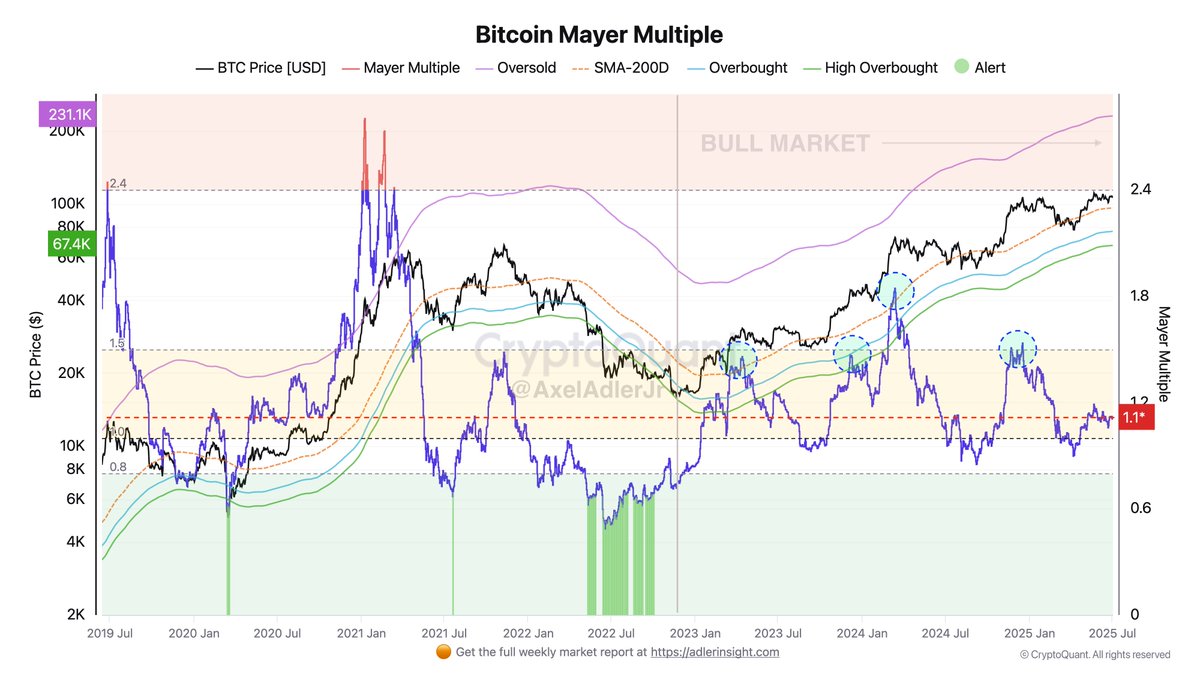

The cryptocurrency market has entered a phase that analysts are calling the “late bear stage.” According to a fresh report from research firm K33, current market indicators show a striking resemblance to the sentiment of late 2022—the period when the industry was searching for a global bottom.

A Mirror of History: Parallels with 2022

Vetle Lunde, Head of Research at K33, notes that Bitcoin’s 28% drawdown since its January highs isn’t just a correction—it’s a transition into a specific market regime. By utilizing a comprehensive indicator (which includes derivative yields, open interest, and U.S. macroeconomic signals), analysts have identified patterns identical to September–November 2022.

What does this mean for investors?

Historically, such periods do not foreshadow an immediate “moon mission.” Instead, they indicate the formation of a local floor, followed by a prolonged and exhausting period of consolidation.

Technical Health: Deleveraging the System

The market cooldown has a silver lining: a reduction in systemic risks. Analysts highlight several key factors:

- Negative Funding: Funding rates have remained in the red for over 11 consecutive days, signaling a defensive posture among traders.

- Declining Open Interest: Futures open interest has dropped below 260,000 BTC.

- Low Leverage: The exit of speculative “hot money” reduces the likelihood of “cascading liquidations” that have previously crashed the market.

Price Forecast

“We expect Bitcoin to trade within the $60,000 – $75,000 range for an extended period,” Lunde predicts.

While current levels look attractive for entry, the analyst warns that the average return in such regimes is roughly 3% over 90 days. This is a game of patience.

Institutional Behavior and the “Fear Index”

Despite the Fear & Greed Index recently hitting a historic low of 5 points, K33 experts urge caution against over-optimism.

90-Day Return Statistics:

| Market State | Average Return |

| Extreme Fear | +2.4% |

| Extreme Greed | +95% |

Paradoxically, buying during “extreme fear” in this specific phase often yields modest results compared to periods of active momentum.

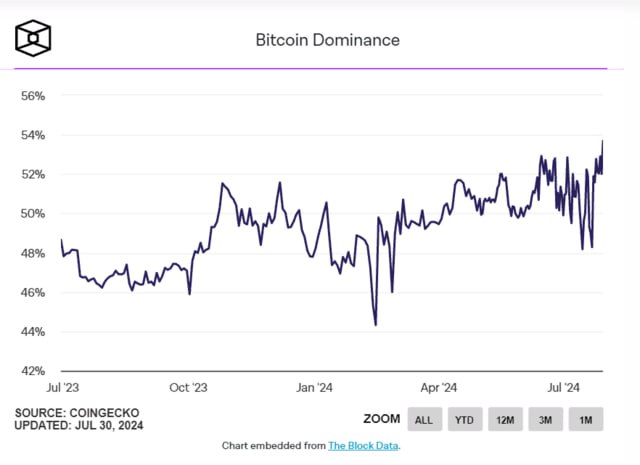

Big Money Movements:

Institutional traders on the CME remain largely passive. Since the October peaks, Bitcoin ETFs have seen outflows of over 103,000 BTC. However, these funds still hold 93% of their peak volume. This suggests that large players have taken some profit but have not lost faith in the asset’s long-term value.

Conclusion: The Era of Patience

The summary from K33 is clear: while the room for further downside is limited, the catalysts for a sharp breakout are currently lacking. The market has entered a “prolonged consolidation” stage. Investors should prepare for a period of “boring” sideways movement, which ultimately serves as the foundation for a future recovery.